The African Refiners and Distributors Association (ARDA) has long grappled with the challenges posed by dollarization in the petroleum industry. This practice, where prices are set in dollars despite local currency transactions, has become increasingly problematic for African refiners and distributors.

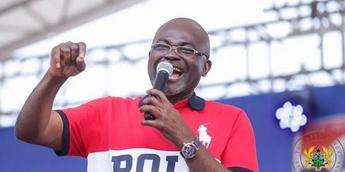

In a powerful call to action during his address at the African Energy Week in Cape Town, South Africa, ARDA President Dr. Mustapha Abdul-Hamid emphasized the need for Africa to strengthen its energy independence through integrated infrastructure and regional collaboration.

By reducing dependency on foreign currencies, particularly the U.S. dollar, Dr. Abdul-Hamid argued, Africa could stabilize its economies, reduce energy import costs, and achieve long-term energy security.

“Nobody puts crude oil in their vehicle or airplane – everything that generates movement and wealth is a refined product,” Dr. Abdul-Hamid remarked, underscoring the economic imperative of refining domestically.

He highlighted the need for synergy between Africa’s upstream (exploration and production) and downstream (refining and distribution) sectors to maximize the continent’s natural resources.

Africa’s reliance on dollar-based transactions for petroleum products exposes it to global currency fluctuations, Dr. Abdul-Hamid noted, and this dependency has resulted in significant volatility for African economies.

To address this, he called on Africa’s 54 countries to prioritize energy security by focusing on local production and refining rather than exporting crude oil only to import refined products.

Dollarization in Africa’s petroleum industry stems from historical economic ties with Western countries, particularly the United States. Many African nations pegged their currencies to the dollar during periods of economic instability or political turmoil.

This practice persisted even after currency devaluations and economic reforms were implemented.

The oil price shocks of the 1970s further entrenched dollarization. As international oil prices rose sharply, many African countries found it easier to maintain stability by pricing domestic products in dollars rather than risking currency fluctuations. Over time, this became a deeply ingrained habit in the industry.

Addressing Dollarization for Energy Independence

To bolster Africa’s energy independence, Dr. Abdul-Hamid introduced a three-tiered strategy: policy harmonization, infrastructure integration, and regional currency adoption.

He argued that these steps would facilitate energy self-sufficiency and economic resilience. Africa’s diverse energy policies, including varying fuel specifications, create barriers to regional trade and collaboration.

For instance, Ghana has implemented a fuel sulfur limit of 50 parts per million (ppm) in refined petroleum products to reduce pollution, while several neighboring West African nations permit sulfur levels ranging from 1,500 to 3,000 ppm. This disparity complicates cross-border trade and raises import costs.

“Without a harmonized specification across Africa, trade within the continent remains difficult, restricting our ability to collaborate effectively,” Dr. Abdul-Hamid explained.

He urged African countries to adopt a uniform standard for fuel specifications, which would not only facilitate trade but also improve environmental and health outcomes across the continent.

Dr. Abdul-Hamid also stressed the importance of developing integrated infrastructure for refining, storage, and distribution. Africa’s dependence on imports of refined petroleum products makes it vulnerable to supply chain disruptions and global price shocks.

One of Dr. Abdul-Hamid’s most ambitious proposals was the adoption of a regional currency to reduce reliance on the U.S. dollar for energy transactions.

“Currently, oil marketers in Ghana require $400 million each month to import refined petroleum products – a demand that constantly pressures the Ghanaian Cedi.”

Dr. Mustapha Abdul-Hamid, ARDA President

This idea, he explained, would reduce the pressure on African currencies, such as the Ghanaian Cedi, which suffers under the weight of high monthly import demands for refined petroleum products.

A shared currency within regional blocs like West Africa, he argued, would ease the burden on African economies and make them less susceptible to currency fluctuations.

“Collaboration is key to transforming Africa’s energy landscape,” he stated. With coordinated efforts, Africa could gradually transition from being a raw materials exporter to becoming a refined product producer, thereby retaining more economic value within the continent.

As global economic conditions remain uncertain, African nations have an opportunity to fortify their economies by focusing on refining and using their own natural resources. Africa’s vast natural resources offer the potential for self-reliance – if leaders are willing to invest in the continent’s future and collaborate across borders.

READ ALSO: PNAfrica Expresses Deep Concern Over Ghana’s Parliamentary Impasse