The Ghana Stock Exchange (GSE) is actively pushing for more state-owned enterprises (SOEs) to list on the local bourse as part of a broader strategy to deepen the country’s capital market.

This move aligns with the GSE’s recent engagement with the Graphic Communications Group Ltd. (GCGL), which is making strides toward an initial public offering (IPO) on the exchange.

The listing of GCGL, a national heritage brand, is being heralded as a significant milestone for both the company and the GSE, reflecting a growing trend of public sector entities turning to the capital markets for growth capital.

During a recent courtesy call at the offices of GCGL, Abena Amoah, the Managing Director (MD) of the GSE, reaffirmed the exchange’s commitment to facilitating the listing process for the media giant.

Ms Amoah, who has a storied career in investment banking and has been instrumental in some of Ghana’s most complex mergers, acquisitions, and IPOs, expressed enthusiasm about the prospect of GCGL’s listing.

“We want to see this national heritage brand continue to excel,” Ms Amoah said, underscoring the GSE’s readiness to support GCGL in raising the necessary capital through the stock market.

The Strategic Importance of SOEs Listing

The GSE’s push for more SOEs to list on the local bourse is not merely a technical exercise but a strategic initiative aimed at bolstering the capital market and driving economic growth.

According to Ms Amoah, the GSE has identified about 30 SOEs that are well-positioned to raise capital on the stock market. These entities, by tapping into the public equity markets, can access the financial resources needed to expand and modernize their operations, thereby contributing to broader economic development.

State-owned enterprises play a crucial role in Ghana’s economy, often operating in key sectors such as utilities, transportation, and communications. However, many of these entities have historically relied on government funding or loans to finance their operations.

By listing on the stock exchange, SOEs can diversify their funding sources, reduce dependence on public finances, and introduce a level of financial discipline that comes with being accountable to public shareholders.

Ms Amoah’s engagement with the State Interests and Governance Authority (SIGA) and the Ministry of Public Enterprises further highlights the GSE’s commitment to this agenda. ShE emphasized the need for deliberate policies that encourage SOEs to list on the stock market, noting that such policies would not only enhance the performance and transparency of these entities but also deepen the capital market.

As one of the leading media organizations in Ghana, Graphic Communications Group Ltd.’s decision to pursue an IPO is seen as a landmark move. The company, which has built a reputation for delivering accurate and reliable news, is looking to raise additional capital to support its growth ambitions.

Mr Ato Afful, the Managing Director of GCGL, emphasized that the listing would enable the company to continue delivering value to its stakeholders in an increasingly competitive media landscape.

“We need additional capital to enable us to deliver on our brand promise of truth and accuracy served every day,” Afful stated. He added that the listing on the GSE is a top priority for the company, with the goal of completing the process before the end of the year.

The capital raised from the IPO is expected to be used for various strategic initiatives, including technological upgrades, content development, and expanding the company’s digital footprint.

Broader Implications for the Capital Market

The potential listing of GCGL on the GSE has broader implications for the capital market and the economy as a whole. For the GSE, attracting a company of GCGL’s stature to the exchange is a testament to the growing confidence in the market.

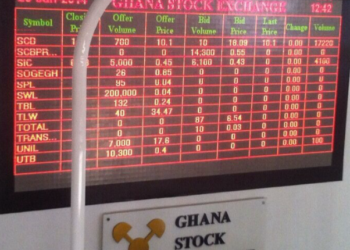

The GSE has seen a resurgence in activity this year, with the GSE Composite Index, which measures the performance of the equities market, rising by 40%—one of the best performances in Africa. The market capitalization of listed companies has also surpassed GH¢90 billion in the first half of the year, reflecting a significant recovery from the previous year.

This renewed vigor in the capital market is being fueled by a combination of factors, including falling interest rates, which make it cheaper for companies to raise capital, and a diversification of products available on the exchange.

The GSE has introduced new instruments such as commercial paper markets and corporate bonds, providing companies with a range of options to raise both short-term and long-term capital. Additionally, the exchange has rolled out sustainability bonds, aligning with global trends toward responsible investing.

The GSE’s call for more SOEs to list on the stock market, coupled with the impending IPO of Graphic Communications Group Ltd., signals a new era for Ghana’s capital market.

By opening up to public investment, SOEs can access the capital needed to grow and thrive, while also contributing to the overall development of the economy. As more companies follow GCGL’s lead, the GSE is poised to play an increasingly central role in shaping the future of Ghana’s financial sector.

READ ALSO: GUM Leader Dares to Break NPP-NDC Duopoly