Ghanaians are beginning to enjoy some relief at the pumps as major oil marketing companies (OMCs) roll out fuel price reductions in line with industry projections for the festive season.

Several leading OMCs have already adjusted their pump prices, with more expected to follow before the end of the week. The reductions are part of a broader trend anticipated for the second pricing window in December and possibly into early 2026, should current market conditions persist.

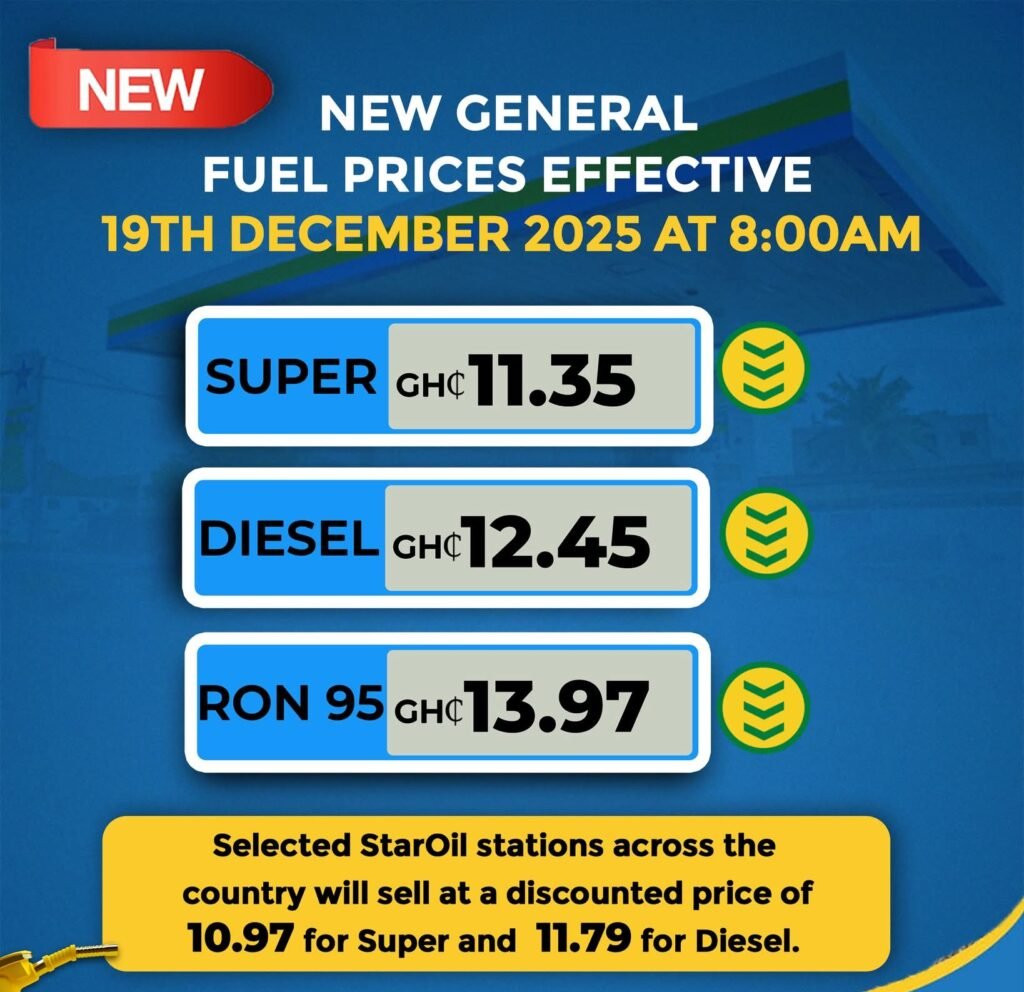

Star Oil Ghana has implemented one of the most notable price reductions so far. The company cut the price of petrol from GH¢11.97 to GH¢10.35 per litre, while diesel now sells at GH¢11.79, down from GH¢12.74.

Explaining the decision, Star Oil said the prevailing market conditions made it possible to transfer cost savings to consumers during the holiday season.

“The relative stability of the Ghana cedi and a drop in global market prices have allowed us to pass on more savings to you this Christmas holiday season.”

Star Oil Ghana

The sharp reduction by Star Oil has been welcomed by drivers, particularly commercial transport operators who typically experience increased fuel demand during the festive period.

The cuts, which took effect this week, are being driven by falling international petroleum product prices, relatively stable foreign exchange conditions and heightened competition among retailers ahead of Christmas.

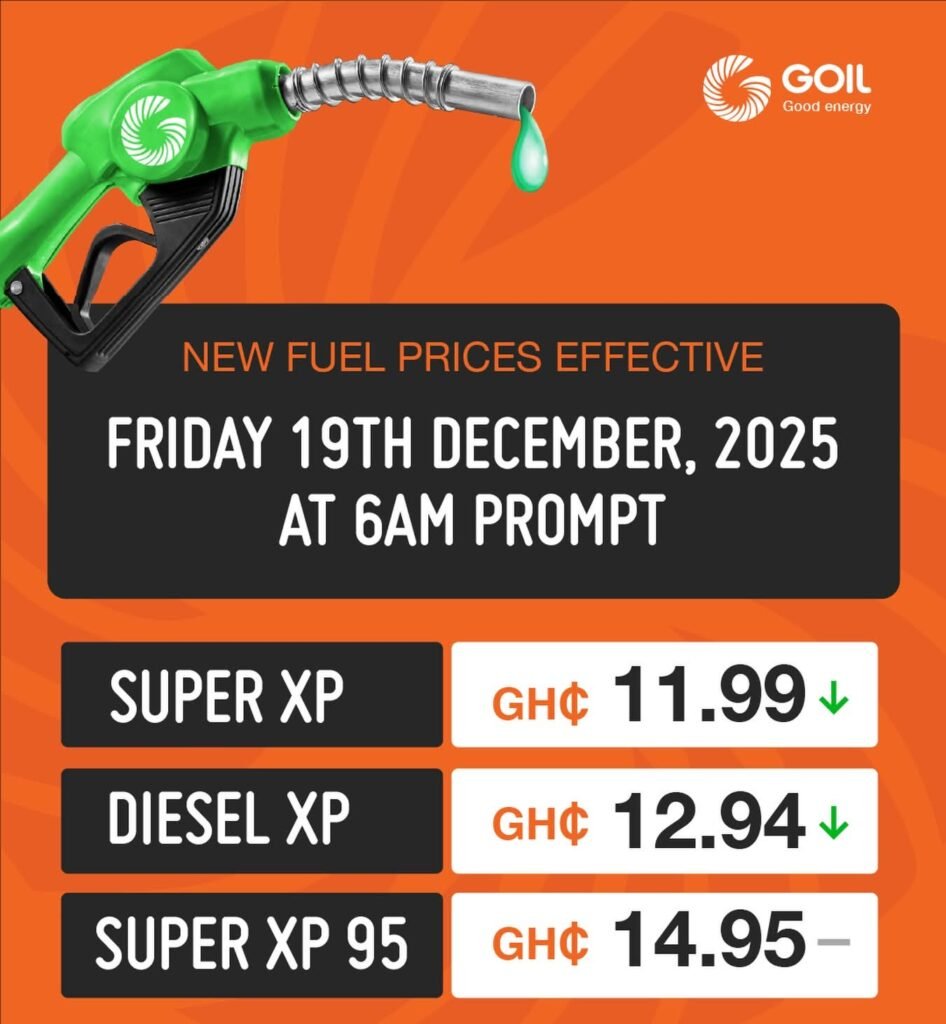

GOIL and Vivo Energy Adjust Pump Prices

State-owned GOIL PLC has also announced price reductions, effective Friday, December 19, 2025. Petrol at GOIL stations has been reduced from GH¢12.62 to GH¢11.99 per litre, while diesel now sells at GH¢12.94, down from GH¢13.20.

Private sector players have followed suit. Vivo Energy Ghana, operators of Shell-branded stations, reduced petrol prices from GH¢12.69 to GH¢12.50 per litre. Diesel prices at Shell outlets have also declined from GH¢13.22 to GH¢12.99 per litre.

Industry observers say the competitive nature of the downstream petroleum sector often accelerates price adjustments once one or two major players initiate reductions.

Another key player, PETROSOL, has also adjusted its prices downward. Petrol now sells at GH¢12.48 per litre, while diesel has been reduced to the same price of GH¢12.48 per litre.

According to industry sources, several other OMCs have indicated plans to announce price cuts before the close of the week. Some have also hinted at a possible review in the next pricing window beginning January 1, 2026, if the factors currently influencing prices remain unchanged.

Industry Outlook Points to Further Declines

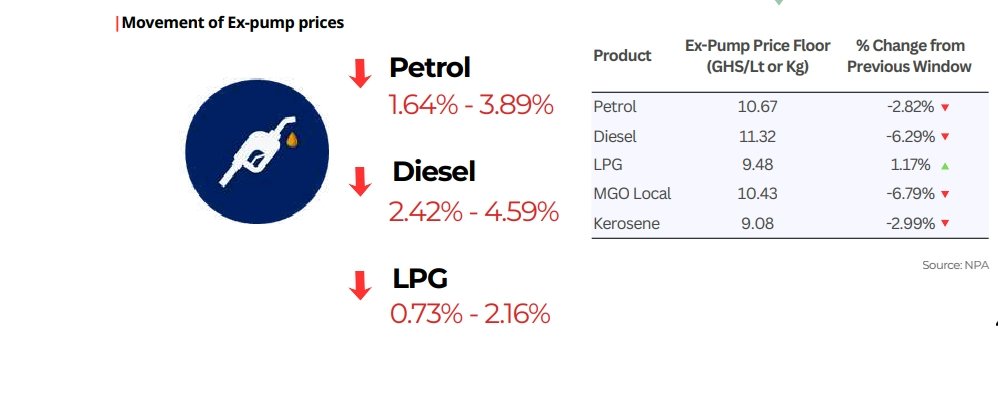

The Chamber of Oil Marketing Companies, in its outlook report, projected that petroleum product prices could decline by as much as four per cent per litre in the second pricing window for December.

The Chamber noted that petrol prices were expected to fall by between 1.64 per cent and 3.89 per cent, potentially bringing the average pump price to about GH¢12.90 per litre.

Diesel prices, the report said, could see an even steeper reduction of up to 4.59 per cent, resulting in a litre selling at approximately GH¢13.20. Liquefied Petroleum Gas (LPG) is also expected to decline by up to 2.16 per cent, bringing prices close to GH¢14 per kilogram.

The Chamber attributed the projected reductions largely to declining prices of finished petroleum products on the international market. Despite a marginal increase in crude oil prices, key refined products recorded notable declines due to oversupply conditions globally.

According to the report, petrol prices on the international market fell by 6.5 per cent, diesel dropped sharply by 11.67 per cent, while LPG prices eased by 0.22 per cent during the period under review.

However, the local currency presented a mixed picture. The Ghana cedi depreciated marginally against the US dollar, weakening from GH¢11.14 to GH¢11.43.

The Chamber noted that limited foreign exchange support during the period restrained further appreciation of the cedi, which could have led to even deeper price cuts at the pump.

With more OMCs expected to announce price cuts and the possibility of further reviews in January, consumers are hopeful that the current trend will provide sustained relief beyond the holidays, easing transportation costs and contributing to lower inflationary pressures in the new year.