As part of Newmont’s obligation to the government of Ghana and community development, the company has paid an amount of GH₵ 2.388 billion to the government.

Newmont Corporation, as of September 2025, has made GH₵ 9.874 billion in fiscal payments to the government since January 2025. This reiterates the Corporation’s unswerving obligations and contribution to fiscal and economic development in Ghana.

“These payments demonstrate our ongoing commitment to honoring our tax and other obligations to the state, as well as to our local communities. By paying our fair share of taxes and disclosing these payments, we help to promote transparency and good governance.”

Danquah Addo-Yobo, Country Manager for Newmont’s Ghana operations

Newmont Corporation has met its tax obligation for the third quarter of 2025 in taxes, royalties, levies, and carried interest. The payments were made through the respective government agencies, including the Ghana Revenue Authority, Forestry Commission, and the Ministry of Finance.

Payment in the third quarter included Corporate Tax of GH₵1.192 billion, Capital Gains Tax of GH₵511 million, Minerals Royalty of GH₵309 million, Carried Interest of GH₵234, Pay As You Earn (PAYE) Tax of GH₵75 million, and Withholding Tax of GH₵67 million.

Newmont’s Performance in Q3 of 2025

According to the Corporation, they produced a significant amount of gold ounces and in free cash flow of over US$ 1 billion each. The free cash flow refers to the cash Newmont generated after accounting for capital expenditures needed to maintain or expand its asset base, indicating the cash available for distribution to investors and shareholders.

“Newmont delivered a robust third-quarter performance, producing approximately 1.4 million attributable gold ounces and generating a third-quarter record of US$1.6 billion in free cash flow, marking the fourth consecutive quarter with over US$1 billion in free cash flow.”

Tom Palmer, Newmont’s Chief Executive Officer

Mr. Palmer added that “we [Newmont] are making significant progress on the cost savings initiatives announced at the beginning of the year, enabling us to meaningfully improve our 2025 guidance for several cost metrics, while maintaining our outlook for production and unit costs in a rising gold price environment.”

According to the Corporation’s 2025Q3 report, net income of US$ 1.8 billion was recorded. 1.4 million gold ounces were produced, as well as 35 thousand tons of copper, primarily from Newmont’s core managed operations. The Corporation is on track to meet its 2025 production and unit cost guidance through cost-saving initiatives being undertaken.

Assets and equity sales reported nearly US$ 640 million in cash proceeds, and more than US$ 3.5 billion in net cash proceeds from announced transactions, including approximately US$ 2.6 billion from divested assets and nearly US$ 900 million from the sale of equity shares.

The Corporation generated US$ 2.3 billion of cash from operating activities and returned US$ 823 million of capital to shareholders through share repurchases and dividend payments.

Newmont has executed and settled total trades of common stock repurchases of $3.3 billion; $2.7 billion remains under the previously authorized programs of $6.0 billion. Also, their reduced debt by US$ 2 billion through the completion of a successful debt tender offer, ending the quarter in a near-zero net debt position with US$ 5.6 billion of cash and US$ 9.6 billion in total liquidity.

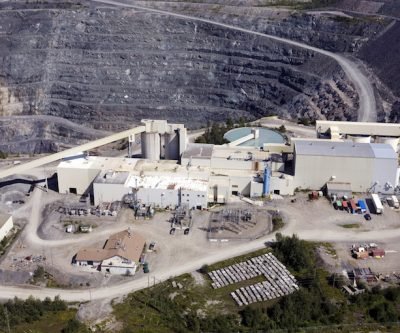

The Corporation is expected to add earnings from the Ahafo North project in Ghana by the end of 2025Q4, adding profitable gold production over an initial 13-year mine life.

Newmont’s Impact on the Ghanaian Economy

Newmont is one of Ghana’s leading taxpayers and a key contributor to national development through tax payments, employment creation, local procurement, and community investment.

With the official opening of the company’s Ahafo North mine in October this year, which is expected to deliver between 275,000 to 325,000 ounces of gold annually, Newmont will increase its production footprint in Ghana, along with an increased contribution to Ghana’s economy.

The Corporation’s timely fulfillment of tax obligations finances the government’s Budget and development projects. These payments follow Ghana’s mining laws and Newmont’s Revised Investment Agreement with the government. According to the Corporation, they remain committed to responsible and transparent operations that benefit the countries it works in.

The Corporation also fulfills community engagement obligations by meeting some community needs as they mine sustainably and in an environmentally friendly manner.

For instance, earlier this year, the mining firm endorsed its commitment to community development in Ghana with an audacious new infrastructure investment plan centered around its Ahafo South operations. The corporation announced a US$ 34 million allocation spanning 2025 to 2028, aimed at rehabilitating key road networks and improving access across the Ahafo Region.

READ ALSO: Police Service Joins ADB’s Transformation Wave After IGP’s Glowing Endorsement