In a strategic move to meet fiscal commitments and steer economic challenges, the government of Ghana has embarked on an ambitious borrowing spree, aiming to secure GH¢12.7 billion through treasury bills in January 2024.

This borrowing initiative aims to cover the financing needs for maturing bills during this period. Notably, this figure represents a 1.2% decrease compared to the borrowing undertaken in December 2023.

As the nation endeavors to address maturing bills and financial obligations, the repercussions on both the current debt stock and the broader economy come under scrutiny.

The primary consequence of this substantial borrowing initiative is a notable increase in Ghana’s overall debt stock. While debt is a common tool for financing, the magnitude of this borrowing requires careful monitoring to ensure sustainable debt levels.

With heightened borrowing, attention turns to managing the associated debt-servicing obligations. The government must navigate the challenges of servicing the accrued debt while maintaining fiscal responsibility.

The Injection of borrowed funds into the economy has the potential to stimulate economic activity. Government spending on various projects and services can create job opportunities, bolster consumer spending, and provide support to businesses.

However, a surge in money supply without proportional economic output could contribute to inflationary pressures. Striking a balance between stimulating economic growth and preventing inflation becomes a critical task.

Implications for Currency Stability

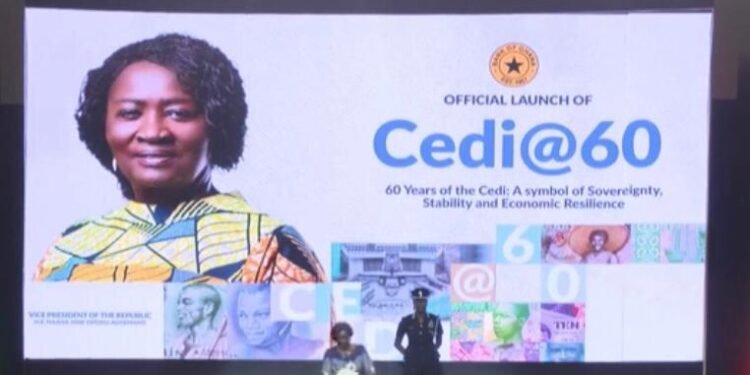

In addition to that, the borrowing spree may have implications for currency stability, depending on its impact on foreign exchange reserves. Striking a careful balance is essential to prevent adverse effects on the national currency.

The success of the government in surpassing its initial borrowing target in the first auction of 2024 signals positive investor sentiment. The strong demand for treasury bills reflects confidence in the government’s ability to meet financial obligations, which bodes well for the overall investment climate.

Ghana’s approach to this borrowing spree underscores its commitment to managing fiscal challenges and meeting budgetary needs. Maintaining fiscal discipline amid increased borrowing is crucial for sustaining long-term economic stability.

Meanwhile, in addition to the planned GH¢12.7 billion, the government has already taken steps towards meeting its financial requirements, successfully raising GH¢3.223 billion in the first auction of 2024. Impressively, this amount surpassed the targeted figure by 15.24%, indicating a robust response from investors.

The heightened demand, averaging GH¢4.0 billion per week, showcases a positive sentiment among market participants and suggests a favorable environment for government borrowing.

Analysts anticipate that, given the sustained strong demand, the government is likely to comfortably refinance the upcoming maturities. The optimistic outlook is grounded in the consistent performance observed in recent auctions, underlining investor confidence in government securities.

While the government has made a successful start to its borrowing endeavors in 2024, there is a likelihood of facing higher borrowing targets in the future. These elevated targets are expected to address the financing needs associated with the 2024 budget deficit and provide a buffer for the February 2024 coupon payments on the restructured bonds.

In a nutshell, as Ghana navigates this ambitious borrowing spree in 2024, the repercussions on the national debt and economic dynamics are multifaceted. Striking the right balance between economic stimulation, inflation control, and fiscal responsibility will be crucial for ensuring sustainable growth and resilience in the face of evolving economic challenges.

READ ALSO: Leaked Tape: Committee Clears IGP, Indicts Three Senior Police Officers