Small and Medium Enterprises (SMEs) remain the heartbeat of Ghana’s economy, driving employment, innovation, and inclusive growth.

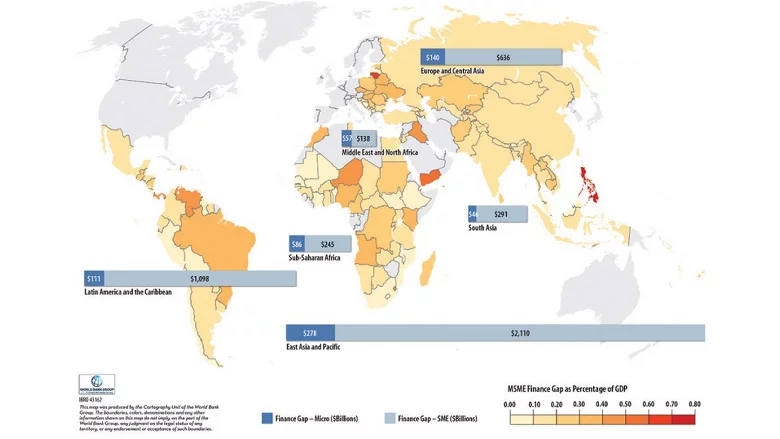

Yet, like their counterparts across the developing world, Ghanaian SMEs continue to grapple with limited access to finance. A new World Bank report on SME Finance reveals a widening global funding gap of about US$5.7 trillion, posing fresh concerns for economies like Ghana that depend heavily on small business activity.

According to the World Bank and International Finance Corporation (IFC) 2025 MSME Finance Gap Report, 40 percent of formal SMEs across emerging markets are credit-constrained. This global trend resonates strongly in Ghana, where many entrepreneurs, particularly women and youth, struggle to secure the capital needed to sustain and expand their operations.

The World Bank’s findings show that the SME financing shortfall is equivalent to 19 percent of GDP and 20 percent of total private sector credit in emerging markets. For Ghana, where SMEs account for an estimated 90 percent of all businesses and over 70 percent of employment, the implications are profound. Limited financing not only restricts growth but also undermines the country’s broader goals of industrialization and job creation.

Between 2015 and 2019, the global finance gap for micro, small, and medium enterprises grew by more than 6 percent annually, despite increased lending activities. This widening gap suggests that while more credit is being made available, much of it fails to reach the most vulnerable segments of the private sector—particularly informal enterprises and women-led businesses.

Women-owned SMEs, according to the report, face a staggering US$1.9 trillion gap, representing 34 percent of the total shortfall. In Ghana, where women make up a significant portion of small-scale entrepreneurs, this barrier hinders their ability to contribute fully to economic transformation and poverty reduction.

Ghana’s Untapped Potential in SME Finance

The SME sector remains Ghana’s greatest opportunity for sustainable growth, yet access to affordable financing continues to limit progress. Banks and microfinance institutions often perceive SMEs as high-risk borrowers due to inadequate collateral, limited credit histories, and informal business structures. As a result, many small businesses rely on personal savings or informal lending networks, which restrict their ability to scale.

Financial experts in Ghana believe that addressing the SME finance gap requires a combination of innovative solutions and policy interventions. “Ghana’s private sector can only thrive when credit becomes more accessible, affordable, and inclusive,” says a financial analyst at the University of Ghana Business School. “The current model does not fully capture the potential of SMEs as engines of growth.”

The World Bank’s latest report underscores the need for countries like Ghana to modernize their financial systems and expand digital public infrastructure to support SME finance. It highlights the role of alternative financing channels such as crowdfunding, peer-to-peer lending, and embedded finance platforms that can reach small firms quickly and efficiently.

In its advisory support, the Bank encourages governments to strengthen credit infrastructure by improving credit reporting systems, collateral registries, and insolvency frameworks. These measures enhance transparency and reduce perceived risks among lenders, allowing SMEs to access credit at better terms.

The World Bank also emphasizes the importance of mobilizing private capital by leveraging public resources to attract commercial investment into the SME sector. Initiatives such as Partial Credit Guarantee Schemes (PCGs) have proven effective in mitigating lending risks and encouraging banks to extend more loans to small businesses.

Harnessing Digital Finance for Inclusion

Technology continues to reshape the financial landscape, and Ghana stands at the forefront of digital transformation in Africa. The World Bank supports digital finance innovations that reduce transaction costs and expand reach through mobile banking, fintech platforms, and open banking frameworks.

Digital lending platforms and alternative credit scoring tools based on data analytics can help lenders assess the creditworthiness of SMEs that lack traditional financial records. Such innovations have the potential to bring thousands of Ghanaian entrepreneurs into the formal credit system, improving access to working capital and enabling faster business growth.

“Digital finance is a game changer for SMEs in Ghana,” notes a representative from the World Bank’s Finance, Competitiveness, and Innovation Global Practice. “It opens doors for entrepreneurs who have long been excluded from formal financing due to structural barriers.”

The report highlights the transformative role of women and youth in driving inclusive growth. In Ghana, female entrepreneurs have shown exceptional resilience across sectors such as agribusiness, retail, and services. Yet their financing needs remain largely unmet. Expanding credit opportunities for women-owned and youth-led businesses can create a powerful multiplier effect, as these groups tend to reinvest profits into their families and communities.

The World Bank advocates for targeted financial programs that support these groups through affordable credit lines, entrepreneurship training, and digital literacy. By empowering women and young entrepreneurs, Ghana can accelerate poverty reduction and strengthen its social and economic fabric.

As the global SME financing gap widens, Ghana faces both a challenge and an opportunity. Bridging the local financing deficit will require coordinated efforts among the government, financial institutions, and development partners.

READ ALSO: Lukashenko Slams Lithuanian Border Closure