The Ghana Revenue Authority (GRA) has assured Ghanaians of its preparedness to aggressively implement the electronic Value Added Tax (E-VAT) system come 2026 to ensure revenue collection improvement.

According to GRA, measures have been put in place to fully implement the domestic revenue mobilization policies and directives outlined in the 2026 Budget. The Authority further assured that it seeks to anticipate all eventualities within 2026, including the IMF-Support program exit, to maintain the national revenue level.

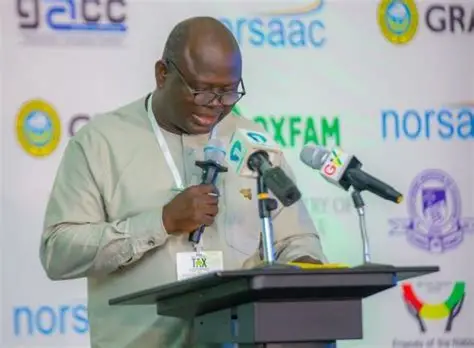

Dominic Naab, the Acting Head of Strategy and Research at the GRA, emphasized the readiness of the government and GRA to enforce the current tax administrative reforms and targeted compliance. He declared that if the new reforms are executed effectively as planned, a robust revenue performance is expected, as well as a reliable revenue stream for the government to execute its development priorities.

“We have instituted a lot of measures. If you look at the budget that was read, for example, you have the E-VAT, which uses electronic means to generate VAT invoices. That will help GRA to monitor in real time what is happening.

“It means, therefore, that if we can do it very well, we are likely to make so much revenue. The Minister [of Finance] also talked about using artificial intelligence, especially in port operations, to make sure the gaps are identified. He also mentioned some declaration defects – all those things will be corrected.”

Dominic Naab, the Acting Head of Strategy and Research, GRA

He again commented that with the constraint on global funding and support of developing countries, Ghana’s only secured and reliable source of funds and revenue will be internally generated. For this reason, he hopes that when these measures are implemented, the country can raise the needed revenue for adequate development.

“The truth of the matter is that there are people really making income, but because they are not on our radar, we don’t get to tax them,” he said. The E-VAT will enable GRA to reach all such persons.

According to tax analysts, the efficiency of domestic revenue measures will be vital in defining Ghana’s fiscal resilience in 2026 and beyond, as the country exits the IMF-supported program.

Ghana’s Revenue Collection Challenge

Ghana, in comparison with other Lower-Middle-Income Countries (LMICs), generally has a low tax revenue collection, often falling between 18 and 20 percent of the GDP benchmark. The country is also challenged with tax compliance, a large informal sector, and tax administration inefficiencies, which cause fiscal deficits despite strong economic growth periods. Reports from the World Bank and experts consistently point to this gap, revealing the country’s administrative weaknesses, mostly in VAT and income tax.

According to Richmond Akwasi Atuahene, a Banking and corporate governance expert, “widespread tax exemptions and waivers, corruption, failure to diversify revenue streams, and non-compliance with tax payments have been major issues in Ghana, as the government has been suffering from a widening fiscal deficit and a rising debt burden over the years.”

The IMF has also mentioned that “weaknesses in revenue administration continue to be reflected in limited compliance and recoveries.”

Ghana’s fiscal fragility is underpinned by revenue underperformance, revealed in Fiscal indiscipline, low revenue mobilization, ineffective revenue policy, widespread tax exemptions and administration, which are the engines for Ghana’s consistent macroeconomic crisis.

Current Reforms Guided by Past Challenges

According to tax experts, every tax strategy requires a procedure or guideline and strict compliance to achieve the tax policy. To have tax policies and strategies dislodged breeds a revenue collection crisis – rather should be interlinked. Tax policy is an objective, and the strategy is the means to achieve the objective.

According to the OECD, the government’s tax policy sets out what it wants to achieve regarding taxation. It also represents the choice by a government as to what taxes to levy, in what amounts, and on whom.

The government of Ghana, through the GRA, intends to be guided by these, as well as by the past challenges in revenue collection, to reform the country’s tax structure. Of these reforms, Dominic Naab is confident that Ghana’s revenue collection and mobilization will surge in the coming year.

He, therefore, urged all Ghanaians to comply with the reforms and comply willingly to ensure all Ghanaians contribute to the growth and development of the country.

READ ALSO: Ghana Heading for 14% Policy Rate by 2026 as Fitch Forecasts Big Shift Ahead