Governor of the Bank of Ghana, Dr. Johnson Asiama, has reaffirmed confidence in the resilience of the Ghana cedi, describing it as one of the world’s strongest-performing currencies despite recent seasonal pressures and weaker remittance inflows.

His remarks came during the opening of the 126th Monetary Policy Committee (MPC) meeting in Accra on Monday, September 15, 2025.

“Despite the seasonal pressures and a slowdown in remittance inflows in recent weeks, the cedi remains one of the strongest currencies globally.

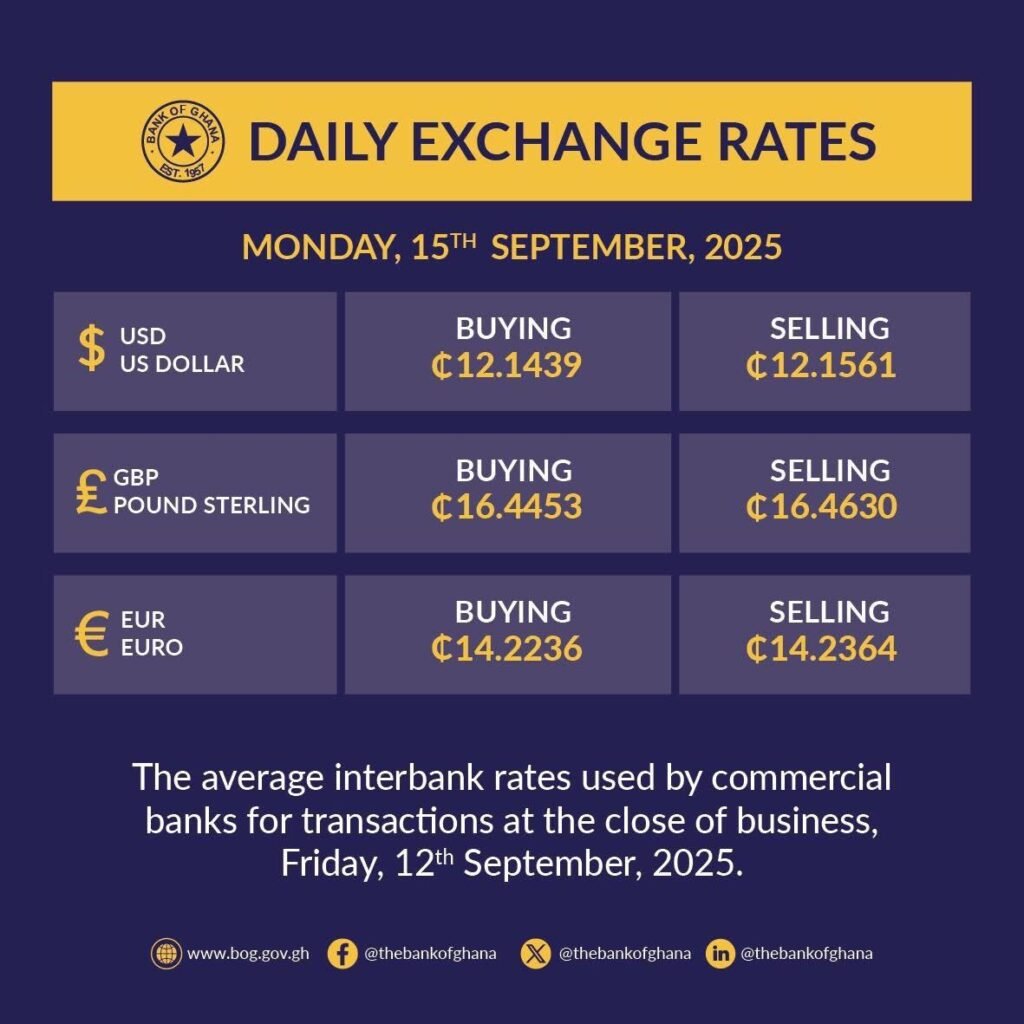

“Year-to-date, it has appreciated by about 21% as of September 12.”

Dr. Johnson Asiama, Governor of the Bank of Ghana

Acknowledging recent market pressures, Dr. Asiama said remittances a critical source of foreign exchange inflows for households and the economy had slowed compared to previous periods.

In addition, seasonal demand for dollars linked to international trade had added further strain on the local currency in recent weeks.

He, however, dismissed suggestions of deeper instability, noting that the cedi’s fundamentals remain robust.

A Currency Among Global Leaders

According to the Governor, the cedi’s performance now places it in the ranks of some of the most resilient global currencies, including the Russian ruble, Swedish krona, Norwegian krone, Swiss franc, euro, and the British pound.

He attributed this resilience to “sound monetary policy, stronger foreign exchange reserves, and tightened regulatory oversight.”

He further explained that the Bank of Ghana’s stricter enforcement of foreign-exchange rules, coupled with prudent macroeconomic management, has been instrumental in sustaining investor confidence.

Economic analysts argue that the appreciation of the cedi has already delivered concrete benefits for Ghanaian households and businesses.

The stronger local currency has helped reduce the costs of imported goods, easing inflationary pressures that have weighed heavily on consumers in recent years.

For businesses, especially those reliant on imported raw materials and equipment, the stronger cedi reduced operational costs, enabling more predictable planning and growth.

However, experts also cautioned that sustaining this trajectory would not be automatic. They pointed to the importance of boosting export earnings, maintaining consistent remittance flows, and reducing Ghana’s dependence on volatile global commodity markets such as gold, cocoa, and crude oil.

Sustaining Investor Confidence

For Dr. Asiama, maintaining confidence in the currency is not solely a technical matter but also a psychological one.

He underscored that the central bank remained vigilant and ready to step in when necessary to prevent speculative pressures or external shocks from destabilising the market.

“We remain fully committed to safeguarding the stability of the cedi and will continue to deploy the necessary tools at our disposal to ensure that the progress achieved so far is not eroded.”

Dr. Johnson Asiama, Governor of the Bank of Ghana

The Governor’s comments come at a time when many emerging market currencies are under significant strain from a strong U.S. dollar and tightening global financial conditions.

Against that backdrop, Ghana’s cedi has stood out, posting gains that few other African or global currencies have matched this year.

As the MPC meeting continues, markets are closely watching for signals on the policy rate, inflation outlook, and fiscal coordination with government.

But for Dr. Asiama, the message to Ghanaians is clear: the fundamentals of the cedi remain strong, and the Bank of Ghana stands prepared to act decisively to protect that strength.

READ ALSO: Market Cheers as Ghana’s Treasury Auction Breaks Four-Week Drought with 15.8% Oversubscription