Bright Simons, Honorary Vice President of IMANI Centre for Policy and Education, has raised questions regarding the World Bank’s financial intervention in Ghana’s economy.

According to Simons, Ghana’s classification as a “lower middle-income country” led many international donors to reduce their contributions, making the World Bank the country’s primary strategic development partner.

However, he argued that the World Bank’s decisions regarding funding allocations in Ghana have often failed to address the nation’s most pressing financial challenges, warranting increased scrutiny and accountability in how these funds are managed.

“$250 million was allocated by the World Bank to support ‘financial stability’ in Ghana.

“The separate ‘Financial Sector Development’ effort was allocated $30 million for rollout of various initiatives to start in 2019.”

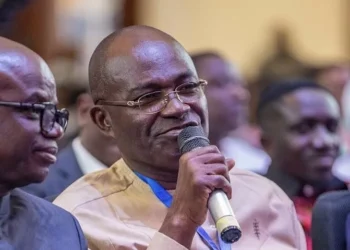

Bright Simons, Honorary Vice President of IMANI Centre for Policy and Education

In recent years, the World Bank has provided substantial funding to stabilize Ghana’s financial sector, which has suffered due to the collapse of several banks and financial institutions and a broader fiscal crisis that has impacted both public and private sectors.

One of the primary critiques raised by Bright Simons concerns the decision to establish a government-controlled credit rating agency, the Credit Rating Agency Ghana (CRAG). This agency was intended to rate government bonds and enhance investor confidence in Ghana’s debt securities.

However, Bright Simons argued that the presence of established private rating agencies, such as Augusto & Co. and Beacon, as well as other internationally recognized agencies like Global Credit Rating (GCR) and DataPro, made this move unnecessary.

According to Bright Simons, a government-controlled agency poses a conflict of interest as it is unlikely to provide unbiased ratings for government bonds, undermining investor confidence.

“Why should a government-controlled credit agency be rating government bonds? Why should any investor take their ratings seriously?” Bright Simons questioned.

Another contentious issue raised by Bright Simons involves the allocation of 89% of the World Bank’s financial stability funds to state-owned banks, many of which have a history of mismanagement exacerbated by political interference.

According to Bright Simons, this choice sidelined private banks that have suffered due to deteriorating fiscal conditions and have struggled to meet regulatory requirements.

“Some of these struggling [private] banks even have negative equity at this point and can’t afford regulatory fines. They, not the state-owned banks, should have gotten the money.”

Bright Simons, Honorary Vice President of IMANI Centre for Policy and Education

This allocation decision, he argued, reflects a missed opportunity to strengthen the sector more equitably by aiding banks that need stability and growth capital the most.

Issues with the ARB-APEX Bank’s Digital Banking Initiative

Simons also criticized the deployment of World Bank funds toward a digital initiative managed by ARB-APEX Bank, a quasi-regulatory entity coordinating community banks in Ghana.

The goal of this project was to create a common digital banking app and agency banking platform for rural banks, an effort deemed innovative but reportedly plagued by design and implementation flaws.

“The plan to get ARB-APEX bank (a quasi-regulator & coordinator of Ghanaian community banks) to build a common app and agency banking platform for rural banks was relatively clever but implementation has been hard due to design gaps. 5 years on, uptake of the app, USSD code #992, and the industry-wide ERP is virtually nill.”

Bright Simons, Honorary Vice President of IMANI Centre for Policy and Education

Bright Simons’ analysis revealed what he describes as a pervasive issue in Ghana’s public financial management culture—a lack of accountability in decision-making and implementation.

He argued that the selection of projects funded by the World Bank reflects political rather than economic priorities, with elected officials often prioritizing projects that serve short-term political gains over long-term financial stability.

“We are action-oriented and intend to ramp up advocacy to change the culture of performance and accountability,” Simons stated, emphasizing the need for civil society and policymakers to critically assess the real impacts of development assistance on Ghana’s financial resilience and governance.