President John Dramani Mahama has fulfilled one of the National Democratic Congress (NDC)’s major tax reform pledges with the formal repeal of the COVID-19 Health Recovery Levy, a 1 percent charge that had been imposed on goods and services in Ghana since 2021.

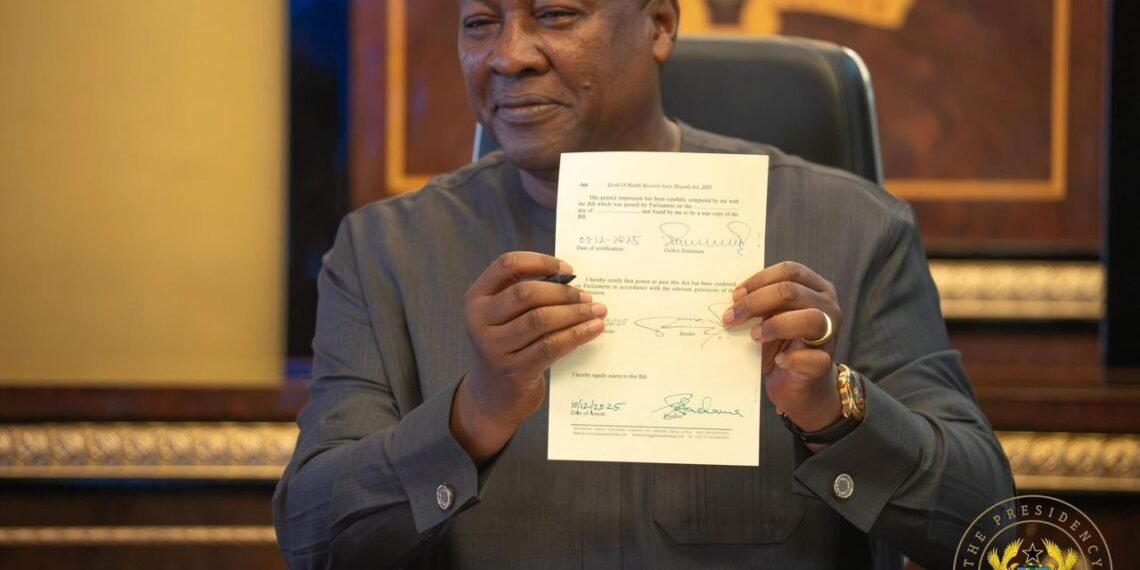

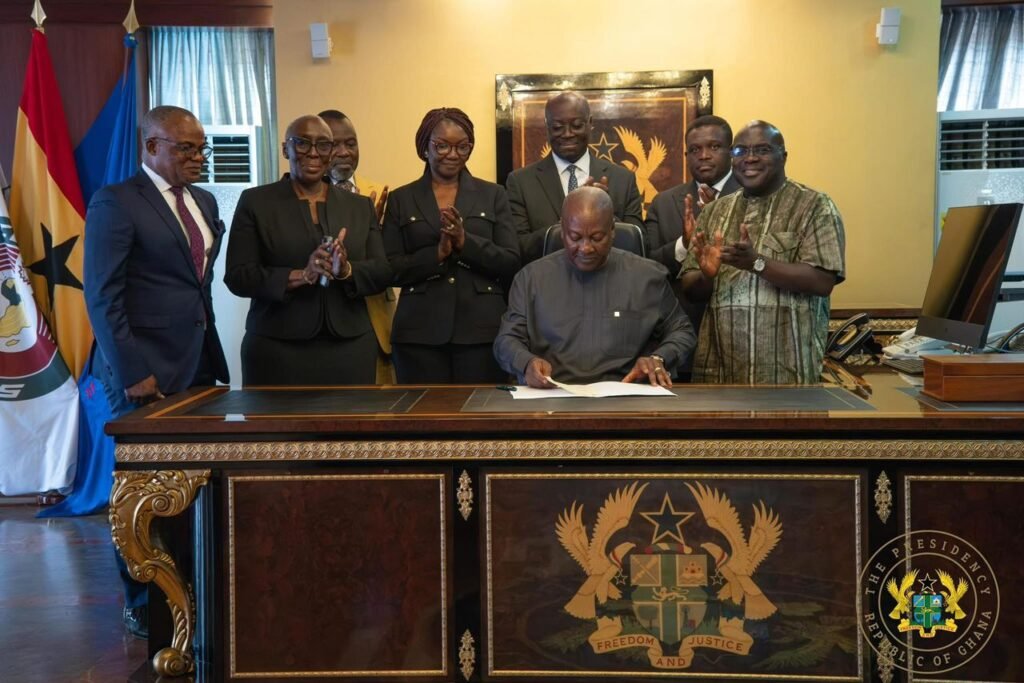

Signing the bill into law at the Jubilee House on Wednesday, December 10, 2025, the President described the moment as the delivery of a clear campaign commitment and a necessary step toward easing the tax burden on Ghanaians.

The new legislation, known as the COVID Health Recovery Levy Repeal Act, 2025, eliminates the levy that had been introduced under the previous administration to support pandemic-related spending.

At the signing ceremony, President Mahama stated plainly that the repeal was in keeping with the NDC’s promise to remove what it considered nuisance taxes that had increased the cost of living without clear justification once the pandemic had passed.

“This is the COVID Health Recovery Levy Repeal Act 2025, and it is my honour and privilege to sign, to repeal the COVID levy. Promise made, promise delivered, and today is the 10th of December, 2025.”

President John Dramani Mahama

He added that Ghanaians deserved relief from a charge that many had long questioned, especially given the circumstances under which it was introduced.

The levy, officially Act 1068, was imposed in 2021 at the height of the COVID-19 pandemic. It applied to almost all taxable goods and services in the country as well as imports, except for items exempted under the VAT Act.

Like the National Health Insurance Levy and the GETFund levy, the COVID-19 charge was a stand-alone, non-recoverable tax collected by the Ghana Revenue Authority.

The government justified the measure as a means to replenish public finances after extensive pandemic-related expenditures, including vaccine procurement and health system strengthening.

Covid-19 Levy Imposition Perplexing

However, President Mahama recalled that the introduction of the levy came at a time when the then government had already claimed to be providing free water, free electricity, and free food to the population during the pandemic. This, he said, made its eventual imposition even more perplexing to the public.

“To the shock of most Ghanaians, after the pandemic was over and after the elections were over, governments slapped Ghanaians with a 1% value-added tax, ostensibly to recover what it is supposed to have spent on the COVID pandemic.

“Ghana continued to remain one of the only countries where we were being taxed for a pandemic that had passed.”

President John Dramani Mahama

He emphasized that resentment toward the levy had been widespread, forming part of the broader public resistance to what had become known as nuisance taxes.

Throughout the 2024 presidential campaign, he pledged that an NDC government would remove such taxes to help reduce the cost of living and restore confidence in the tax system.

“A lot of Ghanaians have disliked this tax, and today, I am pleased that on the 10th of December, 2025, I have signed the repeal act to remove the 1% COVID levy.”

President John Dramani Mahama

The repeal marks the latest in a series of tax reforms introduced by the Mahama administration. The e-levy, the Betting Levy, and the emission levy were all scrapped as part of the government’s first budget.

The COVID-19 levy, however, was scheduled for removal in the 2026 fiscal year to allow, as Finance Minister Dr. Cassiel Ato Forson explained earlier, a “comprehensive review of Ghana’s VAT system.” This review was intended to ensure that the repeal would not disrupt revenue planning while the government worked to rebalance the tax structure.

Parliament passed the repeal bill in November 2025 after it was submitted by the Minister for Finance. With the President’s assent, the act will now be transmitted to the Clerk of Parliament in line with legislative procedure.

Cessation Takes Effect January, 2026

The full cessation of the levy’s collection is set to take effect in January 2026, giving the Ghana Revenue Authority time to adjust its systems and notify taxpayers.

The removal of the COVID-19 levy is expected to impact a wide range of economic activities because of how broadly the tax applied. Businesses and consumers had long argued that even a 1 percent charge on goods and services compounded the already high tax load, especially given concurrent levies under the VAT system.

For many, the repeal represents not only financial relief but also a symbolic reversal of what they viewed as an unnecessary extension of pandemic-era taxation.

President Mahama reiterated that the repeal forms part of a broader agenda to realign Ghana’s revenue strategy toward measures that support growth, fairness, and long-term stability.

He maintained that while the government remains committed to raising revenue responsibly, it will do so in ways that do not place avoidable strain on households and businesses.

As the country prepares for the 2026 fiscal year, the government is expected to continue rolling out its tax reform agenda. The repeal of the COVID-19 levy, long demanded by citizens and businesses alike, now stands as one of the administration’s most visible demonstrations of its commitment to easing the cost of living.

READ ALSO: Government Withdraws Atlantic Lithium Agreement Bill in Parliam