Just after the approval of a $3 billion bailout fund for the West African Country – Ghana, the International Monetary Fund (IMF) has revealed in a statement that Ghana breached the Debt Sustainability Analysis (DSA) thresholds, a situation that led the country into debt distress.

In IMF’s statement themed “Request for an arrangement under the Extended Credit Facility Programme”, the Fund stated that Ghana is in debt trouble, adding that “the country’s debt level is also unsustainable.“

The global leader noted that public debt increased to 88.1% of Gross Domestic Product by end-2022, practically resulting to an evenly split between external (42.4% of GDP) and domestic (45.7% of GDP).

Again, the Fund mentioned that gross financing needs have reached approximately 19% of GDP.

“Under the proposed programmes baseline projections which do not consider the possible outcome of the ongoing debt restructuring, the ratios of present value of public and external debt to GDP, and the ratios of external debt service to revenues and exports are, and would remain above their LIC-DSF thresholds over the medium and long term.”

International Monetary Fund

The IMF in its statement further pointed out that the outlook of Ghana’s system is subject to significant downside risks, if fund and programme is not properly executed and managed.

“The baseline predictions are dependent on successful program execution and rapid progress in carrying out the authorities’ comprehensive debt restructuring and plans to address the substantial stock of domestic arrears, particularly to independent power producers (IPPs).”

International Monetary Fund

Despite mitigating methods, it stated that the exchange of domestic debt poses considerable risks to domestic financial sector stability, adding that “exchange rate, credit, and liquidity risks further add to the vulnerabilities.”

“The authorities’ debt restructuring plans still leave a substantial need for T-bill [Treasury bills] issuance in the near term and expose Ghana to the uncertainty in domestic market conditions, though programme implementation and outreach may help mitigate financing risks.

“Domestic policy slippages represent a significant downside risk to the projections, further compounded by risks associated to the end-2024 general elections.”

International Monetary Fund

IMF Congratulates Ghana, Hopes For A Revived Economy

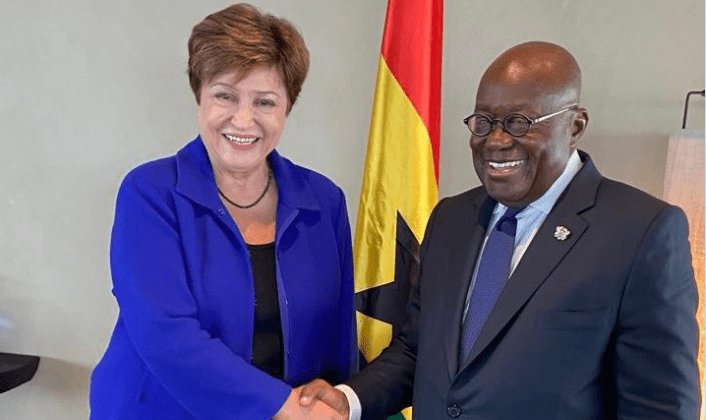

Meanwhile, Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), has congratulated the Ghanaian government for reaching an agreement with the Fund.

The IMF Chief stated that the Fund is ready to assist the government in enacting changes to address existing issues.

“Congratulations to President Nana Addo Dankwa Akufo-Addo and his team on the $3 billion IMF-supported programme approved by our Executive Board. We stand with Ghana as it implements reforms to address the current economic and financial crisis and help build a better future for all Ghanaians.”

Kristalina Georgieva

The focus of the IMF support program, according to her, will be on curbing inflation, restoring macroeconomic stability, ensuring debt sustainability and rebuilding the country’s foreign reserve buffers.

Mrs. Kristalina further added that, despite the approval of the loan, successful implementation of the authorities’ program will require capacity development and continued support from development partners.

Read also: Finance Ministry Engages Traders in Accra on Fraudulent Financial Schemes