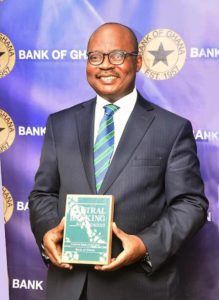

The Governor of the Bank of Ghana, Ernest Addison has lauded the capabilities of the Bank in building a financial institution which is reputable and well respected by stakeholders.

Speaking at a virtual ceremony on the Bank being adjudged the Central Bank of the Year Award, the BoG Governor intimated that the successful execution of the monetary policy and financial sector reforms, as well as subsequent turnaround in the economy, which the Award duly recognizes “has been due to the hard work of the whole Bank of Ghana”.

“It is a great privilege for the Bank of Ghana to be named the Central Bank of the Year, and I thank the team at Central Banking for the honour done us to be named the Central Bank of the Year, and I thank the team at Central Banking for the honour done us.

“This award reflects our vision to build a central bank of excellence that is well-respected by stakeholders, and further strengthens our resolve to continue to implement sound monetary and financial sector policies”.

Commending the notable inputs of his team, Mr. Addison congratulated his “very able and efficient deputies, and heads of departments”.

Additionally, he doled out plaudits on the policy which largely rescued the economic quagmire the country was in due to the COVID-19 pandemic.

“The Bank also received invaluable support from the Monetary Policy Committee, and other key collaborative institutions, including the Ministry of Finance and the Economic Management Team, in the pursuit of its policies and programmes.

“It is fair to say that the three years of policy reform has firmly positioned Ghana’s economy to withstand the headwinds arising from the COVID-19 pandemic. Tight monetary policy stance helped reduced inflation significantly and maintained in single digits and well within the Banks target range, and a well anchored exchange rate stability”.

Recapping the achievements of the central bank, Mr. Addison extensively captured “successfully concluding three years of banking sector reforms”, which saw an increase in the minimum capital requirements, clean-up of the financial sector by revoking licences of weak and insolvent institutions, and a revamp of the regulatory framework to stabilize and strengthen the sector.

“Our banks are now well capitalized, liquid, solvent, and resilient to liquidity and credit risk and well positioned to support Ghana’s economic growth agenda”.

The awards dinner which was slated for March 2020, in Brussels, Belgium to highlight the outstanding performance and achievements of awardees was called off due to the emergence and worldwide effect of the coronavirus (Covid-19) pandemic.

The Central Banking Awards were set up to highlight the outstanding performance and achievements of individuals and organizations within the central banking community.

The awards recognise excellence in a community facing difficult monetary policy and financial stability challenges that needed to be addressed effectively, while prudently embracing technological change in reserves, financial services, payments, currency management and data.