Fidelity Bank Ghana has once again solidified its reputation as a trailblazer in sustainable finance and entrepreneurship by rewarding eight outstanding creative entrepreneurs with over GH¢500,000 in funding at its 3rd Annual Sustainability Conference.

The landmark event, held at The Palms by Eagles, brought together leaders from business, finance, and international development under the theme “Aligning Finance with Climate Action.”

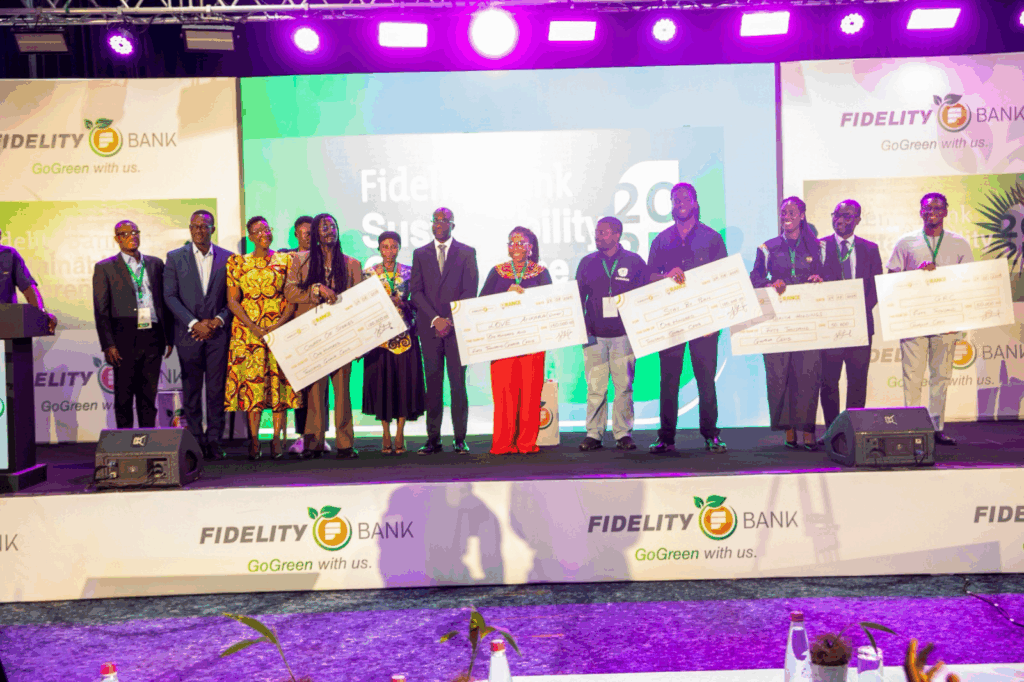

The highlight of the event was the Orange Inspire Creative Challenge, Fidelity Bank’s flagship entrepreneurial competition, which seeks to identify, support, and scale creative businesses across Ghana. The challenge culminated with the announcement of winners, each walking away with significant funding support to propel their ventures.

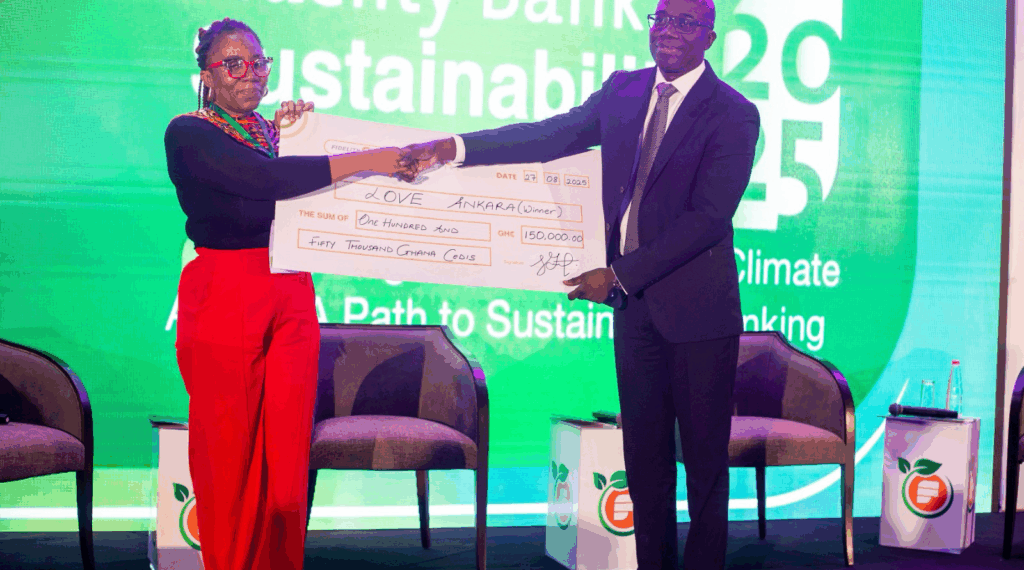

The overall winner of the challenge was Love Ankara, founded by Emma Maame Efua Tandoh, who received GH¢150,000 in funding. An emotional Tandoh expressed her gratitude, calling the award a life-changing opportunity.

“First of all, I want to say a big thank you to God because this has been a journey. It started eight years ago. It’s not easy looking for funding as a creative. I’ve been through many programs, but this has been quite a defining one for all of us.”

She added that beyond the financial support, the exposure and training provided by Fidelity Bank would help participants become “ambassadors for sustainability” while scaling their enterprises.

Big Wins for Other Finalists

The prize pool was spread across eight finalists. Church of Stories and Stay by Plan each secured GH¢100,000 to expand their operations. Abrita Holdings and GRC Concepts walked away with GH¢50,000 each.

In a surprise twist, Fidelity Bank’s Managing Director, Julian Opuni, announced that the remaining three finalists — Fashion Xcel, O Games Studio, and Experience Africa VR — would also receive GH¢25,000 each.

Opuni emphasized the importance of recognizing all participants.

“It’s not easy to pitch a dream in eight minutes and defend it before a panel. The journey to this stage has been rigorous, and every finalist deserves recognition. This is why we made sure no one left without support, because we believe in the potential of every creative who made it this far.”

Julian Opuni

The conference was not only about celebrating creativity but also about driving Ghana’s sustainability agenda. Zia Choudhury, the new UN Resident Coordinator in Ghana, praised Fidelity Bank for aligning its operations with global sustainability standards. He highlighted the bank’s green portfolio, including concessional loans for electric vehicles and financing renewable energy systems for schools and hospitals.

“Fidelity Bank’s leadership does show what’s possible,” Choudhury remarked. “These actions demonstrate that climate action and business success can go hand in hand.”

Building Ghana’s Climate Finance Future

Panel discussions during the event underlined Ghana’s growing momentum in climate finance. The first panel focused on structuring sustainable banking principles in line with international standards, positioning Fidelity Bank as a “climate finance champion.”

The second panel emphasized resilience, noting that climate finance must deliver tangible outcomes in the real economy. Panelists agreed that banks like Fidelity have a vital role in helping businesses become investor-ready through Environmental, Social, and Governance (ESG) frameworks and data-driven insights.

In her closing remarks, Nana Yaa Afriyie Ofori-Koree, Head of Partnerships, Sustainability and CSR at Fidelity Bank, reinforced the bank’s commitment to action. “Let this moment stand as proof that in this room, we committed to act, not only to talk, and not eventually, not at some distant point, but starting here and now,” she declared.

She also revealed that Fidelity Bank would soon launch its 2026-2030 Sustainability Strategy, further strengthening its role in Ghana’s green transition.

Fidelity Bank’s 3rd Sustainability Conference was more than a showcase of financial support — it was a declaration that banking in Ghana is evolving to merge profitability with responsibility. By investing in creative entrepreneurs while committing to climate finance, the bank is proving that sustainability and innovation are not just complementary but necessary for long-term economic growth.

READ ALSO: Constitutionality Of Chief Justice Ouster Debated