Dr. Richmond Atuahene, a Banking and Corporate Governance Consultant, has expressed worry over the banking sector’s low ability to withstand losses due to effects of the Domestic Debt Exchange Programme (DDEP) on capital and liquidity.

The Central Bank of Ghana (BoG) had raised concerns that the current macroeconomic situation is affecting the banking sector with declining profitability and other financial indicators, along with increased pressure on banks’ solvency and liquidity even before the DDEP was implemented.

To help curb potential liquidity difficulties for banks that have agreed to the debt exchange, the Ghana Financial Stability Support Fund has been established with GH¢15billion capitalisation. However, Dr. Atuahene insists that the banking industry’s capacity to manage losses is ‘insufficient’.

“The capacity of the banking sector to absorb losses is lower. It is not well-capitalized to absorb estimated losses from the debt exchange programme.”

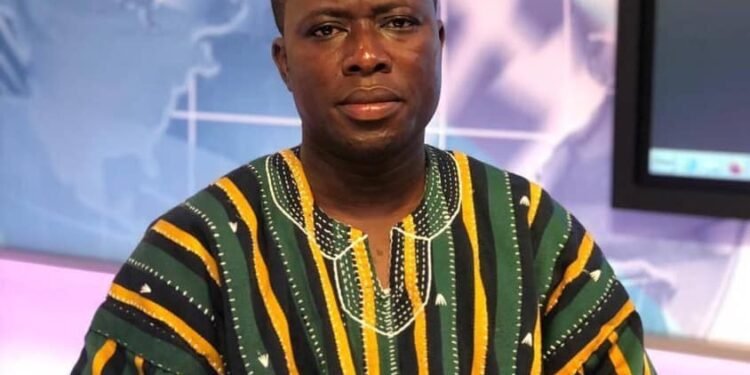

Dr. Richmond Atuahene

The banking consultant disclosed this while sharing his thoughts on the DDEP’s impact on the private sector at an engagement organised by the Ghana National Chamber of Commerce and Industry (GNCCI) in Accra.

According to him, people talk without really taking into consideration the debt restructuring process. He stated that the process itself is capable of worsening existing economic challenges.

Dr. Atuahene further averred that domestic banks will need recapitalisation from government if they incur losses, and that the required fiscal consolidation and burden-sharing by other creditors will reduce.

“Ghanaian banks will not be able to absorb losses without having to resort to recapitalization from government. The fiscal consolidation and/or burden-sharing by other creditors required to restore debt sustainability will be smaller.”

Dr. Richmond Atuahene

Banks are expected to hold onto their government exposures for an extended period with reduced coupon rates, thus limiting the banks’ ability to lend to the real economy as a result of estimated losses in the DDEP.

Against this backdrop, some institutions are projected to experience material combined losses from the DDEP transaction, and second‐round shocks with potential for capital shortfall below minimum regulatory requirements inclusive of insolvency.

The banking consultant opined that based on the discount rate of 19.3% which averages at a coupon rate of 9% on outstanding bonds, analysis of the data estimates losses using Net present value of GH¢41.3billion. He added that such analysis will negatively impact the solvency of 23 banks.

He warned that at least five banks may experience mild losses which could be due to a combination of coupon or interest rate reduction and maturity extension with below-market coupon rates.

“Any losses of the banking sector would likely have negative multiplier effects on solvency, GDP growth, employment, shortage of credit delivery to the private sector, output and poverty – which will in turn impact negatively on domestic revenue generation.”

Dr. Richmond Atuahene

Dr. Atuahene projected capital shortfalls are more likely to emerge for a group of weak banks and a few others because of their higher share of exposure to government domestic debt relative to their capital.

Recent Performance In The Banking sector

Meanwhile, the Central Bank of Ghana in its report disclosed that the performance of the banking sector moderated in December 2022 compared with December 2021, with some key Financial Soundness Indicators (FSIs) recording significant declines. This broadly reflects the current macroeconomic conditions, with rising cost of credit due to inflationary pressures and revaluation-driven balance sheet performance.

Profitability levels in the banking sector have declined. This decline is driven by the mark-to-market losses on investments, higher impairments on loans and rising operating costs

According to BoG’s report, trends in Financial Soundness Indicators were mixed, reflecting heightened risks faced by the industry.

The sector’s profitability indicators; namely the return-on-equity and return-on-assets also declined during the period, in line with declining profit after tax and profit-before-tax respectively.

Read also: Outlook Of Ghana’s Banking Sector