Fuel prices at pumps across Ghana have begun to decline, offering much-needed relief to motorists and businesses. The latest reductions, which took effect at the start of the second pricing window in October, reflect a projected drop of over 4% per litre, according to data from the Chamber of Oil Marketing Companies

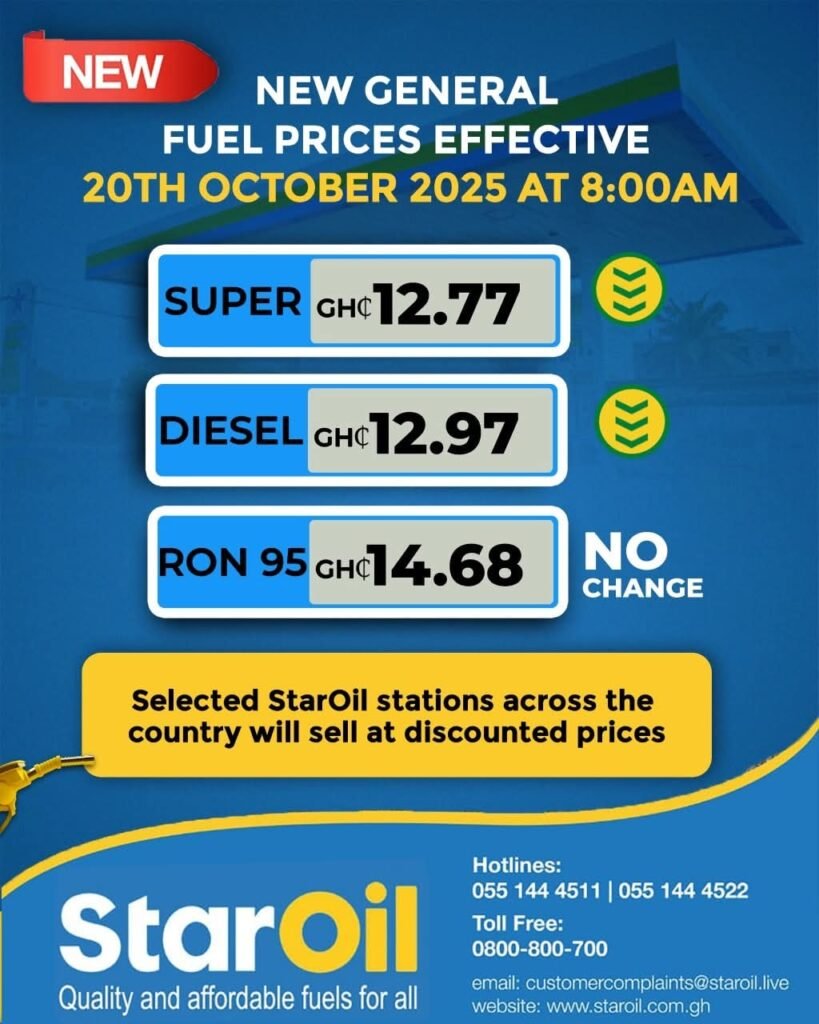

Star Oil, one of the leading Oil Marketing Companies (OMCs), was among the first to adjust its prices.

The company is now selling a litre of petrol at GH¢12.77, down from GH¢13.17 previously. Diesel has also seen a drop, now priced at GH¢12.97 per litre, compared to GH¢13.45 recorded at the end of September.

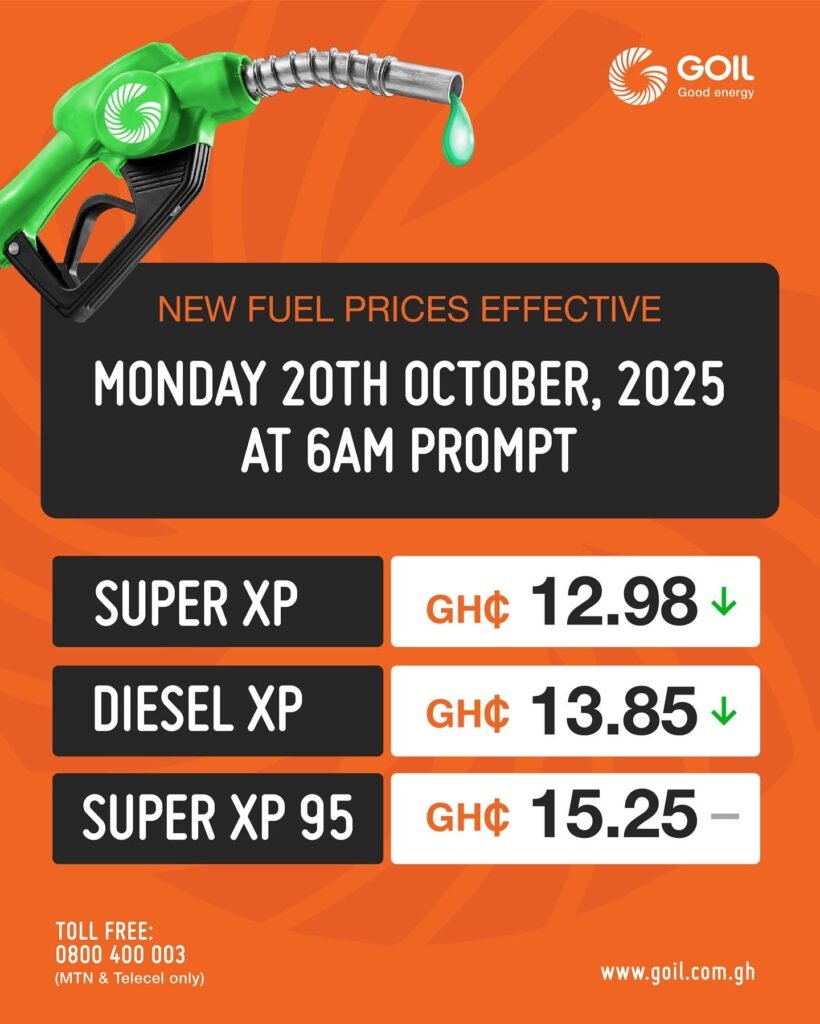

GOIL, the second major player in Ghana’s downstream petroleum sector, has similarly reduced its fuel prices. Petrol is now going for GH¢12.98 per litre, while diesel is selling at GH¢13.85, down from GH¢13.38 and GH¢14.20 respectively.

“Due to the significant decline of refined petroleum product prices on the international market and the notable appreciation of the cedi in the current window compared to the previous window, pump prices are expected to decline in the coming window of 16th to 31st October 2025.”

Chamber of Bulk Oil Distributors (CBOD)

The Chamber of Oil Marketing Companies also attributed the downward trend to a combination of favourable economic developments. “These two factors have played an instrumental role in the projected price decreases at the pumps,” the Chamber noted in its October market review.

Other players, such as Petrosol, have also joined the price cuts. On October 17, Petrosol adjusted its pump prices to GH¢13.48 per litre for petrol and GH¢14.18 for diesel.

Several more OMCs have signaled intentions to follow suit, especially among those commanding the largest market share.

Effective Market Operations

According to the report, the cedi saw a 1.21% gain over the pricing window, appreciating from GH¢12.40 to GH¢12.25 per US dollar.

Analysts credit this modest but significant rebound to increased foreign exchange inflows from Ghana’s commodity exports, renewed investor confidence following the successful conclusion of the Fifth International Monetary Fund (IMF) Review, and more effective market operations by the Bank of Ghana.

On the global market, crude oil prices have dipped to $61.11 a barrel. This decrease has also been mirrored in the prices of finished petroleum products.

Petrol fell by 4.54%, diesel by 3.94%, and liquefied petroleum gas (LPG) by 3.43% during the pricing window under review.

Despite the overall reductions, industry experts caution that not all of Ghana’s over 200 OMCs will reflect the full decreases at their pumps.

This is due to varying pricing strategies and the fact that several companies reportedly absorbed earlier cost hikes at the beginning of the month. Consequently, some outlets may maintain existing prices over the next two weeks rather than pass on the savings to consumers.

Meanwhile, consumer advocacy groups have welcomed the news, calling it a timely intervention to ease financial pressures on households and businesses.

The Executive Secretary of the Chamber of Petroleum Consumers (COPEC), Duncan Amoah, said the drop in prices could delay or possibly prevent the imminent hike in transport fares.

“There have been strong calls from transport operators for fare increases due to earlier fuel price hikes between August and September.

“This reduction offers some breathing room, and we believe that all these efforts will go a long way to reduce the cost of living.”

Duncan Amoah, Executive Secretary of COPEC

Mr. Amoah also acknowledged OMCs that maintained price stability in recent months, even when conditions permitted marginal increases.

“We commend the companies that prioritised consumer relief in difficult times.

“It speaks to the kind of responsible business practices we need more of.”

Duncan Amoah, Executive Secretary of COPEC

While the current trend in prices is a welcome development, analysts say continued stability in the cedi and global oil markets will be crucial to sustaining lower prices.

A reversal in either could once again trigger upward pressure on pump prices, with ripple effects across the economy.

For now, Ghanaians can expect a temporary respite from rising transport and logistics costs a welcome development in a year marked by fuel price fluctuations and broader economic uncertainty.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization