US Treasury Secretary, Janet Yellen, has assured;the public that President Joe Biden’s proposed spending on infrastructure and families will not fuel inflation;because the plans would be phased-in gradually over 10 years.

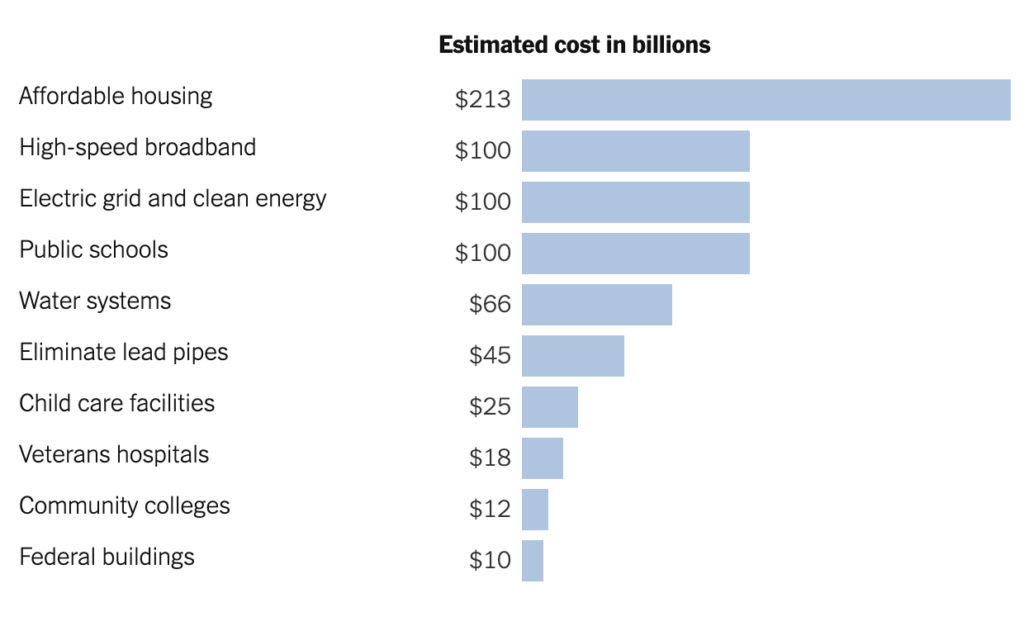

The Biden administration recently proposed;a $1.8tn American Families plan to support programs such as child care, paid family leave and education. Prior to that, the administration also proposed a $2.3tn plan to rebuild infrastructure and reshape the economy.

However, economists, including former US Treasury Secretary, Larry Summers, have warned;that the Federal Reserve’s current “ultra-low” interest rates, along with the Biden administration’s proposed $4 trillion in new spending,;atop about $5 trillion already approved;by Congress, risk accelerating inflation.

Addressing the fears about inflation, Yellen posited;in an interview that, the proposed spending “comes into effect once the economy is back on track.”

“It’s spread out quite evenly over eight to 10 years. So, the boost to demand is moderate. I don’t believe that inflation will be an issue,;but if it becomes an issue, we have tools to address it.”

She added that the Biden plans are “historic investments that we need to make our economy productive and fair.”

Her assertion echoes that of Federal Reserve Chairman, Jerome Powell, earlier this week. Powell, in an interview, indicated;that he does not believe a “sharp surge in prices is likely”. He intimated that the Fed can “keep interest rates low even as the economic recovery intensifies, and will not have to quickly raise rates to stop inflation.”

Proposed plans to be paid for by taxes

Yellen also noted that the administration is proposing that the spending plans will be;paid for by raising the tax rate on corporations above the current level of 21% and closing loopholes that encourage US corporations to “shift their income abroad” to tax havens.

People earning more than a million dollars annually would see a tax increase on their capital gains and dividends to 39.6%, the same rate as income for families making over $400,000 a year before the 2017 Trump tax law, she said.

Yellen assured that the administration is pledging that under its plan, no family earning less than $400,000 would pay a penny more in taxes.

Both the spending plans and the tax changes must be approved by Congress to take effect. However, Republican lawmakers strongly oppose using tax increments to pay for the packages.

In a bipartisan meeting at the Oval office last week, Republican senator, John Hoeven told President Biden that they are opposed to increasing the corporate tax rate to pay for his proposed infrastructure plan.

“There is broad support for infrastructure, and I believe a bipartisan bill is possible, but we need to find agreement to make these updates in a targeted way that doesn’t raise taxes.”

In an interview, Senate minority leader, Mitch McConnell, also averred that he would “fight them (Democrats) every step of the way because I think this is the wrong prescription for America”.

“That package that they’re putting together now, as much as we would like to address infrastructure, is not going to get support from our side”.

Read Also: Development Banks, Partners pledge over $17 billion to increase food security in Africa