Founder of IMANI Africa, Franklin Cudjoe, has taken a swipe at Ghana’s economy, revealing that it has been “ramshackled by chest-thumping incompetent talkatives”.

According to him, despite the growing insurgency in some African countries, they have managed to grow in their GDP.

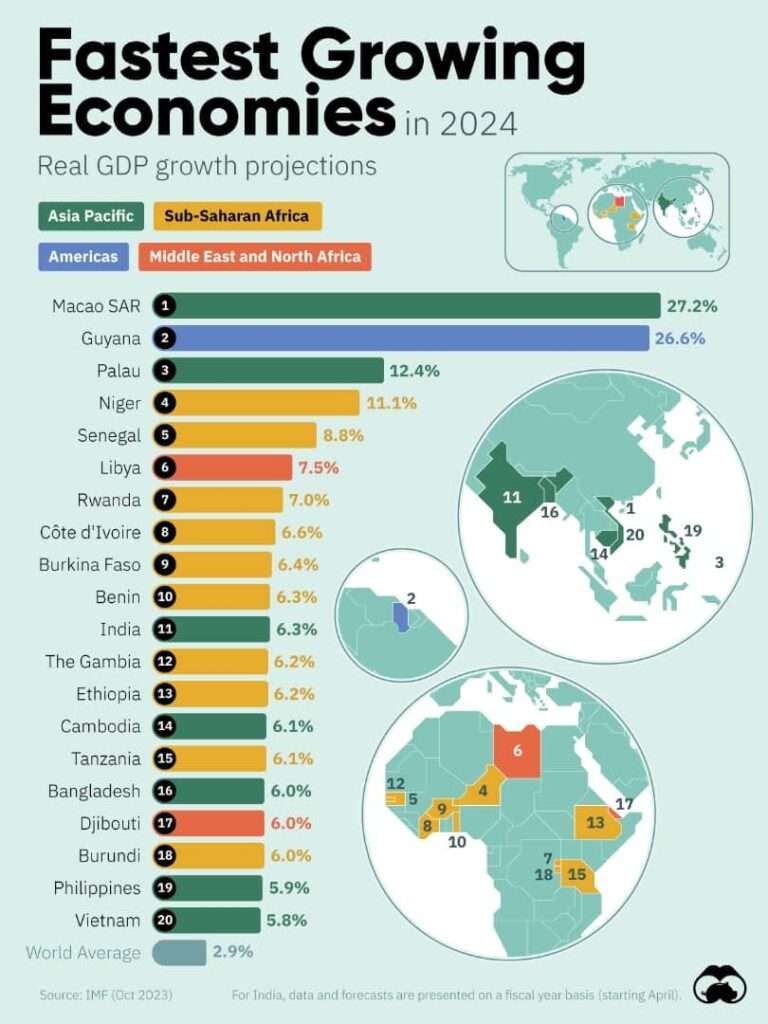

He revealed that Niger and Burkina Faso, both “paralyzed” by terrorists and ruled by military junta are projected to grow in real terms by 11.1% and 6.5% respectively.

Commenting on IMF’s outlook of African economies in 2024, Mr Cudjoe stated that Libya, a country balkanized and controlled by “blood thirsty maniacs” will grow at 7.5%., while other African countries projected to grow at least 6%.

“Note, these African countries were not spared the ravages of Covid-19, Russia’s war on Ukraine and also by Israel’s war on Gaza. Our beloved country, ramshackled economically by neither terrorists nor the military, but chest-thumping incompetent talkative will manage 2.7%, that is if they do not finish selling the country to buy votes during the elections in 2024.”

Franklin Cudjoe

The International Monetary Fund in its outlook of African economies in 2024 expressed optimism on signals that economic activity is gradually strengthening with stronger growth, falling inflation, and narrowing fiscal imbalance.

It revealed that 2023 has been a difficult year for Africa, as the region is still emerging from the Covid-19 pandemic and African countries have been hit by high borrowing costs and a cost-of-living crisis.

Notwithstanding, it highlighted that these challenges, recent data, and the outlook for 2024 provide hopeful signals that economic activity is gradually strengthening with stronger growth, falling inflation, and narrowing fiscal imbalance”.

The Fund projected its neighbor, Nigeria, an oil-exporting country, to grow at 3.2 percent in 2024, while the Ivory Coast had a high projection of 6.6 percent for its growth for the same period.

Reflection of economic stability on affordable loans

Meanwhile, the Ghana Union of Traders Association (GUTA) has called on the government to ensure the economic stability enjoyed in the first two quarters of 2023 has an impact on affordable loans for traders and businesses.

According to President of the association, Dr Joseph Obeng, government has lived up to ensuring some reduction in inflation and cedi depreciation.

“The stability we’re experiencing now, especially, for the first two quarters of 2023, is good for us; inflation has responded positively and depreciation of the cedi has not been bad. However, these are not at an appreciable level for businesses and industry to thrive, coupled with high-interest rates and taxes, as lack of access to affordable credit remains a challenge.”

Dr Joseph Obeng

Dr Obeng attributed the current economic stability to the impact of the US$600 million first tranche of the US$3 billion loan-support programme with the International Monetary Fund (IMF).

He explained that the Fund programme has helped restore confidence in the banking and financial system and pushed inflation downwards.

“Nonetheless, we want the government to ensure that we are able to have inflation around 15 per cent in the short term, and monetary policy rate reduced to reflect low-interest rate, so we can have access to affordable credit.”

Dr Joseph Obeng

Moreover, Dr Obeng revealed that discussions held with the Finance Ministry in view of the 2024 budget equally “showed positive signs of some tax relaxation, though we’re yet to see the figures and how its impact will be on businesses”.

He stated that the business community has sent its proposals, including the COVID-19 levy, which it wants to be removed, special import levy, and VAT, which we expect some reductions.

READ ALSO: Police Assures ‘Overdose Of Security’ In NPP’s November 4 Election