Former Executive Director at Standard Chartered Bank, Ghana, Alexander Mould, has painted a bleak picture on the country’s banking space once the debt exchange programme is implemented.

According to him, when this happens, government will have no other option than to cut down its expenditure as it will record lower than expected revenue. He indicated that the first to go will be discretionary expenditure and other non-productive policy programmes.

“The Debt Exchange, if carried out in its current form, will result in many banks not getting any income from Government Treasury Bonds they hold for almost 1.5 years! In some cases, this forms up to 60% of their revenue and is a huge contributor to their profits! To be blunt most banks will be making losses when you combine this loss of income to the high default rate on loans to SMEs and corporates.”

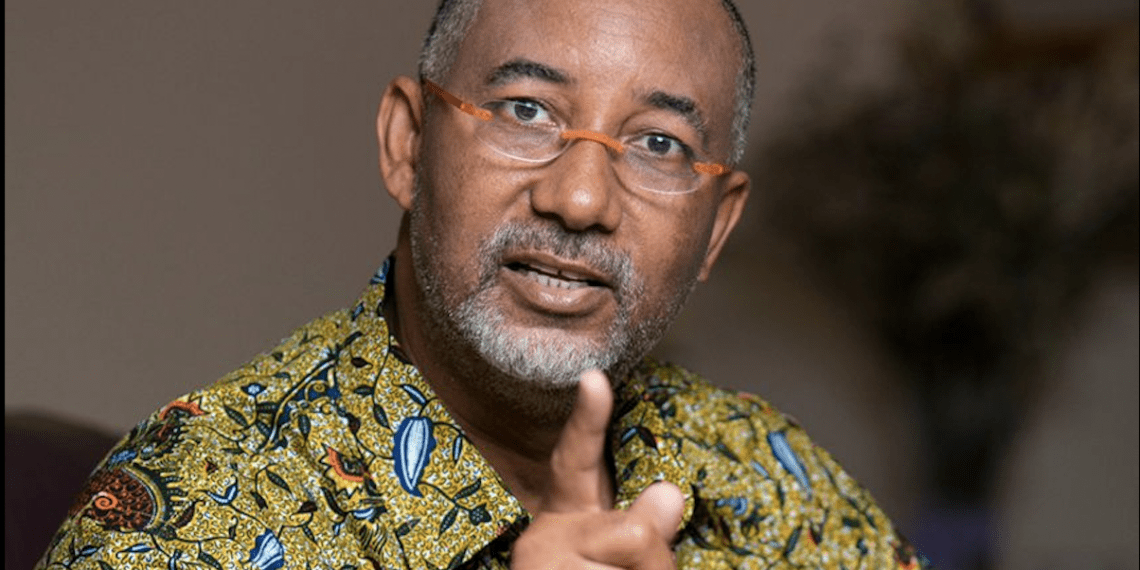

Alexander Mould

Mr Mould insisted that government seems not to have thought through the debt exchange programme thoroughly, especially as the “economic contraction implications” are dire. He noted that there will be a general slowdown of the economy and the economy will either not grow as anticipated, and perhaps, even not exceed 2% GDP growth this year.

“This will be due to less demand, which means that there will be less production, fewer imports, and fewer services being given to the populace.”

Alexander Mould

Impact of debt exchange programme on government’s revenue

Commenting on what this could potentially mean for government revenue, Mr Mould revealed that since the demand for goods and services will go down, it means people will be paying less taxes. Additionally, he highlighted that due to reduced demand, which is a result of less discretionary expenses, there be fewer imports and as such there will be less duty and other excise taxes collected at the ports.

“So, government revenue will plummet, and they may fall short of making the projected revenue in the approved budget.”

Alex Mould

Another downside of the debt exchange, Mr Mould highlighted on, was on its impact on infrastructure. With this, he explained that it is expected that there will be a reduction in the construction of new roads as well as a slowdown in road maintenance.

Moreover, he indicated that it would lead to a lot of non-essential government workers’ salaries being delayed or not paid at all, which means more expenditure accruals.

“Furthermore, with the statutory payments, like pension contributions, the situation will be worse than it currently is i.e., government backlog of unpaid pension contributions of gov’t workers.”

Alexander Mould

Government, the former Executive Director at Standard Chartered Bank, emphasized, must do something urgently. He stated that the state needs to re-visit the debt exchange program and create policies that will bring back confidence in the economy, as well as attract investment to spur on the economy, resulting in more spending and increased savings.

Following government’s announcement of debt exchange programme, which finance minister, Ken Ofori-Atta, stated is a part of a key requirement for the government to obtain economic programme from the International Monetary Fund, stakeholders and persons likely to be impacted have registered their disdain for the programme.

The latest to join the disgruntled bunch of persons affected by the debt programme are pensioners. The Pensioner Bondholders Forum, a Group of pensioners, has called on the government to exempt all retirees government bondholders from the Domestic Debt Exchange Programme (DDEP).

Dr Adu A. Antwi, a pensioner and Convener of the Forum, revealed that if the pensioners bonds were not exempted, it would have adverse effects on their already challenging lives. He made the call at a press conference during the Pensioner Bondholders Forum, a forum for the protection of pensioners investment.

READ ALSO: Minerals Commission Commences Implementation Of Fifth Edition Of New Procurement List