Ghana’s foreign exchange (FX) market has bounced back from months of volatility, with the Bank of Ghana (BoG) confirming that commercial banks are now taking the lead in driving currency trade.

According to Dr. Johnson Asiama, Governor of the Bank of Ghana, the FX market has regained its stability after a turbulent period marked by heavy outflows, lumpy payments, and declining remittance inflows.

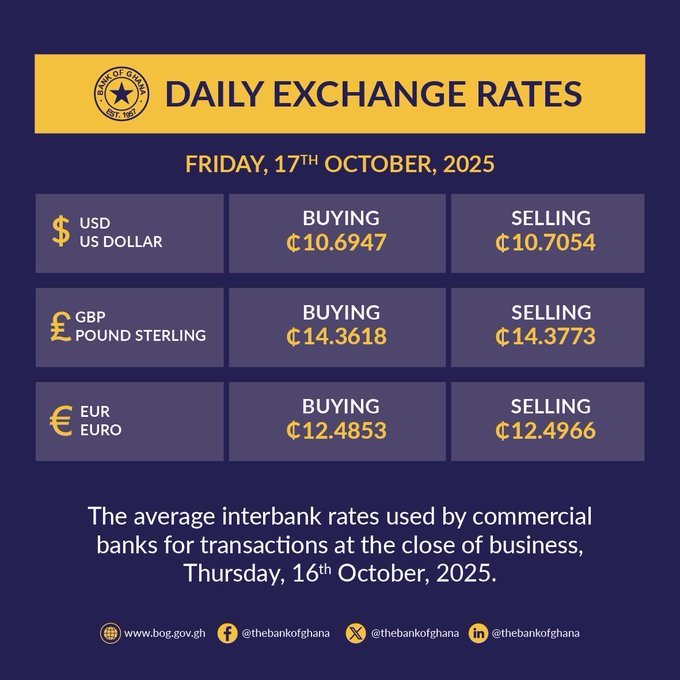

Speaking in an interview with the International Monetary Fund (IMF) during the ongoing IMF/World Bank Spring Meetings in Washington, D.C., Dr. Asiama said recent BoG interventions were only temporary measures to cushion the market. Currently, the cedi is trading at GHS 10.73 to the US dollar, reflecting relative calm after months of pressure.

Responding to speculation that the central bank was over-intervening in the market, Dr. Asiama clarified that BoG’s actions were time-bound and necessary to protect the economy.

“Yes, there were allegations about whether we were intervening in the market,” he said. “But that was not exactly the case.”

He explained that between the second and third quarters, the central bank was compelled to meet significant financial obligations, including billions of dollars owed to Independent Power Producers (IPPs). These payments, combined with outflows from domestic debt exchange bondholders who decided to exit after the cedi appreciated, temporarily strained the foreign exchange system.

“There were all these large arrears in payments to some of the IPPs. And we also had some of the domestic debt-affected bondholders that wanted to exit. Because the currency had appreciated, they felt it was the right time to take up their investment. We had to allow them to go.”

Dr. Johnson Asiama

Pressure on the FX Market

The outflows and arrears came at a time when remittance inflows, one of Ghana’s major sources of foreign exchange had started to decline.

“All these inflows accrue to the central bank, and it was happening at the time when we saw some decline in remittance inflows. Remittance inflows are another huge source of FX injection — over six billion US dollars per year. However, immediately after the currency appreciated, we saw a decline.”

Dr. Johnson Asiama

The combined effect of these events, he said, led to a temporary liquidity squeeze in the interbank market, which required BoG’s support. “During that time, the interbank FX market had dried up, and so the central bank needed to provide that support,” he said.

A Recovered and Self-Sustaining Market

Dr. Asiama, however, expressed confidence that the market has since recovered and is now operating with renewed stability.

“I’m happy to say that the interbank FX market has come back. We have written to the mining firms, for example, to take all their inflows through the commercial banks. So, we are beginning to see some pickup in interbank FX market activity.”

Dr. Johnson Asiama

The BoG Governor highlighted that this policy shift is part of a broader strategy to make the FX market more self-sustaining and less reliant on central bank intervention. “What we have now is to intermediate what comes from the Gold Board, and then the rest is taken into our reserves,” he explained.

According to Dr. Asiama, current market indicators show that the FX market is now responding to real economic forces rather than artificial interventions. The Bank of Ghana, he said, has maintained a steady and predictable approach to managing supply and demand in the market.

“As of yesterday, we had committed to make available 150 million US dollars. This morning, when I checked, the market had picked up only 90 million dollars, so 60 million automatically goes into our reserves. Same thing Tuesday — we made available 150 million dollars, and the market picked up less than half that.”

Dr. Johnson Asiama

The figures, according to the Governor, are evidence of stabilizing demand and improving confidence among traders and investors.

“We do not over-support the markets at all. All we seek to do is to limit the volatilities in the markets, to ensure that we have that smooth dynamics in the market, and that’s the framework we will maintain going forward.”

Dr. Johnson Asiama

Confidence Returns to the Cedi

The renewed stability in the FX market has also been reflected in the performance of the cedi, which is currently trading at GHS 10.73 to the US dollar. This marks a period of relative calm after the currency faced immense pressure from debt restructuring uncertainties and dwindling inflows earlier in the year.

Market analysts say BoG’s decision to gradually step back and allow commercial banks to take the lead is a positive sign of confidence in the system. By ensuring that mining and export proceeds are channeled through the banking sector, the central bank is fostering a more robust and market-driven FX ecosystem.

Dr. Asiama’s remarks suggest that the Bank of Ghana’s role will remain that of a regulator and stabilizer, rather than a dominant player. “Our goal is not to control the market,” he said. “We are building a structure where the market can operate efficiently on its own. That’s the sustainable way forward.”

READ ALSO: GSE Dips 12 Points as NewGold ETF, MTN Ghana, and Access Bank Drag Market Down