According to Professor Fred Mawunyo Dzanku, an economist at the Institute of Statistical, Social and Economic Research (ISSER), Ghana’s public debt challenge is a result of national structural deficiencies.

He mentioned that Ghana’s public debt crisis is a long-term structural phenomenon that the country has failed to find a long-term solution to. The temporal solutions have not yielded any fruit as the crisis persists.

“Ghana’s public debt challenge did not begin in 2017, and it cannot credibly be reduced to the actions of a single individual. The long-run trend reveals a structural problem.”

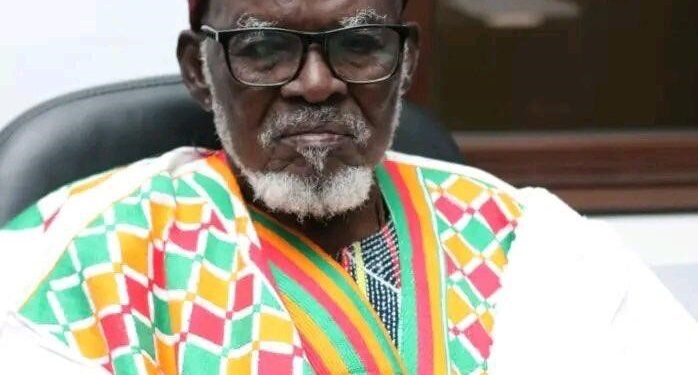

Professor Fred Mawunyo Dzanku, ISSER

Prof. Dzanku linked Ghana’s debt crisis to deep-seated structural issues such as “persistent fiscal deficits, weak domestic revenue mobilization, exchange-rate depreciation, and rising interest costs, [which] have driven debt accumulation across multiple administrations.”

He also revealed that weak export diversification, rather than just external shocks like COVID-19, exposed the country’s structural weaknesses that hinder sustainable growth and make debt management challenging despite debt relief efforts.

He explained that, looking at the annual changes in the debt-to-GDP ratio, “while [Ghana’s] debt rose steadily before 2017, the pace of accumulation accelerated sharply after 2020,” adding that “the COVID-19 shock, emergency spending, revenue collapse, and severe exchange-rate depreciation translated into historically large year-on-year jumps in the debt ratio.”

He claimed boldly that “these are measurable outcomes and cannot be dismissed.” Addressing these will require structural reform to lay a new foundation for fiscal discipline and macroeconomic stability.

“The key lesson is therefore institutional, not personal. Ghana’s debt problem reflects repeated failures to consolidate during growth periods, heavy reliance on non-concessional borrowing, and limited buffers against shocks.”

Professor Fred Mawunyo Dzanku, ISSER

Ghana’s consistent struggle to stabilize debt when economic conditions improve is an institutional problem that requires dedication and willpower from the managers of the economy.

World Bank and Others Support Debt Claim

The World Bank tied Ghana’s debt issue to the continent, suggesting that “structural weaknesses such as lack of a diversified export base make it more difficult for these countries to adjust to changing world economic conditions. Also, higher population growth in these countries makes achieving higher per capita income growth more difficult. These weaknesses prevent these countries from achieving the rapid economic growth necessary to escape from debt difficulties.”

The World Bank also asserted that debt has distorted the trade and policy initiatives of governments in Ghana. The debt situation absorbs substantial resources that could make a lot of difference in the lives of Ghanaians.

The distorted trade is a result of slowing productivity and exports in favor of rising debt. An opportunity cost is created when many developmental projects are written off because the debt level has absorbed the resources.

“External debt has grown faster than exports, while slowing trade, tighter financial conditions, and policy uncertainties have further constrained fiscal space.

“In several cases, rising debt service costs are absorbing a growing share of public revenues, potentially decreasing spending on health, education, and infrastructure—and eroding prospects for inclusive growth.”

World Bank

The Bank also alluded that “high external debt burdens are also associated with broader systemic fragility,” because “countries with weaker institutions and limited resilience face elevated vulnerability and reduced fiscal flexibility.”

Ghana’s economic system is fragile due to the high debt level the country has recorded in recent years. Addressing it will take a while to ensure systematic change and a reformed national economy.

The World Bank confirmed that the 2022 crisis exposed pre-existing weaknesses, not just COVID-19 or the Russia-Ukraine war.

The IMF, in its analysis of the Ghanaian economy, noted that structural issues limit the rapid growth needed to escape debt difficulties, requiring country-specific solutions to Ghana’s predicament.

Prof. Godfred Bokpin has also argued that the high political costs of democracy strain budgets, necessitating expenditure cuts and better governance. This adds to the root solution to the debt menace Ghana faces.

Other experts have also highlighted the negative “debt overhang” and “crowding out” effects, where debt hinders investment.

Therefore, the long-term solution to Ghana’s high public debt is to address the structural, deep-seated economic issues the country faces. Ghana has previously failed to take advantage of the intermittent economic growth achieved in the past to address the structural issues and solve the debt crisis. The current macroeconomic stability and growth resilience should enable the government to set the country on a different economic path.

READ ALSO: Global Oil Prices Hit Below $60