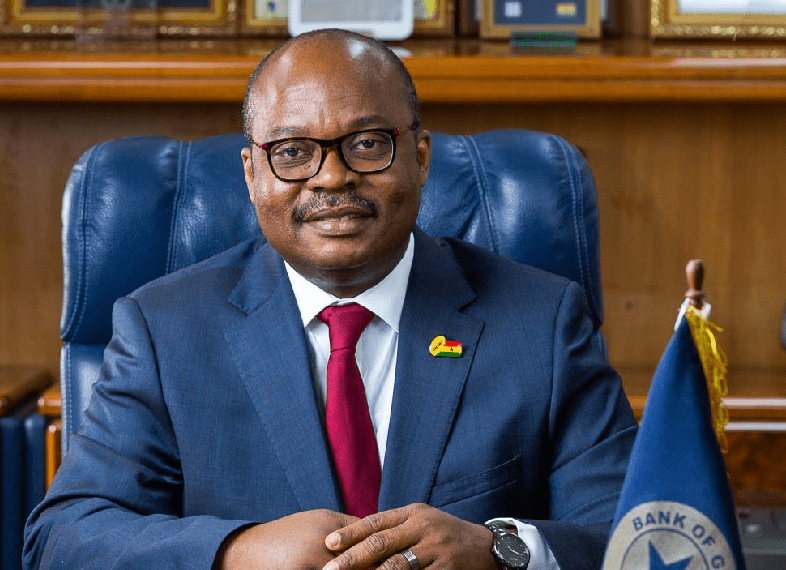

The Governor of the Bank of Ghana, Dr. Ernest Yedu Addison has intimated that to reduce the occurrence of high Non-Performing Loans (NPLs) amid the coronavirus pandemic, Financial Institutions should remain vigilant in their supervision .

“Pandemic tail-risks, that is, pandemic-related impact on non-performing loans, would require continuous supervisory vigilance”.

Non-performing loans reduced marginally to 15.3 percent by the end of October 2020 from 15.8 percent recorded in September this year, indicating a decline of approximately 50 basis points (0.5%) monthly, according to the latest summary of financial and economic data released by the Bank of Ghana.

In the same vein, last year October, NPLs lingered around 17.3 percent, depicting a year-on-year decline of about 2 percent, the Bank of Ghana mentioned, translating into an improvement in asset quality for the period under review.

Even though the 15.3 percent represents a recuperation from last month and last year concurrently, it’s quite high compared to the figures recorded at the beginning of the year 2020, from January to May, where NPL ratio kept hovering around 13.6 percent and reaching up to 15.2 percent, the Bank of Ghana alerted.

Commenting on the marginal increases in NPLs, Dr. Addison said most banks placed moratorium on loan repayments allowing borrowers to temporarily put off their monthly payments without increasing their interest or defaulting on their loans as a strategy to provide support to individuals and businesses amid the COVID-19 crises that has inflicted economic hardships affecting the livelihoods of many.

“We noted the marginal increase in our meetings, and we think that it’s too early to make any major assessments because we also know that we asked the banks to give moratoriums to their clients. It means that it’s only after the period that they’ve given these forbearances that we can determine which loans are performing and which ones are not really performing.”

Also, the Governor of the Bank of Ghana further asserted that “the latest credit conditions survey conducted in October 2020 show a net easing in overall credit stance on loans to enterprises and households” as against a net tightening in the overall credit stance on loans to enterprises observed in an earlier study performed in August 2020.

“The survey results showed that with the recovery in economic activities underway, demand for loans over the next two months is also expected to rise,” he remarked. All these happenings may possibly translate into an upsurge in NPLs by the end of the year.

“Net outstanding claims on the private sector, which also captures repayments to the banking sector, show some moderation since the beginning of the year. With respect to new advances, the data shows that cumulatively from the beginning of the year, new loans to support economic activity stands at GH¢27.4 billion compared with GH¢21.3 billion for the same period of last year”.

Overall, new loans meted to individuals and businesses to boost economic activities have increased by approximately 28.6 percent year-on-year. With a resurgence of the coronavirus pandemic and a decline in lending rates, there are fears that loan advances will shoot up hence the need for the banking sector to remain prudent and vigilant to help mitigate the escalating levels of non-performing loans and a possible collapse of the financial sector again.

READ ALSO: Bank of Ghana Improves Collateral Registry System