Ghana’s dependence on domestic borrowing has once again come under global scrutiny.

The World Bank has sounded the alarm, warning that the nation’s heavy reliance on short-term Treasury bills (T-bills) is not only unsustainable but also disproportionately expensive. According to the World Bank’s Country Director for Ghana, Sierra Leone, and Liberia, Robert Taliercio, the country risks locking itself in a costly borrowing cycle when cheaper and more concessional financing options exist.

Between 2023 and 2024, Ghana’s T-bills carried an average interest rate of 27.4 percent—a staggering figure compared to concessional loans from the International Development Association (IDA), which attract interest and service fees between 0.75 and 2.0 percent. Although domestic borrowing costs dropped to 11.9 percent in September 2025, Mr. Taliercio noted that even the lowest T-bill rates remain far above concessional financing levels.

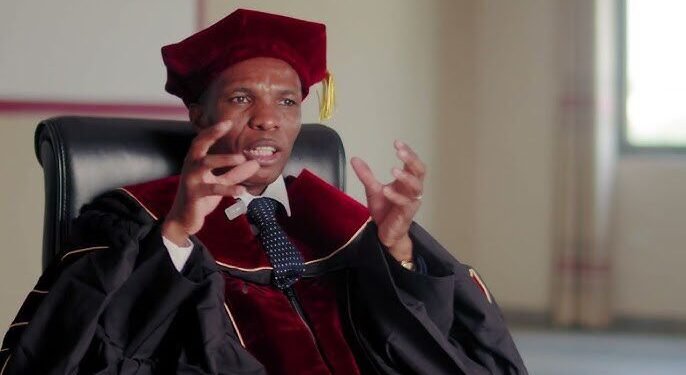

“New IDA blend terms offer significantly lower rates at 1.5 percent, locked in for longer periods. So it’s an obvious choice in terms of using all IDA available before resorting to further domestic financing.”

Robert Taliercio

This stark comparison highlights how Ghana’s debt strategy often prioritises short-term fixes over long-term sustainability.

The Case for Concessional Loans

Concessional financing from IDA and other multilateral partners provides Ghana with breathing room. Unlike T-bills, which must be repaid quickly and at high costs, IDA loans come with longer grace periods and extended repayment terms. Such loans also cushion government finances, freeing up resources that can be redirected toward critical sectors like education, health, and infrastructure.

The World Bank argues that Ghana must maximise every concessional dollar available before turning to domestic markets. By doing so, the country would reduce its debt servicing burden, which already consumes a large portion of national revenue.

The World Bank’s 2025 Policy Notes, which outline strategic priorities for Ghana’s economy, emphasise that financing choices are only part of the bigger picture. Restoring macro-financial stability, strengthening domestic revenue mobilisation, and implementing reforms in key sectors such as energy and cocoa are equally crucial.

Ghana’s tax-to-GDP ratio stood at just 13 percent in 2021, far below the Sub-Saharan African average and its estimated potential of 21 percent. Despite modest improvements, the country still struggles to meet its revenue targets. In the first half of 2025, tax revenues reached 7.1 percent of GDP, falling short of the 7.3 percent goal.

This underperformance limits the government’s fiscal flexibility, leaving it more reliant on borrowing.

The Vicious Cycle of Debt

Analysts argue that Ghana’s overdependence on costly domestic borrowing has created a vicious cycle. High interest rates on T-bills crowd out private sector lending, stifle investment, and ultimately slow economic growth. Meanwhile, the government’s ballooning debt servicing obligations leave little room for developmental spending.

The World Bank’s intervention is a reminder that unless Ghana changes course, it risks perpetuating a cycle where borrowing begets more borrowing, without the structural reforms needed to sustain long-term growth.

The Policy Notes also highlight reforms in the energy and cocoa sectors as essential to breaking the debt trap. Energy inefficiencies have weighed heavily on public finances, with recurring shortfalls in the sector adding to government liabilities. Similarly, Ghana’s cocoa industry, long considered a backbone of the economy, faces challenges ranging from ageing farms to fluctuating global prices.

Addressing these structural issues would reduce fiscal pressures and improve the country’s creditworthiness, enabling Ghana to borrow on more favourable terms.

Balancing Borrowing with Reform

Experts agree that concessional loans alone cannot solve Ghana’s debt problem. What is needed is a balanced strategy that combines concessional borrowing with domestic revenue mobilisation and structural reforms. The World Bank has made it clear: concessional loans should be prioritised, but without reforms in revenue collection and expenditure management, Ghana risks falling back into the same trap.

The World Bank’s candid assessment of Ghana’s borrowing habits is both a warning and an opportunity. The evidence is clear: domestic borrowing at high interest rates is bleeding the country’s finances, while concessional loans remain an underutilised lifeline.

Ghana must take decisive steps to escape the borrowing trap by embracing concessional financing, mobilising domestic revenues, and reforming key sectors. Failure to act could deepen fiscal vulnerabilities, but a strategic pivot could set the stage for sustainable growth and inclusive development.

READ ALSO: Dame-Jakpa Scandal Sparks Fresh Concerns Over Justice