The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has decided to play safe by maintaining its policy rate, the rate at which it lends to commercial banks, at 13.5% despite mounting pressures to reduce interest rates in the country.

BoG’s decision to maintain the policy rate comes after a thorough review of developments in both the domestic and the global economies during its 102nd MPC meetings. The BoG said the major reason for maintaining the policy rate is the fairly balanced risks to inflation and growth in the outlook.

“Given these considerations, and the fairly balanced risks to inflation and growth in the outlook, the Committee decided to keep the policy rate at 13.5%”.

MPC

Developments in the global economy

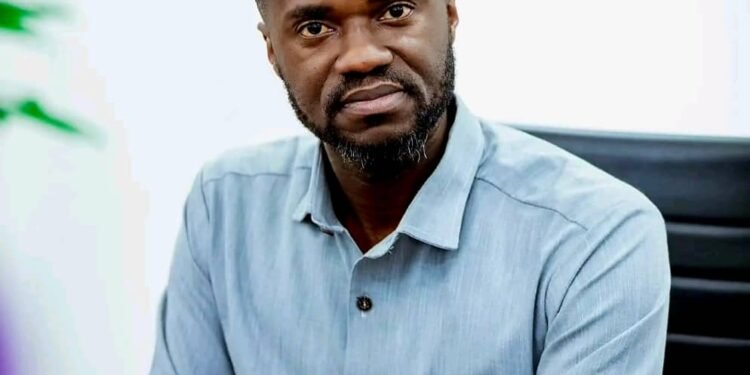

Addressing the press, Governor of the Bank of Ghana, Dr. Ernest Addison, said the recovery in global economic activity is in progress, although unevenly spread across regions and countries. The MPC, based on its review, highlighted some possible threats to the global outlook that may trickle down to the domestic economy.

“But, uncertainties regarding the continued spread of the Delta variant of the COVID-19 virus, variations in policy stimulus programmes, and low access to vaccines in emerging market and frontier economies may weaken near-term growth prospects.

“However, the factors driving headline inflation are judged to be temporary. The still sizeable spare capacity in the global economy and the slackness in labour market conditions would restrain wage growth and prevent a significant and sustained pick-up in underlying inflation. Inflation is expected to return to their target over the medium-term as the spare capacity is eroded”.

Dr. Ernest Addison

Domestic economy

On the domestic front, the Governor stated that the Committee concluded that the economy is on the path of recovery from the impact of the pandemic. This is because the BoG’s high frequency economic indicators point to continued recovery in economic activity, even though below pre-pandemic levels.

To this end, Dr. Addison revealed that the BoG will maintain its policy measures in the interim to further cushion the economy.

“Although consumer confidence picked up, weakening business sentiments, stemming from supply disruptions, is;adversely impacting input costs, driving down short-term company prospects. While credit to the private sector saw a marginal pickup, the trends remain below expectations largely;on account of pandemic-related risk aversion. The COVID-19 related macro-prudential measures, put in place by the Bank of Ghana, will be;maintained for the time being to support full recovery in economic activity”.

Dr. Ernest Addison

Resilient Bank sector

The Governor also stated that the banking sector balance sheet;performance remains strong with sustained growth in total assets, investments and deposits. But, he highlighted that the MPC expressed worry about the increasing trend of domestic financing;of the deficit, driven by high-yielding government paper held largely by banks. According to Dr. Addison, the MPC said this “was crowding out credit to the private sector”.

Dr. Addison further said “the latest data suggests that fiscal consolidation efforts appear to be on track”. But he cautioned that “there are some inherent risks associated with wage settlements and energy sector payments, amid low revenue mobilization”.

Regarding price movements, inflation has risen sharply over the last two readings, driven mainly by sustained food price increases. As such, the Governor said a close monitoring of the inflation situation is necessary to respond swiftly to;prevent potential second round effects on headline inflation from the rising food inflation. The Committee noted that it stands ready to respond appropriately as needed if this particular risk materializes.

READ ALSO: Cambodian students build manned drone