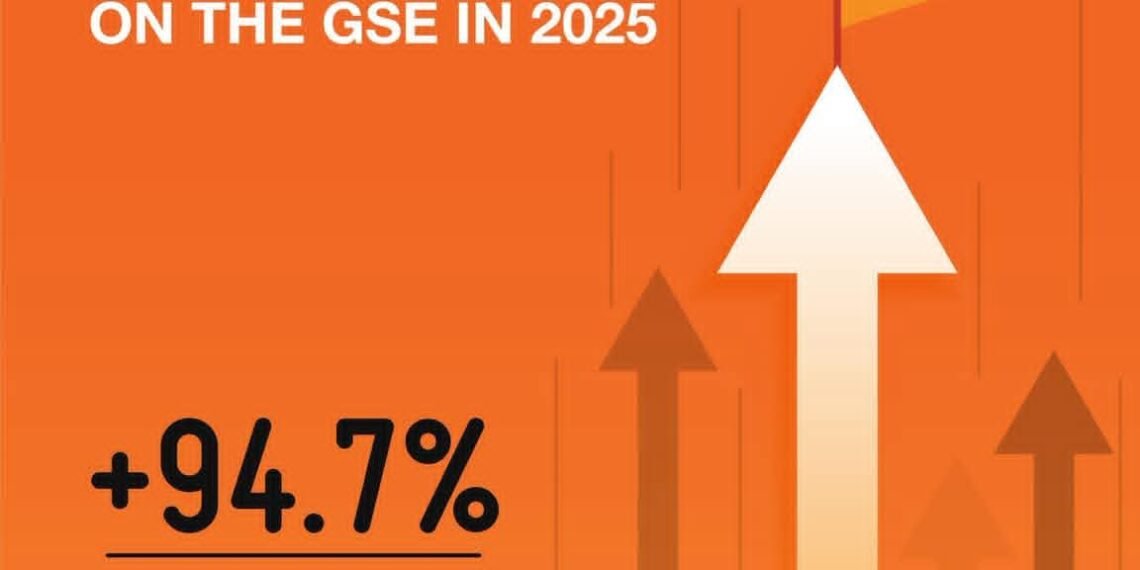

GOIL PLC has emerged as one of the standout performers on the Ghana Stock Exchange (GSE) in 2025, posting a sharp rise in its share price and reinforcing renewed investor confidence in the company’s strategic direction and long-term prospects.

The rally marks a significant turnaround from 2024, when the stock recorded only marginal gains.

“GOIL’s share price rose significantly from GH¢1.52 at the beginning of the year to GH¢2.96 as at 31 December 2025, representing an approximate 95% increase over the period.”

GOIL PLC

The strong rally in 2025 followed what GOIL described as a subdued but stable performance in 2024, a year marked by macroeconomic challenges and cautious investor sentiment.

During that period, GOIL’s share price edged slightly from GH¢1.50 to GH¢1.52, a modest movement that nonetheless reflected resilience at a time when many equities struggled.

Management says the company’s ability to maintain stability during that phase laid the foundation for the strong rebound witnessed in 2025. The company noted that the latest performance reflects a decisive shift in investor perception.

“GOIL PLC recorded an impressive performance on the Ghana Stock Exchange (GSE) in the 2025 financial year, reflecting renewed investor confidence and growing optimism about the Company’s future direction.”

GOIL PLC

A Bullish Year for Ghana’s Equities Market

GOIL’s gains came against the backdrop of a broader rally on the Ghana Stock Exchange, which recorded one of its strongest performances in recent years. Market analysts attribute the bullish sentiment to improving macroeconomic indicators and changing investment preferences.

GOIL said, “The year 2025 proved to be a standout period for the Ghanaian equities market,” pointing to improved macroeconomic stability, easing inflationary pressures and a gradual shift by investors away from fixed-income instruments toward equities.

This favourable environment, the company noted, created opportunities for fundamentally strong stocks to outperform. Within this context, GOIL distinguished itself as one of the market’s notable gainers.

Governance and Management Reforms Drive Confidence

GOIL attributed much of its improved market performance to growing confidence in its strategic direction, governance standards and operational discipline under its current management.

“The marked improvement in 2025 underscores growing investor confidence in GOIL’s strategic direction, operational discipline, and long-term growth prospects.”

GOIL PLC

It also highlighted positive market sentiment surrounding its renewed focus under the leadership of Group Chief Executive Officer and Managing Director, Mr. Edward Abambire Bawa.

According to GOIL, the current management team has prioritised strong governance structures, improved operational efficiency, financial discipline and accountability.

These fundamentals, the company said, have resonated positively with the investing public and strengthened confidence in GOIL’s ability to deliver sustainable growth.

Beyond its stock market performance, GOIL said the rally reinforces its position as a leading fully indigenous player in Ghana’s downstream petroleum sector.

“GOIL’s performance further reinforces its position as a leading fully indigenous player in Ghana’s downstream petroleum sector, with a clear commitment to sustainable growth and value creation for shareholders.”

GOIL PLC

Industry observers note that GOIL’s strong market showing reflects broader confidence in its role as a trusted national energy brand, particularly at a time when competition and regulatory scrutiny within the downstream sector remain intense.

Outlook for Long-Term Value Creation

Looking ahead, GOIL expressed confidence in its ability to sustain momentum by strengthening its core fundamentals and executing its strategic priorities.

Management says its focus remains on operational excellence, prudent financial management and long-term investments that enhance shareholder value.

“As the Company continues to strengthen its fundamentals and execute its strategic priorities, GOIL remains well positioned to deliver long-term value while consolidating its role as a trusted national energy brand.”

GOIL PLC

Market analysts say while short-term share price movements can be influenced by broader market sentiment, sustained gains are often driven by strong governance, transparency and consistent performance, all areas GOIL has emphasised in recent years.

The near doubling of GOIL’s share price in 2025 has positioned the company as a reference point for renewed confidence in Ghana’s equity market. For many investors, the stock’s performance signals both a recovery in market sentiment and belief in GOIL’s long-term strategy.

As the Ghana Stock Exchange continues to benefit from improving economic conditions, GOIL’s 2025 performance is being viewed as a benchmark for how strong fundamentals and effective leadership can translate into shareholder value, even after periods of market uncertainty.

READ ALSO: Credit War Errupts as Ghana Publishing Dismisses Former MD’s “Self-Serving” Claims