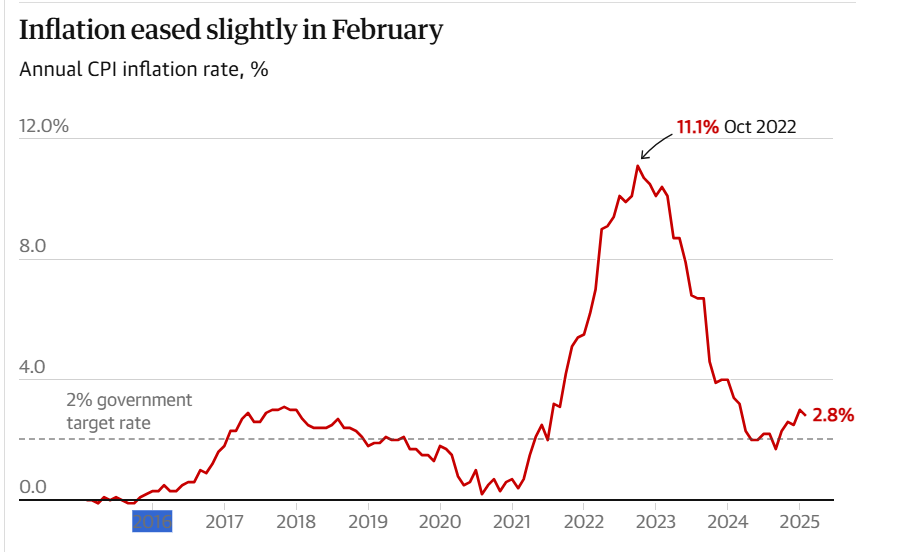

The UK’s inflation rate has fallen more than anticipated, reaching 2.8% in February, offering a brief moment of economic optimism ahead of Chancellor Rachel Reeves’ upcoming spring statement.

According to the Office for National Statistics (ONS), consumer price index (CPI) inflation resumed its downward trend last month after an unexpected rise to 3% in January from 2.5% in December. The latest figure surpassed economists’ forecasts of 2.9%, reinforcing the notion that price increases are slowing, albeit gradually.

Grant Fitzner, ONS chief economist, attributed the decrease mainly to lower clothing prices, particularly in women’s apparel, though the effect was partially offset by small increases in alcoholic drink prices.

The data comes just hours before Reeves’ fiscal address to the House of Commons, where she is expected to unveil bleak economic forecasts from the Office for Budget Responsibility.

The UK economy has been teetering on the edge of stagnation, as households grapple with the burden of high prices and elevated borrowing costs. Business and consumer confidence has also been shaken due to rising taxation and ongoing concerns over Donald Trump’s trade policies.

Energy and Food Prices Set to Rise

Despite the temporary relief, analysts warn that inflationary pressures are far from over. Rising wholesale energy costs and climbing food prices are likely to drive inflation back up in the coming months, with the Bank of England projecting a possible peak of about 3.7% later this year.

Households are preparing for a fresh round of financial strain, as council tax, utility bills, and other household expenses are set to increase from April. Meanwhile, business leaders caution that Reeves’ planned autumn hike in employer national insurance contributions — scheduled to take effect next week — could lead to job losses and further price hikes.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, expressed concern over the near-term outlook.

“February’s slowdown is a false dawn as notable near-term price rises are already baked in, with next month’s jump in energy bills and national insurance likely to push inflation perilously close to 4% sooner rather than later.”

Suren Thiru

Paul Dales, chief UK economist at Capital Economics, predicts that inflation may briefly decline to 2.5% in March before surging again. He noted that a 6.4% increase in utility prices and a 26% jump in water bills could push inflation above 3% in April.

Rate Cuts Uncertain as Inflation Persists

Persistent inflation could limit the Bank of England’s ability to cut interest rates, further complicating the government’s financial strategy. Rising government borrowing costs in financial markets have added to Chancellor Reeves’ economic challenges.

Core inflation, which excludes volatile food and energy prices and reflects underlying price pressures, stood at 3.5% in February, down from 3.7% in January. Meanwhile, inflation in the services sector, a key metric monitored by the Bank of England, remained unchanged at 5%.

Threadneedle Street has signaled a cautious approach to interest rate cuts. After three reductions in the past year, financial markets currently anticipate only two additional quarter-point cuts in 2024, bringing rates down to 4%.

Darren Jones, Chief Secretary to the Treasury, reassured the public of the government’s commitment to economic stability.

“Our number one mission is kickstarting growth to raise living standards for working people, that is why we are protecting working people’s payslips from higher taxes.”

Darren Jones

With inflationary pressures still looming and economic uncertainty persisting, the coming months will be crucial in determining the UK’s financial trajectory.

READ ALSO: Actor Calls for Collective Action to Revive Ghana’s Movie Industry