With the motive to play an important role in supporting local business, Development Bank of Ghana (DBG) has partnered with Commercial Banks in Ghana to spur a quicker recovery leading to growth and sustainable prosperity for the private sector.

During a meeting hosted by DBG’s Chief Executive Officer – Mr. Kwamina Duker, the Chief Executive Officers (CEOs) and Senior Executives of CalBank, Absa Bank, Consolidated Bank Ghana (CBG), GCB Bank, Fidelity Bank and Access Bank assembled to set out plans on how the partnership’s mission can be attained, strengthened and improved for the benefit of the nation.

The drive themed – “DBG Economic Recovery Initiative” has been fashioned out by the Bank in line with its mandate to transform and develop the country’s economy by empowering the private sector.

The discussions centered on how DBG would work with the commercial banks, GIRSAL and other partners to support the private sector with long-term capital in an efficient and effective manner – for the long term benefit of the economy.

Areas of focus for the commercial banks included the utilization of technology to build scale, efficiency and advocacy to secure policy change in the support of local industries and their related value-chain.

The partnership, as stated by the commercial banks sought to build, increase lending and develop prudential guidelines with associated safe guards to better realize DBG’s mandate.

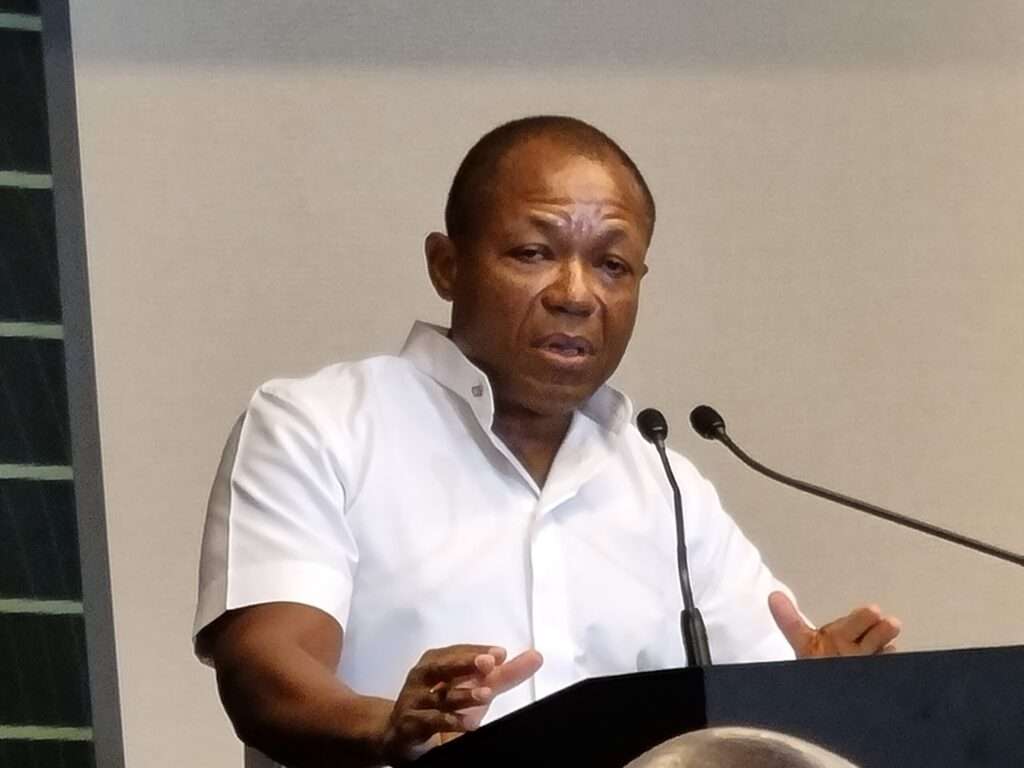

Commenting on the Bank’s economic recovery initiative, Mr. Kwamina Duker averred that DBG remains focused on its agenda to empower local businesses in order to achieve a transformation of Ghana’s economy.

“Our Economic Recovery Initiative is primarily aimed at improving the already great partnerships that DBG has forged in its first year in order to achieve a higher level of success which should see stronger local businesses who will form the backbone of our recovery and progress economically.”

Mr. Kwamina Duker

According to the CEO of DBG, the Bank will this year introduce tailored solutions and further products for the benefit of local businesses, adding that: “These would include Equity Funding and Partial Credit Guarantee.”

CEOs Of Commercial Banks Express Willingness To Support DBG’s Drive

Speaking on the partnership’s motive, Mr. Daniel Wilson Addo – the CEO of CBG expressed optimism in the outcome of the initiative.

“There is no gainsaying the conspicuous fact that this initiative is very timely and should help all commercial banks to find ways of dealing with the challenges banks face currently, to enable us to support the private sector better.”

Mr. Daniel Wilson Addo

Mr. Kofi Adomakoh, the CEO of GCB communicated that efforts were being made by his bank towards the attainment of the partnership’s mission.

“We had a very fruitful discussion, and we are already tackling some of the bottlenecks. The Bank of Ghana and other institutions would be engaged on specific issues. In addition, we intend to carry out advocacy in the area of government policy relating to some of the industries we intend to support.”

Mr. Kofi Adomakoh

According to Mr. Philip Owiredu, the CEO of CalBank, it is now even more critical that DBG delivers on this mandate considering the economic challenges Ghana is facing currently.

“At the end of the day, the good thing is that we have taken the initiative to tackle head-on the responsibility of leading the recovery of the economy and that is a great step.”

Mr. Philip Owiredu

In attendance were CEOs Philip Owiredu – CalBank, Kofi Adomakoh – GCB Bank and Daniel Wilson Addo – CBG. The Senior Executives present were Thairu Ndungu, Deputy CEO (CBG), Ms. Amazing Grace Anim-Yeboah, Director Business Banking and Mr. William Nettey, Head, Agribusiness (Absa), James Bruce, Head, Wholesale Banking and Solomon Ocquaye, Financial Institutions (Access Bank), Alex Agyei Amponsah, Director, Commercial and SME (Fidelity), Dzifa Nyansafo, Head of Credit (CalBank), Sam Aidoo, Director, Wholesale and Investment Banking and Linus Kumi, Head, Corporate Banking (GCB).

Also in attendance were Dr. Yaw Ansu, Board Chairman of DBG, Kwesi Korboe, Chief Executive Officer of Ghana Incentive-based Risk Sharing System for Agricultural Lending (GIRSAL) and Michael Mensah-Baah, Deputy Managing Director, DBG.

Development Bank Of Ghana 2023 Agenda

DBG’s agenda for 2023 focuses on food security and seeks to offer long-term funding of GHS500 million to the agriculture sector, specifically for products like maize, soya, poultry and rice. There will be an additional GHS500 million funding for sectors like tourism and manufacturing.

As has been the approach employed by DBG in empowering local businesses, the Bank through its business partners, the Association of Ghana Industries (AGI), Ghana National Chamber of Commerce and Industry (GNCCI) and Ghana Chamber of Young Entrepreneurs (GCYE) will provide technical assistance to 15,000 local businesses in order to build their capacity.

Read also: Finance Ministry Announces Resumption Date For Coupons And Principals Payment Of Old Bonds