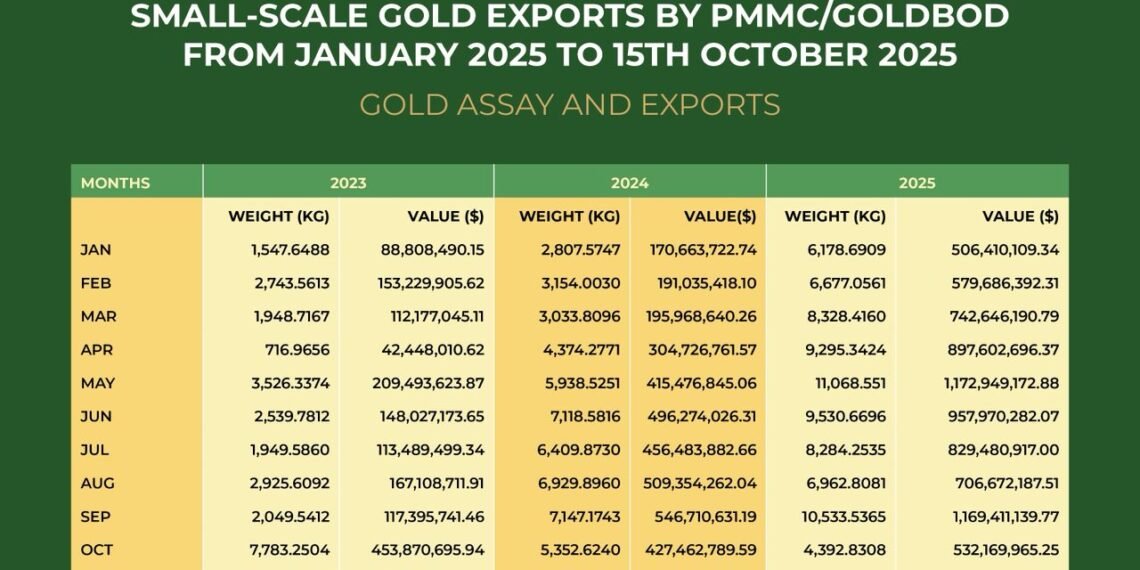

Ghana’s small-scale gold export sector has generated over $8 billion in foreign exchange earnings between January and mid-October 2025, according to data from the Ghana Gold Board (GoldBod) and the Precious Minerals Marketing Company (PMMC), marking a significant moment for the country’s mineral economy.

Policy analyst Alfred Appiah was among those who welcomed the publication of the detailed monthly export breakdowns but urged a more nuanced interpretation of the data.

“Good to see these monthly breakdowns of small-scale gold exports being published again. This allows for some analysis.

“What I take from this table is that we have become effective at aggregating small-scale gold, including galamsey, and this trend didn’t start with the GoldBod.”

Alfred Appiah, Policy Analyst

Appiah pointed out that even before the GoldBod began operations, export volumes were already climbing significantly. “To illustrate, by August 2024, we had already exported a higher weight of small-scale gold, 39,766.54 kilograms than the total for all of 2023, which stood at 37,454.01 kilograms,” he said.

“Similarly, by August 2025, exports had reached 66,325.79 kilograms, surpassing all of 2024, and this happened well before GoldBod’s systems were fully operational.”

Alfred Appiah, Policy Analyst

Appiah added that year-over-year data for the first nine months of each year paints an even clearer picture of rising volumes. “Gold export volumes grew by 135% in 2024 and 64% in 2025. Again, there was no GoldBod in 2024,” he noted.

His broader point is that while institutional reforms may be helping to improve oversight and compliance, they are not solely responsible for the surge in export volumes.

He emphasized that his analysis focused on weight rather than value, given that the latter has been heavily influenced by record-high global gold prices, which Ghana cannot control.

“If we were buying galamsey gold, that was also happening before the GoldBod.

“We had already flagged potential implications for the Bank of Ghana’s reserves prior to the establishment of the GoldBod.”

Alfred Appiah, Policy Analyst

Structural Shifts and Market Dynamics

Economist and political risk analyst Dr. Theo Achiampong offered a complementary perspective, noting that while the upward trend in export volumes began earlier, 2025 marks a structural step-up driven by higher realized prices and improved regulatory oversight.

He pointed to a discernible seasonal pattern in export activity: a ramp-up in the first half of each year, softer figures in the third quarter, and a sharp peak in September 2025.

“Compared with 2023, both weight and value levels in 2024 rise steadily, but 2025 accelerates strongly, most visible on the left-hand scale.”

Dr. Theo Achiampong, Economist and political risk analyst

Still, the Ghana Gold Board maintains that its ongoing reforms are playing a critical role in shaping a more compliant and formalized small-scale mining sector.

According to officials, aggressive monitoring, licensing enforcement, and tight control over the gold supply chain have significantly reduced smuggling and boosted transparency.

The Board has also attributed its performance to enhanced trader verification systems, and a deliberate policy push to formalize previously informal gold channels, including those linked to artisanal and small-scale miners.

As Ghana seeks to build up its foreign exchange reserves and stabilize the economy, the boom in small-scale gold exports is a welcome source of hard currency. The gains are expected to support broader economic recovery efforts and reduce pressure on the cedi.

However, analysts warn that sustainable growth in the sector will depend on continuous monitoring, accurate data reporting, and a nuanced understanding of the forces driving export volumes and values.

Without this, there is a risk of overestimating the impact of institutional reforms and underestimating external factors such as global prices and pre-existing trends.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization