John Awuah, the Chief Executive Officer (CEO) of the Ghana Association of Bankers (GAB) has identified among other reasons, lack of vigilance as the chief cause of ATM fraud in the country.

The CEO of the Ghana Association of Bankers, has therefore, charged merchants to be extra vigilance when providing goods and services in order to help reduce ATM or card fraud.

John Awuah noted that apart from educating customers on the safe use of their ATM cards, merchants also need to play their part to reduce ATM or card fraud.

“We are talking to our merchants, we are urging them to be vigilant and ensure that when they are processing transactions, they should make sure people around them are trusted people. There could be a customer who is just nosing around trying to steal card details from other unsuspecting customers. A lack of vigilance could lead to card details being stolen and used in a manner that can lead to financial loss for customers and even the merchants.”

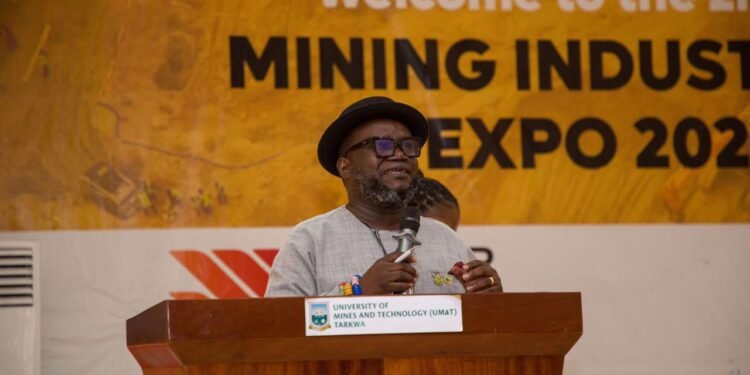

John Awuah

Additionally, Mr Awuah stated that there are other ways in which fraudsters use to carry out their activities. He thus, called for an all inclusive education and training to limit the incidence of ATM fraud.

“All in all there are other things that can be done to reduce ATM or card fraud like training for merchants, training for card users and general education on the safety of ATM cards.”

John Awuah

The 2020 fraud report from the Central Bank revealed among other things that, ATM or Card fraud recorded a loss value of approximately GH¢ 8.19 million in 2020, as compared to an approximate loss value of GH¢1.26 million recorded in 2019, representing a year-on-year increase of over 500 percent in losses associated with ATM fraud.

The reported value of fraud recorded by Banks and Specialized Deposit-Taking Institutions in Ghana in 2020 was about GH¢ 1 billion.

This represents an increase of over 750 percent when compared to the reported value of fraud recorded in 2019, which stood at about GH¢115 million.

The emergence of the COVID-19 pandemic, according to the fraud report, saw customers who were not used to digital/electronic methods of making financial transactions being compelled to use them.

Consequently, some sections of the banking sector were exposed to heightened levels of fraud-related risk, due to the increased patronage of electronic/digital products and services.

ATM and Cyber Fraud Linked to Technology

It can be recalled that Dr Ernest Addison, the Governor of the Bank of Ghana (BoG), has attributed the recent surge in incidences of cyber fraud and bank related fraud to the result of growth in the bank’s use of technology in the country. He, thus, assured Ghanaians and bank’s customers that measures have been put in place by the central bank to ensure safer cyber space in the financial sector of the local economy.

The BoG Governor explained that, the more financial institutions resort to the use of technology, the more likely they are to be exposed to frauds including ATM fraud.

READ ALSO: World Bank forecasts higher End-year inflation for Ghana