The Bank of Ghana’s decision to reintroduce the 14-day bill has sparked renewed discussion within financial and economic circles, with several analysts praising the move as timely and necessary.

As the country continues to navigate a declining interest rate environment, the central bank is seeking more precise tools to manage liquidity and ensure that recent policy decisions meaningfully impact the wider economy.

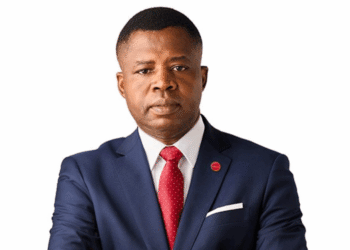

Among the notable voices supporting this development is banking consultant Dr. Richmond Atuahene, who describes the shorter-tenor instrument as a crucial mechanism for enhancing the effectiveness of monetary policy.

This policy move follows the announcement at the 127th Monetary Policy Committee meeting, where the central bank confirmed the return of the 14-day bill as part of its open market operations. With Ghana experiencing months of disinflation and a sharp fall in the policy rate, the Bank of Ghana’s renewed interest in shorter-term instruments reflects its determination to keep monetary conditions stable.

A Response to Declining Interest Rates

The reintroduction of the 14-day bill comes at a time when the policy rate has fallen significantly from 27 percent to 18 percent. This sharp reduction has implications for liquidity levels in the financial system, making it necessary for the central bank to deploy tools that respond more quickly to market movements.

According to Dr. Atuahene, the 14-day bill provides exactly that.

“By using the shorter term, Bank of Ghana can react more quickly to changes in liquidity, helping to ensure that policy rate decisions transmit effectively to the economy.”

His assessment highlights how a shorter-term liquidity instrument can provide the agility needed to maintain control over monetary conditions.

As Ghana transitions into a lower interest-rate regime, maintaining the delicate balance between liquidity and inflationary expectations becomes even more crucial. The 14-day bill, therefore, offers the central bank a strategic lever to reinforce the effectiveness of its rate decisions.

Dr. Atuahene stresses that without such measures, the falling policy rate could lose its intended impact.

“The policy rate has dropped from 27 percent to 18 percent, and if the Bank of Ghana does not create another leg, it can affect the policy rate. The 14-day bill becomes an instrument to manage liquidity changes as rates fall.”

A More Responsive Policy Toolkit

The financial landscape in Ghana has evolved rapidly over the past few years, especially with inflation now moderating after a period of volatility. To sustain this progress, the central bank is strengthening the tools available for open market operations.

Dr. Atuahene describes the reintroduction of the 14-day bill as an important enhancement to the policy framework. “To me, it is a new part of monetary policy intended to make the policy rate more responsive,” he noted.

This emphasis on responsiveness reflects broader efforts by the Bank of Ghana to align liquidity management practices with changing macroeconomic conditions. Shorter-tenor instruments are particularly effective in volatile or transitioning environments because they allow central banks to intervene more frequently and with greater precision. The return of the 14-day bill signals Ghana’s recognition of this need for agility.

The bill is expected to complement existing instruments such as repos, longer-term bills, and primary reserve requirements. As market watchers point out, the Bank of Ghana’s toolkit must remain flexible enough to address fluctuations in liquidity, ensure alignment between policy signals and market conditions, and support the broader goal of economic stability.

Market Reaction and Economic Implications

Market analysts have largely welcomed the move, describing the 14-day bill as a smart step that aligns with international best practice. In many emerging markets, central banks rely on short-term bills to fine-tune liquidity conditions without disrupting broader monetary trends. Ghana’s adoption of this approach reinforces its commitment to maintaining credibility and consistency in monetary policy.

The reintroduction is also expected to influence the behavior of commercial banks and other financial institutions. By offering a short-term avenue for liquidity absorption, the Bank of Ghana can encourage more predictable interest rate movements, reduce market volatility, and promote stability in loan pricing. This, in turn, could support private sector activity by creating a more stable financing environment.

Furthermore, with inflation trending downward and confidence gradually returning to the financial sector, a stronger liquidity-management framework is essential for sustaining the ongoing recovery. The 14-day bill supports this process by ensuring that disinflation is matched with appropriate policy actions.

The Bank of Ghana’s decision to revive the 14-day bill marks a pivotal moment in the country’s monetary management strategy. As Ghana shifts into a lower interest-rate environment, the ability to manage liquidity with greater speed and accuracy becomes increasingly important. Dr. Atuahene’s endorsement of the policy underscores its significance in ensuring that policy rate decisions continue to influence the economy as intended.

READ ALSO:GSE Trading Crashes 80% as Market Suffers Dramatic Slowdown Despite Index Gains