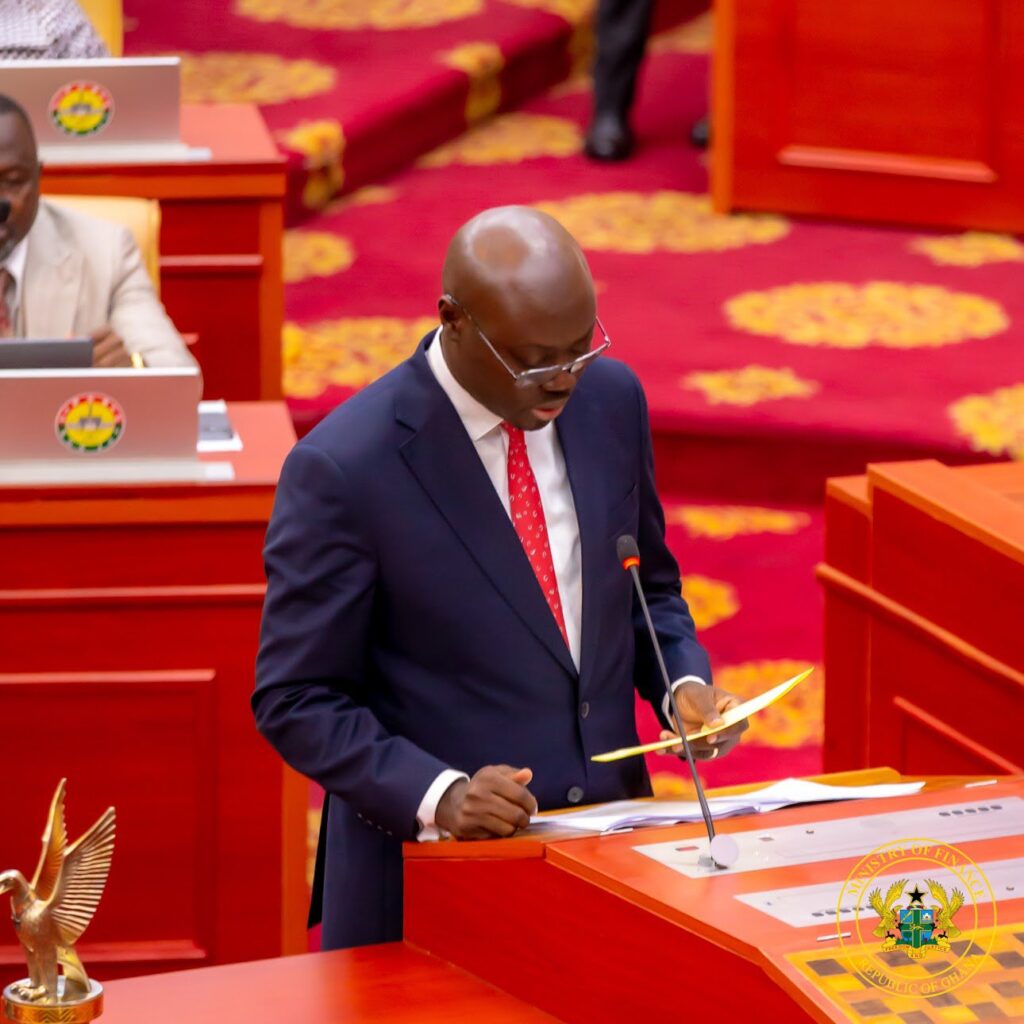

Following the much-anticipated budget presentation, Finance Minister Dr. Cassiel Ato Forson took center stage to defend the government’s fiscal decisions.

From tax reforms to policy cancellations and concerns over the cedi’s stability, Forson laid out the rationale behind the administration’s tough calls.

His remarks came amid growing scrutiny, particularly from opposition figures questioning the government’s approach to economic recovery.

Ato Forson dismissed claims that the recently abolished betting tax was never implemented, asserting that the government had already collected over GHS 80 million from the tax before its removal.

His comments come in response to former Finance Minister Dr. Amin Adam, who claimed at a press conference that the betting tax was only on paper and had never been enforced.

“I don’t think he’s on top of the matter because my checks revealed that it was implemented in the second half of 2024,” Dr. Forson stated emphatically.

“Year to date, the government of Ghana has collected over GHS 80 million from betting tax. So I don’t know what he’s talking about. It is not a fact. The facts on the ground do not support his assertion”

Dr. Cassiel Ato Forson, Minister of Finance

His remarks underscore a growing debate over the effectiveness and enforcement of tax policies under the previous administration, as the current government moves to reform Ghana’s revenue system.

The Scrapping of Key Economic Policies

The budget announcement also revealed the government’s decision to discontinue several flagship programs, including the One District, One Factory (1D1F) initiative, Ghana Cares, and the YouStart program.

Dr. Forson defended these cancellations, arguing that they had not yielded the intended economic benefits.

“We don’t see that,” he said when asked why a policy that had visibly contributed to industrial growth was being eliminated.

“The evidence we’ve seen does not support the argument that was made in the past. The business growth that we saw was not coming from the One District, One Factory policy.”

Dr. Cassiel Ato Forson, Minister of Finance

He further explained that a significant portion of the financial backing for 1D1F had been allocated to undeserving companies, a revelation that had led Parliament to resist granting additional funds for the initiative.

“In the last Parliament, we noticed that a huge chunk of that money was being allocated to companies that did not actually deserve it.

“That was the basis why Parliament fought against it, and it didn’t go anywhere. So the policy has been dying, and we felt that it was an opportunity for us to cut that waste”

Dr. Cassiel Ato Forson, Minister of Finance

The PFM Act

Dr. Forson also took aim at Ghana’s weak enforcement of financial regulations, emphasizing that the issue was not the absence of laws but the failure to implement them effectively.

“The Public Financial Management Act (PFM) is a gold star,” he asserted.

“In fact, it is one of the best you can get in the world. I don’t think you can count the first twenty countries with a very strong, robust PFM regime better than that of Ghana. But the truth remains that Ghana has been unable to implement it”

Dr. Cassiel Ato Forson, Minister of Finance

Rather than introducing new financial laws, he advocated for stricter enforcement and the application of sanctions against those who had violated the Act in the past.

“You need to apply the sanctions and the sanctions may not only be looking forward, they have to look at those who have infringed upon the PFM Act in the past”

Dr. Cassiel Ato Forson, Minister of Finance

Reforming VAT

A significant aspect of the budget discussion revolved around Ghana’s Value Added Tax (VAT) system, which Dr. Forson described as highly distorted and burdensome for households.

He argued that reforms were necessary to provide relief to ordinary Ghanaians.

“VAT is a consumption tax, and the incidence falls on you, the consumer. Businesses will just input VAT and be able to offset, but for households, the incidence is directly on them”

Dr. Cassiel Ato Forson, Minister of Finance

He pointed out that Ghana’s effective VAT rate stood at 21.9%, making it one of the highest in Africa.

“I think the second highest is Morocco, with about 20%, so clearly, there is a problem with VAT.”

According to him, the current VAT system is riddled with complexities, including cascading tax elements and a mix of sales tax with VAT.

He promised a thorough review and stakeholder engagement to address these issues.

Market and Exchange Rate Concerns

In an effort to gauge public sentiment ahead of the budget presentation, Dr. Forson had visited Makola Market, where he engaged traders on Ghana’s economic challenges.

He revealed that nearly every trader he spoke to during that exercise pointed to “exchange rate volatility” as the biggest issue affecting their businesses.

“To my surprise, almost every single person that I met, most of them women, said, ‘The problem of Ghana today has to do with the exchange rate.’”

He shared an interaction with a trader from Twifo Praso who had experienced a drastic price increase within just three weeks.

“She told me, ‘I was in this shop three weeks ago. I bought an item for GHS 1,350, and today, it has increased to approximately GHS 1,750.’ I was really shocked,” he said.

This, he explained, was a result of businesses preemptively adjusting prices to hedge against currency fluctuations.

“The shop owner told me that because of the volatilities we see in the exchange rate, they also have to hedge and in hedging, they increase their price, looking at what may happen in the next couple of days.”

Dr. Cassiel Ato Forson, Minister of Finance

This prompted his assurance to the traders that the new government’s policies were aimed at stabilizing the cedi and would help curb these price fluctuations.

“If you can signal to us that the exchange rate will be stable, we will also hold our prices,” one shop owner reportedly told him.

Dr. Forson highlighted how going beyond the economic think tanks and engaging with the real practitioners gave him invaluable insight into market realities prior to the budget reading.

Insights which according to him, helped shape up the widely applauded 2025 budget.

His statements highlight a government keen on enforcing fiscal discipline, eliminating ineffective policies, and addressing pressing concerns such as VAT distortions and exchange rate volatility.

Consequently, his budget presentation and subsequent clarifications reflect an administration determined to make tough decisions, even if they come with political pushback.

READ MORE: Panama Rejects Trump’s Claim of ‘Reclaiming’ Canal