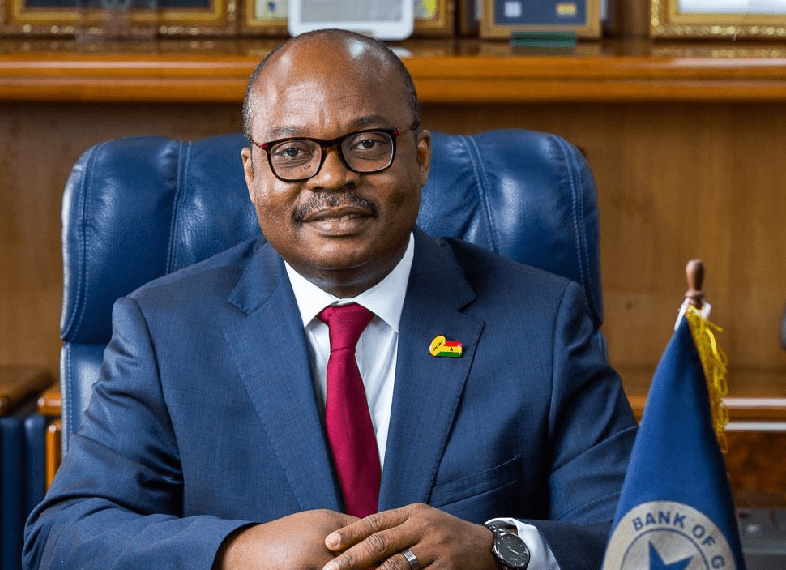

The Governor of the Bank of Ghana, Dr. Ernest Addison, has called on the International Monetary Fund (IMF) to enhance its lending framework to provide critical support to Africa’s debt crisis.

According to Dr. Addison, the COVID-19 pandemic, climate-related disasters, and other global factors have contributed to Africa’s rapidly accumulating external debt stock and elevated debt-service costs and rollover risks.

The Governor emphasized that nineteen of the 35 low-income countries in Africa are either in or at high risk of debt distress, while some others are completely shut out of the international capital market.

To address this pressing issue, Dr. Addison urged the IMF to increase concessional financing to the continent by modifying access thresholds, expanding access limits, and relaxing eligibility criteria for Poverty Reduction and Growth Trust (PRGT) resources.

He also recommended that the Fund should continue close engagements with other international financial institutions and creditors to strengthen the multilateral framework for dealing with Africa’s debt distress in a timely manner.

The BoG Governor emphasized the need to enhance the G20 Common Framework (CF) to deliver swift, predictable, transparent, and equitable debt resolutions while permitting debt service suspension during negotiations to offer immediate relief to debtors.

He called for stronger support from international institutions, particularly the IMF, to prevent the region’s debt levels from spiraling out of control.

In addition to the domestic policy efforts undertaken by African countries to pursue credible fiscal consolidation, anchored on efficient expenditure rationalization and robust domestic revenue mobilization measures, Dr. Addison stressed the need for stronger international support to sustainably address the debt burden and restore macroeconomic stability in the continent.

Overall, Dr. Addison’s call for the IMF to improve its lending framework to enhance Africa’s access to Fund resources highlights the critical need for multilateral support in addressing Africa’s debt crisis.

With the COVID-19 pandemic and other global factors continuing to put pressure on Africa’s debt dynamics, it is imperative that international institutions work collaboratively to provide swift and effective solutions to this challenging issue.

IMF Forecasts 2.9% GDP Expansion For Ghana’s Economy In 2024

Meanwhile, the International Monetary Fund’s (IMF) is projecting Ghana’s economy to expand by 2.9% in 2024, representing a positive outlook for the country’s economic growth.

The projected growth rate is 1.3% higher than the 1.6% GDP growth rate projected for 2023. However, it is lower than the 3.2% GDP growth experienced by the Ghanaian economy in 2022.

Despite Ghana’s relatively optimistic growth outlook, the report highlights that the GDP growth in sub-Saharan Africa is expected to decline to 3.6% in 2023 due to a global slowdown.

Although some countries, particularly non-resource-intensive economies, are expected to register a small pickup in growth this year, the overall situation in the region remains concerning.

Against this backdrop, the IMF report suggests that Ghana’s projected growth rate for 2024 is a positive sign of economic progress.

Nonetheless, the report underscores the need for continued vigilance in addressing the underlying structural issues that threaten to undermine the region’s long-term economic prospects.

In particular, there is a pressing need for policymakers to prioritize measures aimed at promoting sustainable fiscal policies, reducing debt levels, and fostering inclusive growth that benefits all segments of society.

Read also: Pensioners Bondholders Forum Expose Ken Ofori-Atta: The Proposal from the Ministry Was Not Accepted