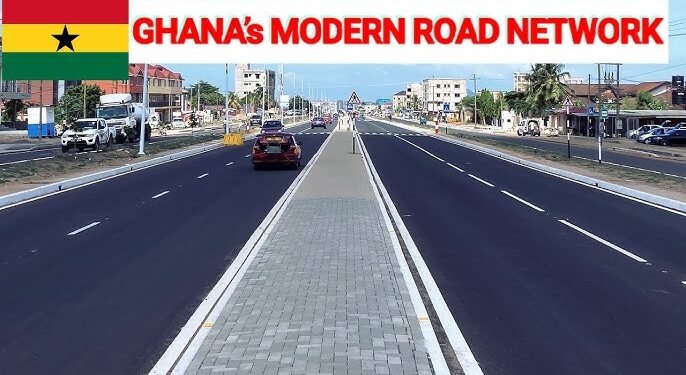

The first half of 2025 marked a significant turning point in Ghana’s downstream petroleum industry, with new data from the Chamber of Oil Marketing Companies (COMAC) highlighting increased competition, remarkable consumption growth, and shifting market dynamics.

According to the report, Star Oil has unseated GOIL PLC as the leading Oil Marketing Company (OMC) in the country, a move underscoring the increasing fragmentation and competitiveness of the sector.

The COMAC report noted, “The downstream petroleum market in Ghana became increasingly competitive and fragmented during the first half of 2025,” citing aggressive market entries, rising demand, and innovative distribution strategies as key drivers behind the changes.

Petrol Market Expands as Demand Rises 21.6%

The report revealed that petrol demand rose sharply by 21.66%, increasing from 1.23 billion litres in H1 2024 to 1.50 billion litres in the same period of 2025.

Petrol remains Ghana’s most consumed petroleum product, driven by growing vehicle use, urban expansion, and commercial activities.

“Star Oil’s 228.4 million litres of liftings represent a 46.37% increase, enabling it to dethrone GOIL PLC.”

OMAC’s Analysis of Petroleum Volumes – Mid-Year 2025 Report

GOIL followed with 189.4 million litres, representing a modest 2.72% growth, while Vivo Energy maintained a strong presence at 132.6 million litres, up 5.09%.

COMAC noted that the most significant percentage growth was recorded by new entrants. Moari Oil, for instance, scaled from minimal volumes in 2024 to 57.04 million litres in H1 2025.

Others, including Yass Petroleum and Westol, posted jumps of 135.56% and 132.68%, respectively.

The strongest regional demand growth came from Upper East (86.4%), Western (47.7%), and Brong Ahafo (32%), confirming the growing energy consumption in emerging economic zones.

Market Share and Concentration

In terms of market share, COMAC data showed that the top 10 OMCs continued to dominate Ghana’s petrol supply chain. Star Oil (15.21%), GOIL (12.61%), Vivo Energy (8.82%), and TotalEnergies (5.78%) together accounted for over 40% of total petrol sales.

The top ten companies collectively controlled 61.7% of total petrol volumes, while the remaining 171 OMCs shared 38.3%, underscoring a highly concentrated market that nonetheless allows space for aggressive newcomers.

COMAC’s analysis revealed that “both established leaders and fast-rising entrants drove growth, reshaping market competition.”

Petrol volumes increased consistently month-on-month, with the sharpest rise recorded in June (32.6%), followed by January (27.5%) and April (20.4%).

This sustained upward trend, according to COMAC, reflects growing economic activity and stable fuel availability.

Diesel Market Mirrors Petrol Growth

Ghana’s diesel market mirrored petrol’s expansion, recording 20.7% growth, from 1.10 billion litres in H1 2024 to 1.33 billion litres in H1 2025. The performance was driven by both established players and a wave of new entrants scaling up operations.

“Star Oil led the market with liftings increasing from 126.3 million litres to 171.1 million litres,” the report stated, describing the company’s 44.8 million-litre gain as “a decisive shift in market leadership.”

“Moari Oil stands out with a dual feat, with diesel lifting of 36.0m litres (3rdin volume gains), while posting the highest growth rate of 28,591%inH1 2025.”

OMAC’s Analysis of Petroleum Volumes – Mid-Year 2025 Report

Other notable players included Yass Petroleum, which recorded a 52.9 million-litre surge, followed by Vivo Energy (12.9m litres), Zen Petroleum (9.2m litres), and Petronax Energy (9.2m litres).

At the mid-tier, Gamma Petroleum and Akara Energy posted strong performances with increases of 6.4 million and 6.3 million litres respectively.

The top four diesel marketers, Star Oil (12.86%), GOIL (10.37%), Vivo Energy (8.77%), and TotalEnergies (7.13%) jointly accounted for 39.1% of total diesel supply.

“The top 10 OMCs accounted for 58.84% of diesel volumes, while the remaining 41.16% was shared among numerous smaller players. This indicates the continued dominance of leading OMCs, where many smaller OMCs compete intensely for market space and relevance.”

OMAC’s Analysis of Petroleum Volumes – Mid-Year 2025 Report

Monthly consumption data revealed that diesel volumes grew steadily throughout the first half of the year, peaking in April at 238.97 million litres, the highest monthly consumption figure recorded.

The average monthly diesel demand stood at 221 million litres, compared to 183 million litres in the first half of 2024 an indication of expanding industrial and transport activity.

Competitive Outlook for the Second Half

The COMAC report concludes that Ghana’s downstream petroleum sector is entering a new era defined by competition, innovation, and market diversification.

The rise of aggressive newcomers such as Moari Oil and Yass Petroleum demonstrates the dynamism of the market and signals a shift in consumer preferences.

With consumption levels rising and regional demand expanding, COMAC expects the second half of 2025 to maintain strong growth momentum.

However, it cautioned that exchange rate volatility and international crude price fluctuations could impact import costs and pricing.

Star Oil’s dominance, coupled with the impressive performances of emerging OMCs, positions Ghana’s downstream sector as one of the most competitive in West Africa.

READ ALSO: Market Cheers as Ghana’s Treasury Auction Breaks Four-Week Drought with 15.8% Oversubscription