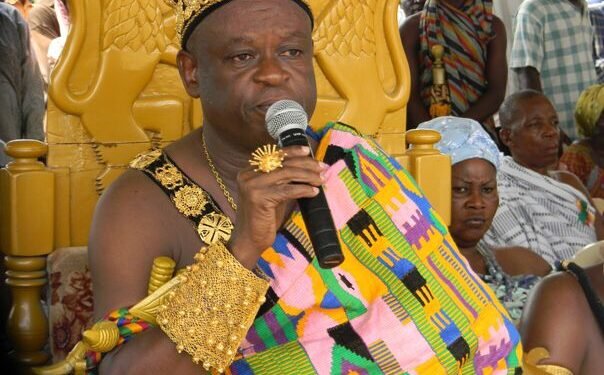

Togbe Afede XIV,the President of the National House of Chiefs, has attributed the collapse of businesses in the country to Ghana’s interest rates which according to him, has over the years, remained on the high.

He further noted that, the state of Ghana’s monetary policy administration is rendering the survival of businesses in the country near impossible to thrive.

According to the Agbogbomefia of the Asogli State, the high rates prevent Ghanaian companies from borrowing from the banks, which means they are not able to invest in their business and make profit.

Speaking in an interview, he quipped how the country expects these business to mobilize enough funds to contribute their quota to the development of the country.

“I’ve never met anybody who disputed the fact that our interest rates have been too high. If you adjust the yields in our money markets for depreciation, the real return is still very high. Why are we doing this to ourselves? And we expect businesses to mobilize money and industrialize this country? We expect people to borrow money and risk in agriculture? It just would not happen.”

Further chastising government, he intimated that the high interest rates deepens the woes of businesses making their profit-rendering venture almost impossible to achieve.

“We want to industrialize, talking about one district, one factory, where would people get the desired capital from? Businessmen don’t come with a lot of money in their pockets that they invest. It’s a little bit of equity and a little bit of debt that goes to fund a company, but the interest rates that we have in this country make it almost impossible to do business profitably. That is why you look around and companies are collapsing. It’s hard to find Ghanaian companies that are 50 years old. But the foreign owned companies are able to borrow from abroad”.

Contrarily, on September 22, 2020, Mr. Alhassan Andani noted that the Central Bank’s position to maintain the monetary policy rate will create an enabling business environment to help struggling Micro, Small and Medium scale enterprises recover from the impact of the pandemic.

He indicated that businesses as a result, will be able to access credit for banks to have their liquidity.

“I think the general posture I want to believe will be to ensure that, we can have a quick and easy recovery. And therefore for businesses to access credit for the banks to have liquidity, but because of the slowdown in economic activity, GDP will be up to maybe 2%. I am sure the posture will be to ensure that the business environment is enabling enough for most of the SMEs and large companies to come back and start productions quickly.”

“The context of doing that is always the supply of credit and how affordable the credit is. So I expect that they will hold the policy rate. We have seen some bit of pressure on inflation, but the good thing is that it’s still within a range, so I suspect they will keep the policy rate [where it is at the moment]”.

That notwithstanding, he revealed that the current position of the country will not support a decrease in policy rate.

“At the moment I don’t think the fundamentals will support a decrease in the policy rate, especially when you still see inflation pressure. Also, we need to ensure that, the exchange rate is pretty stable, it is maintained and there is a fine balance between the two. Marginal borrowers would rather, where the interest rates are too low, to either you use borrowed funds or their own funds to start doing things which would hurt the foreign currency, so I don’t think the fundamentals are supporting a decrease of the policy rate”.