Ghana’s debt management efforts received a major boost following the Ministry of Finance’s successful clearance of GH¢9.7 billion in coupon arrears under the Domestic Debt Exchange Programme (DDEP).

The move, which has pushed total debt service this year to GH¢19.4 billion, is being lauded as a crucial step toward rebuilding investor confidence after a turbulent restructuring process.

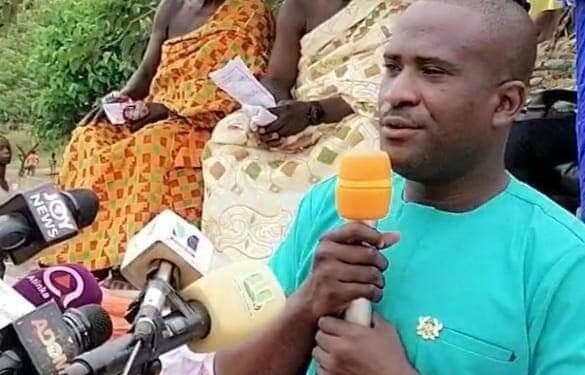

Economist Professor Godfred Bokpin has emphasized that prompt and consistent coupon settlements are central to restoring trust in Ghana’s financial system and positioning the country for a return to the bond market.

The DDEP, launched in late 2022 as part of Ghana’s broader debt restructuring plan under an IMF-supported programme, was designed to ease short-term fiscal pressures by reducing immediate debt servicing obligations. However, the exercise dealt a heavy blow to investor confidence, leaving both domestic and international market players wary of government commitments.

Speaking at Prudential Bank’s Special Customer Seminar on the cedi’s appreciation, Prof. Bokpin said, “If you look at what we have gone through with the debt restructuring and the fact that it has wounded confidence in the market, I think the predictability and the sustainability of keeping to the debt repayment roadmap is good for building confidence. Government itself is thinking about opening the bond market.”

Building Credibility Through Predictability

According to Prof. Bokpin, the predictability of payments is essential not only for stabilizing market confidence but also for laying the groundwork for Ghana’s eventual re-entry into the international capital markets. With major refinancing needs expected in 2027 and 2028, he stressed that credibility today would determine access to capital tomorrow.

“You need this predictability to be able to consolidate confidence so that we can open the bonds market and hopefully open the international capital market going forward. That will offer some kind of transition and flexibility for government’s fiscal operations and debt sustainability.”

Prof. Bokpin

The economist further warned that without regaining investor trust and reopening access to bond markets, Ghana could face severe refinancing difficulties in the coming years.

Fiscal Discipline and Transparency as Cornerstones

Prof. Bokpin underscored that Ghana’s success in restoring investor faith will hinge on strict fiscal discipline and transparency in debt management. These principles, he argued, would help reassure both local and foreign investors that the country is committed to long-term debt sustainability rather than short-term fixes.

The government appears to be moving in that direction. The Finance Ministry has created two dedicated sinking fund accounts—a Cedi Sinking Fund and a US Dollar Sinking Fund—under the 2025 Mid-Year Fiscal Policy Review and in line with the Public Financial Management Act, 2016 (Act 921), as amended. These funds are designed as liquidity buffers to ensure timely redemption of bonds maturing between 2026 and 2028.

IMF Programme and Market Transition

Ghana’s ongoing engagement with the International Monetary Fund has reinforced the urgency of restoring debt sustainability and fiscal credibility. The IMF programme not only provides external support but also signals to investors that Ghana is committed to reforms.

By settling coupon arrears under the DDEP, the government is showing its readiness to stick to agreed frameworks and rebuild relationships with creditors. The Ministry of Finance has assured investors that all subsequent obligations under the programme will be honoured fully and on schedule.

This assurance, if backed by consistent action, could mark the turning point for Ghana’s re-entry into both domestic and international capital markets.

Despite the positive momentum, challenges remain. Ghana faces significant refinancing pressures, particularly in 2027 and 2028, when large “bullet payments” fall due. Without access to international markets, the government would struggle to manage these obligations while financing developmental projects.

Prof. Bokpin stressed that early preparations and confidence-building measures are the best safeguards against future crises. “It is going to be difficult for us in terms of refinancing the bullet payments that lie ahead in 2027 and 2028 in addition to financing government projects,” he cautioned.

READ ALSO: Tanko-Computer Doubts NPP’s Exit from Tamale Central Race