Africa’s biggest lender by assets, Standard Bank is ready to recapitalize its Ghanaian unit after making provisions to cover more than half of its holdings in the nation’s debt.

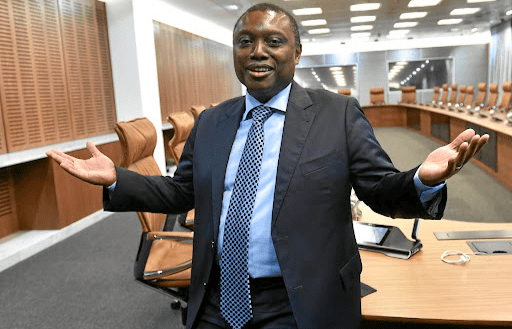

This was revealed by Chief Executive Officer, Sim Tshabalala, According to the CEO, “It may become necessary for us to inject capital in that business and we will, at the appropriate time.”

Banks in Ghana are staring at losses after President Nana Akufo-Addo’s government restructured GH¢83 billion ($6.8 billion) of local debt as part of a move to finalize a $3 billion bailout from the International Monetary Fund.

Standard Bank, meanwhile, joined FirstRand Ltd. In accounting for the impairment. Standard Bank noted that it has set aside 1.5 billion rand ($81 million) to cover potential losses arising from the Ghana’s loan-restructuring program. The bank said its total holdings of both domestic and onshore dollar-denominated bonds is about 2.6 billion rand.

“We believe that the pain that we have taken in Ghana is exquisite. The numbers are very large, but we have a portfolio, and the portfolio is calculated to do that. Notwithstanding the impact of Ghana, our Africa regions business performed very well.”

Sim Tshabalala

Ghana’s Approach to Restructuring

According to Mr. Tshabalala, the government of Ghana has been “textbook” in their approach to the restructuring, “extracting the appropriate bargain from all stakeholders”.

“They’ve been very tough in the negotiation process, as you can expect, because they have a public policy role to play. The government has extracted what they consider to be the appropriate bargain, which while appropriate from a policymaker and a government point of view, it’s been painful for holders of that debt.”

Sim Tshabalala

Standard Bank’s shares, which have advanced 7.3% this year, was up as much as 1.6% before paring gains to 0.6% by close of trade in Johannesburg.

FirstRand also said last week it impaired 496 million rand to cover potential losses. Nedbank Group Ltd., which has an indirect exposure to Ghana through its 20% holding in Ecobank Transnational Inc., estimated its exposure to the country’s sovereign debt at 175 million rand.

Despite the challenges, Standard Bank said it remains committed to Ghana. It plans to leverage its fortress balance-sheet to drive market share and capitalize on growth opportunities when they arise.

“We’ve made a commitment to cooperate with policymakers to have the appropriate solutions, and we stand by our Ghanaian business, we stand by our Ghanaian clients, and we take a long-term view, we will look through the volatility.”

Sim Tshabalala

Beyond Ghana, the lender remains concerned by the sovereign debt levels in African countries, such as Kenya, Malawi and Nigeria. The bank said it will be calibrating its risk appetite to accommodate for any looming threats.

“In each case, debt-to-gross domestic product is too high, which illustrates that at some point, the countries are going to struggle to meet their obligations as they fall due, which will give rise to the need for them to restructure.”

Sim Tshabalala

In spite of the challenges, Standard Bank’s headline earnings surged 37% to a record 34.25 billion rand for the year ending in December 2022, beating forecasts.

READ ALSO: Digital Transformation Drive: Ghana Is Not Performing Well Despite Growth In Internet Services