Ghana has achieved a significant milestone by being ranked the 1st West African country and the 5th in Africa on the World Economics Governance Index (WEGI), as reported by World Economics Research based in London, the United Kingdom.

This ranking is a testament to Ghana’s strong governance, as it scored 61.7 points on the index. The World Economics Governance Index evaluates governance across various indicators, including corruption perception, rule of law, press freedom, and political rights, all of which are crucial for investors and the global community to assess the risk associated with governance in different countries.

“All index numbers have been rebased and are shown on a scale of 0-100. Governance: 0 = poor governance; 100 = as excellent as it gets. Corruption Perception: 0 = bad; 100 = good. Rule of Law: 0 = low rule of law; 100 = high rule of law; Press Freedom: 0 = low press freedom; 100 = high press freedom; and Political Rights: 0 = low political rights; 100 = high political rights. The grade definitions are A: Very Good, B: Good, C: Average, D: Poor, and E: Very Poor.”

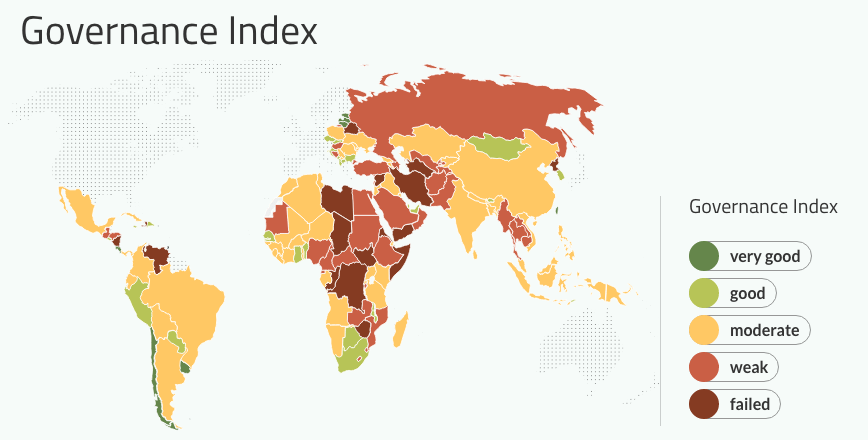

World Economics Governance Index

Ghana’s high ranking on the index is particularly noteworthy given the challenges it faces in terms of economic growth and governance. Despite the ongoing fiscal consolidation, high inflation rates, elevated interest rates, and macroeconomic uncertainties, Ghana is expected to gradually rebound to its long-term potential of approximately 5% by 2026 as prevailing conditions stabilize.

The fiscal deficit is projected to decline further to 5% of GDP in 2024 due to ongoing fiscal consolidation reforms and external debt restructuring. By 2026, the authorities expect to generate a primary surplus of 1.6% of GDP, marking a significant fiscal adjustment.

The World Bank’s Ghana Country Partnership Framework (CPF) for FY22-26 aims to support the government in managing the impact of the COVID-19 crisis and build back better for a dynamic and diversified economy, creating job opportunities for a greener, more resilient, and inclusive society.

The focus areas include enhancing conditions for private sector development with quality job growth, improving inclusive service delivery, and promoting sustainable resilient development. Digital transformation is a cross-cutting theme in these efforts.

Ghana achieved near-perfect scores for the rule of law, press freedom, and political rights, which are crucial components of the index. These high scores reflect a strong commitment to governance principles within the country.

Compared to other West African countries, Ghana outperforms its counterparts. For instance, Senegal, the closest West African competitor, was ranked sixth with a grade of C and an index of 53.6, indicating a significant gap in governance performance between Ghana and its neighbors.

Denmark, Norway, Finland, New Zealand, and Sweden were ranked first, second, third, fourth, and fifth globally. Switzerland, the Netherlands, Ireland, Luxembourg, Canada, Germany, Iceland, Estonia, Australia, and the United Kingdom follow in that order.

Ghana is ranked 48th, ahead of countries such as Argentina, Bulgaria, Hong Kong, Malaysia, Brazil, Senegal, Malawi, Indonesia, India, Tunisia, Cote d’Ivoire, United Arab Emirates, Benin, Rwanda, Kenya, Morocco, Tanzania, Ethiopia, Nigeria, Turkey, and Egypt.

The World Economics Governance Index provides valuable insights for investors, helping them assess risks related to governance. Ghana’s high ranking suggests that the country’s governance landscape is viewed favorably by investors, which can contribute to its economic development and growth.

Ghana’s strong governance and economic outlook, as reflected in its high ranking on the World Economics Governance Index, underscores the country’s commitment to good governance and its efforts to create a conducive environment for economic growth and development. This achievement is a positive indicator for investors and the global community, highlighting Ghana’s potential for continued growth and development in the years to come.

READ ALSO: Inflation, China, Elections, and Developments in the Middle East Pose Risks to Global Markets