OmniBSIC Bank Ghana Limited, the fastest-growing bank in the country, has reported impressive financial results for 2024, demonstrating its strength and resilience in Ghana’s banking sector.

The bank achieved a remarkable 109 percent increase in profit, reaching GH¢314 million, underpinned by strong operating income growth and effective cost control measures.

The bank’s 2024 financial results reflected substantial improvements across various performance indicators. Interest income surged by 49 percent to GH¢1.24 billion, while operating income grew by 39.7 percent to GH¢746.1 million.

This growth was fueled by a significant increase in earning assets, which expanded from GH¢3.83 billion to GH¢5.99 billion, representing a 56 percent growth. Additionally, non-funded income saw an 83 percent rise, reaching GH¢200 million, up from GH¢109 million in 2023.

OmniBSIC Bank’s total assets also saw an impressive 65 percent growth, rising to GH¢9.4 billion. This expansion was primarily driven by a robust increase in deposits, loans, and investments. Customer deposits increased by 70 percent from GH¢4.8 billion in 2023 to GH¢8.2 billion in 2024.

Meanwhile, the bank’s commitment to supporting businesses was evident in the 77.5 percent increase in loans and advances, which rose from GH¢579 million to GH¢1.03 billion during the period.

The bank also reinforced its liquidity position, with cash and balances with other banks increasing by 80 percent to GH¢2.7 billion in 2024. This strong liquidity ensures that the bank remains well-positioned to meet customer needs and drive economic growth.

Growing Customer Trust and Market Position

OmniBSIC Bank continues to strengthen its market presence through innovative banking solutions, customer-centric services, and adherence to regulatory standards. As one of Ghana’s most successful financial sector mergers, the bank has consistently demonstrated resilience and commitment to delivering value to its customers.

The bank has enhanced its corporate governance structures and invested in infrastructure to align with the Bank of Ghana’s (BoG) regulatory requirements. This strategic approach ensures transparency and accountability, fostering customer confidence in the bank’s operations.

Headquartered in Accra’s Airport City, OmniBSIC Bank operates a network of 40 branches across Ghana, providing a full suite of banking services tailored to corporate, SME, and individual customers. The bank has also made significant strides in digital banking, offering innovative solutions that enhance convenience and accessibility.

OmniBSIC Bank’s transformation over the years has positioned it as a leading financial institution in Ghana. Its commitment to excellence has earned it several prestigious awards, including Most Customer-Centric Bank (CIMG, 2022), Fastest-Growing Corporate Bank in Ghana (Global Banking and Finance Awards, 2023), Best Bank in Ghana (Ghana Business Awards, 2023), Bank of the Year (Ghana Business Standard Awards, 2024), SME Bank of the Year (Ghana Credit Excellence Awards, 2024), and Best Corporate Bank, Ghana (Global Banking and Finance Awards, 2024). The bank is currently ranked as the 29th best company in Ghana by the Ghana Investment Promotion Centre’s (GIPC) Ghana Club 100 rankings.

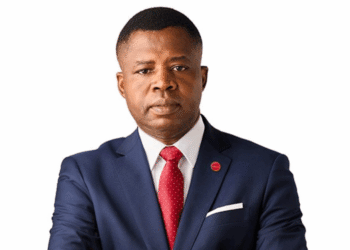

OmniBSIC Bank’s Managing Director, Daniel Asiedu, attributed the bank’s success to divine grace, dedication, and the growing trust customers have in the brand.

“We are a young bank, but we deliver on our promise and that is earning us growing trust from customers. The aim is to maintain and grow that trust by offering superior products and services that will help our customers and the economy to grow.”

Daniel Asiedu

Strategic Growth and Future Outlook

Looking ahead, OmniBSIC Bank is committed to sustaining its growth momentum and expanding its support to customers. The bank’s leadership is focused on introducing innovative products and services to meet the evolving needs of businesses and individuals.

Daniel Asiedu, who also serves as a reverend minister and Chairman of the International Presbytery of Fountain Gate Chapel (FGC), emphasized the bank’s strategic direction.

“As part of our transformation agenda, we are positioning the Bank as the brand of choice through continuous innovation. To achieve this, we have refreshed our brand, made significant investments in cutting-edge technology, and enhanced staff capacity amongst others, to meet the evolving demands of customers in the banking industry.”

Daniel Asiedu

OmniBSIC Bank is working towards becoming a top-tier financial institution in Ghana. The bank’s leadership has developed a clear roadmap to achieve this goal, focusing on digital transformation, operational efficiency, and customer satisfaction.

The former Managing Director of Zenith Bank Ghana and Agricultural Development Bank (ADB) further noted, “These strategic initiatives place us ahead of the curve, fostering an environment where our customers can confidently entrust us with their financial needs, thereby allowing us to consistently exceed their expectations.”

OmniBSIC Bank’s strong financial performance in 2024 highlights its growing influence in Ghana’s banking sector. The bank’s impressive profit growth, asset expansion, and customer-focused approach reflect its commitment to delivering exceptional banking services. With a clear vision for the future, OmniBSIC Bank is well-positioned to drive economic growth, support businesses, and enhance financial inclusion in Ghana.

As the bank continues to innovate and strengthen its market presence, it remains a trusted partner for businesses and individuals seeking financial solutions tailored to their needs.

READ ALSO: Vice President Vows to Strengthen Ghana’s Security as GAF Council Chair