In a recent move, the Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has opted to maintain the policy rate.

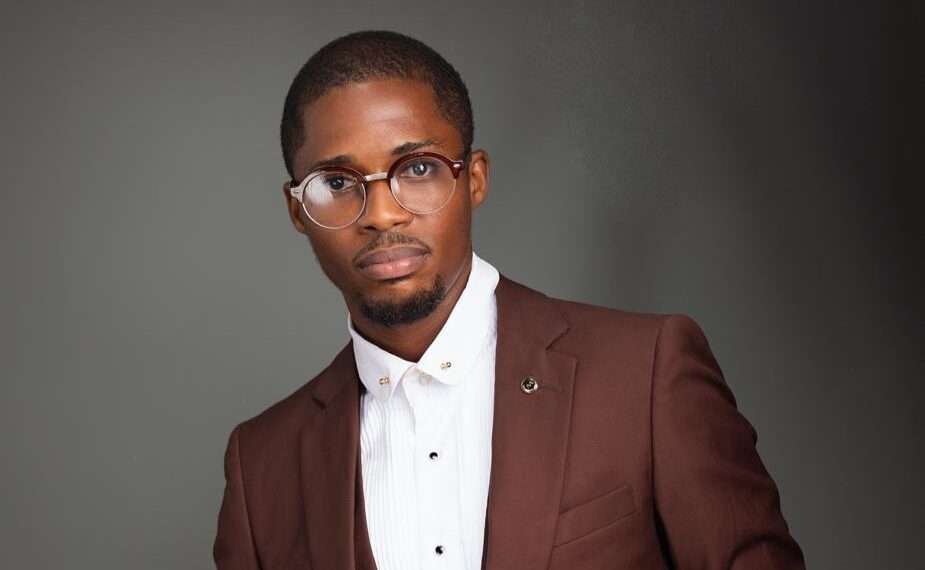

Mr. Kwabena Nyarko, a Financial Market Analyst and the CEO of Pipliquidator Fx, in an interview with the Vaultz News, has explained that this decision, reflecting a steady approach to monetary policy, is a catalyst to drive investment on the Ghana Stock Exchange (GSE).

According to the analyst, policy rate is a critical tool used by central banks to control inflation, manage economic growth, and influence the cost of borrowing.

“When the BoG decides to maintain this rate, it sends a signal of stability and predictability to the market. Investors, both local and international, often view stable monetary policy as a positive indicator of a country’s economic health. This stability can reduce uncertainty and risk, making the GSE a more attractive destination for investment.

“In the volatile world of finance, predictability is a precious commodity. Investors need assurance that the macroeconomic environment will not undergo abrupt changes that could affect their returns. By maintaining the policy rate, the BoG provides this assurance, potentially encouraging more investment in stocks listed on the GSE. This increased investment can lead to higher stock prices and improved market capitalization, benefiting both companies and investors.”

Mr. Kwabena Nyarko

Meanwhile, Mr. Kwabena Nyarko noted that one of the direct consequences of an unchanged policy rate is the stabilization of borrowing costs for businesses. He explained that companies often rely on borrowing to finance their operations, expand their businesses, or invest in new projects. “When interest rates are stable, businesses can plan their financial strategies with greater certainty, knowing that their cost of borrowing will not fluctuate unexpectedly,” he added.

Stable Borrowing Costs to Translate into Stable Financial Performance

Moreover, Mr Nyarko stated that for companies listed on the GSE, stable borrowing costs can translate into stable financial performance. Predictable interest expenses allow businesses to manage their budgets more effectively and maintain profitability. “This stability in corporate earnings can make these companies more attractive to investors, who are always on the lookout for reliable returns”.

“Stable borrowing costs can encourage more companies to seek listing on the GSE. When businesses are confident in their financial planning, they are more likely to explore opportunities for growth, including raising capital through equity markets. This can lead to an increase in the number of listed companies, further enriching the diversity and vibrancy of the GSE.”

Mr. Kwabena Nyarko

Mr Nyarko stated that the policy rate also has a significant impact on consumer behavior. When the rate is kept low, it becomes cheaper for consumers to borrow money. “This can lead to increased consumer spending, which in turn drives economic growth. In Ghana, where consumer-driven sectors play a crucial role in the economy, this can have a substantial positive impact on the GSE”.

“Increased consumer spending boosts the revenues of companies, especially those in retail, manufacturing, and services sectors. As these companies perform better financially, their stock prices on the GSE are likely to rise. Moreover, higher consumer spending can lead to more robust economic growth, creating a positive feedback loop that benefits the stock market and the broader economy.”

Mr. Kwabena Nyarko

Another important aspect of maintaining the policy rate according to Mr Nyarko stated is its effect on the exchange rate. Stable interest rates can contribute to a more stable currency, which is particularly beneficial for companies involved in international trade.

He added saying when the exchange rate is stable, these companies can plan their import and export activities with greater confidence, knowing that currency fluctuations will not erode their profits.

“For the GSE, a stable exchange rate can attract foreign investors who are wary of currency risk. International investors are often concerned about the impact of exchange rate volatility on their returns. By maintaining the policy rate and contributing to exchange rate stability, the BoG can help mitigate these concerns, making the GSE a more attractive option for foreign capital.”

Mr. Kwabena Nyarko

The Bank of Ghana’s decision to maintain the policy rate is a strategic move aimed at ensuring economic stability and fostering an environment conducive to investment. For the Ghana Stock Exchange, this decision holds multiple benefits. All these benefits combined create a favorable backdrop for the GSE, potentially driving more investment and boosting the performance of listed companies.

By maintaining this rate, the BoG is not just influencing monetary policy; it is also laying the groundwork for a more vibrant and resilient stock market, ultimately contributing to the overall economic prosperity of Ghana.

READ ALSO: Labour Pushes for Railway Nationalisation Ahead of Next Election