Ghanaian motorists and households are set to enjoy modest relief at the pumps from today, December 16, as prices of petroleum products decline marginally across the country.

The slight reductions coincide with the peak festive travel period and follow a drop in international petroleum product prices, according to the latest Pricing Outlook released by the Chamber of Oil Marketing Companies (COMAC).

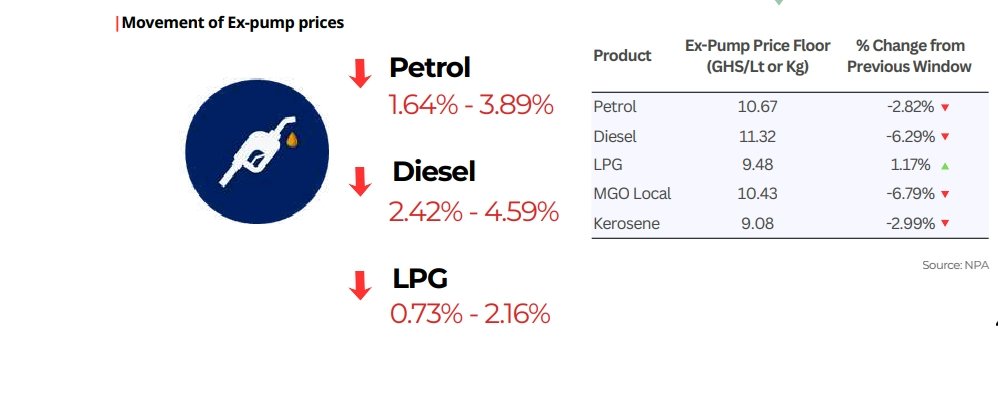

“For the festive period, petrol, diesel, and LPG ex-pump prices are projected to drop by 1.64%–3.89%, 2.42%–4.59%, and 0.73%–2.16% respectively.”

COMAC Latest Pricing Outlook

The industry body says the downward adjustment reflects favourable global market conditions that have outweighed the impact of a weaker cedi, creating room for oil marketing companies to review prices downward for the second pricing window of December.

COMAC explained that “the seasonal decline was driven by a significant drop in international petroleum product prices, which offset the slight depreciation of the cedi,” allowing retailers to pass on some relief to consumers during the Christmas and New Year period.

Cedi Depreciation Fails to Reverse Gains

Ordinarily, depreciation of the local currency would translate directly into higher fuel prices in an import-dependent market like Ghana.

For the December 16 pricing window, the cedi weakened from GHS 11.14 to GHS 11.43 to the US dollar, representing a depreciation of about 2.68 percent.

COMAC said the currency movement “aligns with expectations of seasonal festive demand pressure and limited foreign exchange support, which have restrained further appreciation of the local currency during this period.”

Increased demand for foreign exchange ahead of Christmas, combined with ongoing pressures in the forex market, contributed to the cedi’s marginal slide.

Despite this, the Chamber emphasised that the scale of the drop in international product prices was sufficient to neutralise the currency effect, allowing oil marketing companies to reduce prices rather than pass on higher costs to consumers.

International Product Prices Drive the Trend

The pricing outlook points to sharp movements in refined petroleum product prices on the international market as the key driver behind the marginal reductions at the pumps. Despite a modest rise in crude oil prices in mid-December, finished products moved decisively lower due to oversupply conditions.

COMAC noted that petrol prices on the international market declined by 6.55 percent, while diesel recorded a much steeper fall of 11.67 percent. LPG prices also edged lower, albeit marginally, with a 0.22 percent decline.

These drops, the Chamber said, created sufficient headroom to counterbalance currency pressures and support lower ex-pump prices locally.

Industry analysts say diesel’s sharper decline is particularly significant for transport operators, logistics firms and the industrial sector, where fuel costs play a major role in operating expenses.

While refined products softened, crude oil prices moved in the opposite direction, rising modestly during the period under review. COMAC reported that crude oil prices increased by 1.06 percent, climbing from about $63.12 per barrel to $63.79 per barrel in mid-December 2025.

However, the Chamber stressed that the rise was limited, noting that “growing consensus about supplies exceeding demand next year has pushed crude toward the lower end of a band it has traded in since mid-October.”

Market expectations of ample supply in 2026, combined with subdued demand growth, have capped crude price gains, preventing any significant upward pressure on downstream prices.

What Consumers Can Expect at the Pumps

The projected reductions mean that consumers should see modest price cuts at filling stations, although actual prices may vary depending on supplier pricing strategies, inventory costs and whether products were procured on a cash or credit basis.

The timing of the marginal price cuts is expected to ease transportation costs during one of the busiest travel periods of the year.

Lower fuel prices could help moderate transport fares, support commercial activity and reduce operating costs for businesses that rely heavily on diesel and petrol, including logistics firms and manufacturers.

For households, even small reductions at the pumps can translate into savings over the festive season, when fuel consumption typically rises due to increased travel and social activities.

For now, however, the December 16 pricing window offers a measure of festive relief. As COMAC’s outlook makes clear, falling international petroleum product prices have provided a cushion against currency weakness, giving Ghanaians a modest but welcome break at the pumps as the year draws to a close.

READ ALSO: Developing Countries Restructure $90bn in Debt — But Rising Costs Spell Trouble for Ghana