Economist, Godfred Bokpin, has revealed that government is on a course to creating a financially repressed society.

According to him, he is disappointed in the 2023 budget as government failed to communicate the truth to Ghanaians on time and created the impression that what “independent-minded” people were putting forth on the state of the economy was false. He indicated that government’s reasons for the state of the country isn’t exclusive to Ghana and cannot be used as leverage in justifying the situation in the country.

“They created false confidence and hope that things weren’t as bad as the data suggested… We are on course to create a financially-repressed society, that’s where we are heading toward. We are presenting 2023 budget on the premise that COVID-19 has affected the government and Russia-Ukraine. But COVID did not only affect government, COVID affected individuals and households…”

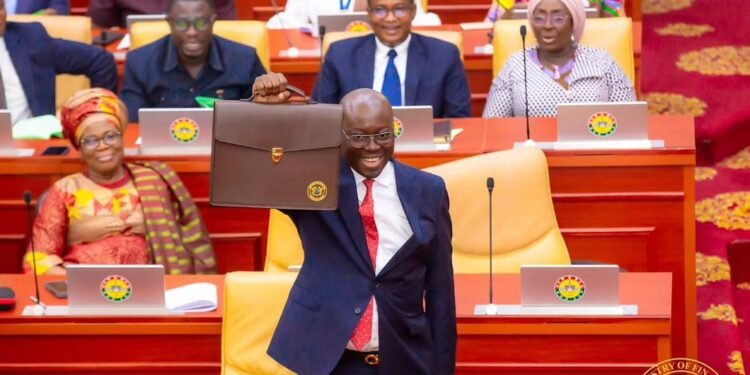

Prof Godfred Bokpin

Prof Bokpin stated that a careful consideration of emerging market and advanced countries proves that they have discovered measures and are implementing them, a situation which cannot be said about Ghana. He noted that government’s tax measures since COVID began looks as though households and businesses have an “exceptional resilience to COVID-19 other than government”. As such, government resolve to balance its books must excessively be loaded on households and firms.

The economist noted that the strength of every economy lies in the strength of household balance sheets and private sector, and government is eroding that.

VAT increment to worsen conditions of Ghanaians

Commenting on the introduction of a 2.5% addition to VAT, Prof Bokpin bemoaned the deluge of taxes being piled on Ghanaians by government. He highlighted that despite government’s conclusion that the future is digitization, which holds the key to greater economic transformation and inclusive productivity growth, it has gone ahead to introduce tax components like the e-levy.

He indicated that since COVID, government has introduced levies such as COVID levy and sanitation levy.

“To make matters worse, government now has also increased the VAT rate rather than exploring efficiency within existing tax side. Studies have shown that when your VAT rate is 18% or above, it significantly inhibits growth. In other words, it becomes counterproductive.”

Prof Godfred Bokpin

Prof Bokpin asserted that the implication of the VAT and the treatment of straight levies effectively puts the VAT burden on the consumer in excess of 20%. This, he explained, contributes to the high productive cost base of doing business and deceives every attempt to build savings mobilization.

“When it happens that way, it’s going to be difficult for the average Ghanaian to actually build reserves and take advantage of the limited economic opportunities that will be created. What that does is to undermine private sector competitiveness as we go deeper into the implementation of the African Continental Free Trade Area. I fear for Ghana…”

Prof Godfred Bokpin

Additionally, Prof Bokpin questioned the impact of government’s interventions and policies on Ghanaians and the number of persons it has liberated from poverty. He emphasized that the efficiency of these policies are dependent on its tangible impact.

“The data is clear… How many people have we lifted out of poverty? How have these programs narrowed inequality? We are interested in impact… Over 14 million Ghanaians are multidimensionally poor.”

Prof Godfred Bokpin

READ ALSO: The Barter Of Gold For Oil Represents A Major Structural Change- Dr Bawumia