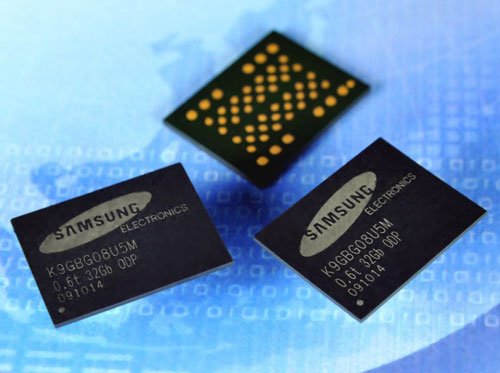

Samsung Electronics’, a major manufacturer of Electronic components and one of the largest sought after electronic brands has reported a 69 percent decline in profit.

This decline the company reveals is due to a global economic slowdown that has caused memory chip prices and demand for IT gadgets and servers to decrease.

For the quarter ending December, Samsung’s operating profit fell to KRW 4.3 trillion (approx. USD 3.7 billion), significantly lower than the KRW 6.7 trillion (approx. USD 5.8 billion) estimated by analysts. The company also reported a decline in sales, which totaled KRW 70 trillion (approx. USD 60 billion).

Samsung is nonetheless slated to release a complete financial statement, including net income and divisional performance details, on January 31st.

The company, South Korea’s largest, has been struggling with a decrease in demand for memory chips, smartphones, and displays due to consumers cutting back on holiday spending in the face of rising interest rates and inflation.

In addition, one of Samsung’s largest customers, Apple, experienced production delays at its iPhone factory in Zhengzhou, China, further contributing to the demand issues.

“The decline in fourth-quarter demand was greater than expected as customers adjusted inventories in their effort to further tighten finances.”

Samsung

Samsung experienced larger-than-anticipated price drops in memory chips and also mentioned that “smartphone sales and revenue decreased due to weak demand resulting from prolonged macro issues”.

The crisis in the memory chip market has been heightened by US sanctions on some chip-related exports to China, which has affected demand from some of Samsung’s major clients.

Chip sales in South Korea, a leading indicator of global tech demand, declined 29% in December 2022, marking the fifth consecutive monthly drop and following the largest year-on-year decline since 2009 in November.

Competitors reduce spending

After increasing production to record levels to meet the increased demand during the pandemic, chipmakers have had to reduce spending on new production and cut costs in response to the current market conditions.

Memory chipmakers, including Micron Technology, do not expect a recovery until the second half of this year and have reduced budgets for new equipment and plants and implemented cost-cutting measures.

Micron has also warned that it may be difficult to return to profitability this year and has announced a 10% reduction in its workforce and further cuts in capital expenditure (CAPEX). SK Hynix also stated that it will halve its CAPEX for 2023.

In contrast to its competitors, Samsung, the world’s largest memory chip maker, announced in October that it had no immediate plans to reduce output.

However, since then, memory chip prices have continued to fall rapidly due to increased competition over server clients.

Samsung’s memory output in terms of storage capacity increased by approximately 10% during the last quarter of the year, although average selling prices dropped by around 28%, indicated eBEST Investment & Securities on December 22nd.

The negative outlook has led to speculation that Samsung may need to decrease its CAPEX in order to protect its profitability.

Flash memory chips are now at price levels matching Samsung’s cost of production, noted Peter Lee, analyst at Citigroup.

Given the bigger-than-expected price declines, Samsung is likely to modify its 2023 estimated CAPEX strategy “to a more dovish stance and refrain from a capex increase”, Mr. Lee added.

READ ALSO: Lands Ministry To Fully Implement National Lands Conference Communique