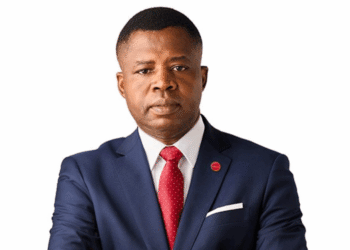

The Governor of the Bank of Ghana (BoG), Dr. Ernest Addison, has shed light on the critical role of the International Monetary Fund (IMF) in the revocation of UT Bank and Capital Bank licenses in August 2017.

Speaking at the Governor’s Day Dinner hosted by the Chartered Institute of Bankers, Dr. Addison explained how the IMF’s stringent financial preconditions influenced his administration’s decision to take drastic measures to stabilize Ghana’s financial sector.

According to Dr. Addison, the IMF’s financial support for Ghana came with a set of “prior actions” that the country was compelled to meet before receiving any disbursements. Among these actions was the revocation of UT Bank and Capital Bank licenses, a move that marked a pivotal moment in Ghana’s financial sector reforms.

“There are a few requirements which the IMF calls the prior actions. You have to do this, you have to do that; otherwise, they are not even going to organize a board meeting to discuss Ghana and disburse any funds to you.”

Dr. Ernest Addison

The closure of the two banks took many Ghanaians by surprise, as such drastic regulatory interventions were unprecedented in recent history. However, Dr. Addison emphasized that these actions were unavoidable if the BoG was to meet the IMF’s conditions and protect the stability of the financial sector.

Governance Failures at UT Bank and Capital Bank

Dr. Addison highlighted that poor corporate governance was a significant factor leading to the collapse of the two banks.

“Corporate governance plays an important role in promoting a sound financial system, contributing significantly to improving overall performance not only in profits but in credibility.”

Dr. Ernest Addison

The licenses of UT Bank and Capital Bank were revoked due to significant capital deficiencies and governance lapses that posed risks to depositors and undermined confidence in the banking system. The BoG had little choice but to act decisively to safeguard the financial ecosystem.

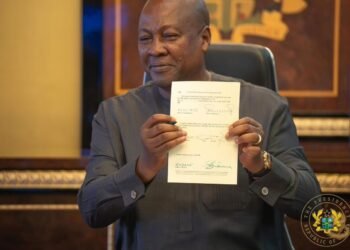

Meanwhile, the 2017 financial sector reforms, which included the dissolution of UT Bank and Capital Bank, marked a turning point in Ghana’s financial sector.

Dr. Addison explained that the measures were essential for stabilizing the sector and preparing it to withstand future shocks, such as the COVID-19 pandemic and global economic disruptions stemming from the Russia-Ukraine conflict. “This was one of the prior actions to dissolve UT and Capital Bank. Ghanaians had never seen that in a long period of time. People were shocked when the licences of those two banks were pulled,” Dr. Addison acknowledged.

Despite the initial backlash, the reforms have been credited with fostering resilience in Ghana’s banking industry and enhancing public confidence in the financial system.

Legacy of the 2017 Reforms

The comprehensive cleanup initiated by the BoG in 2017 went beyond the closure of UT Bank and Capital Bank. It aimed to address broader systemic challenges, including capital inadequacies, governance weaknesses, and liquidity constraints across the banking sector.

The reforms resulted in the dissolution of insolvent institutions and the creation of a more robust and restructured banking industry.

They also underscored the importance of regulatory vigilance and adherence to international financial standards. “Stabilizing and strengthening the financial sector was not just about protecting depositors but also about ensuring the integrity and credibility of the entire system,” Dr. Addison stated.

The lessons from the revocation of UT Bank and Capital Bank licenses and the subsequent sector-wide reforms have set a precedent for regulatory interventions in Ghana. While the measures were controversial at the time, they have proven to be necessary steps in safeguarding the financial system.

In retrospect, while challenging, these interventions have reshaped Ghana’s banking sector, laying the groundwork for a more strong financial future.