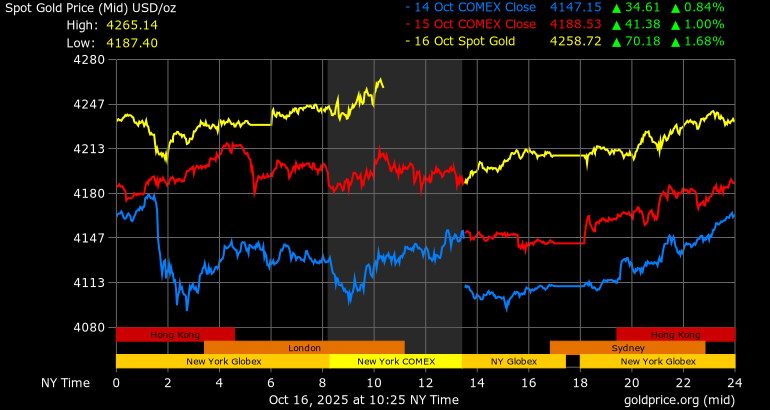

Global gold prices surged to an unprecedented level on Wednesday, breaking past the $4,200-per-ounce barrier for the first time in history as investors flocked to the safe-haven asset amid escalating geopolitical tensions and growing expectations of U.S. interest rate cuts.

Spot gold climbed as much as 1.7% to $4,217.95 per ounce, while U.S. gold futures advanced by the same margin to settle at $4,265.80 per ounce in New York at time of writing, marking a new all-time record for both benchmarks.

The surge extends gold’s remarkable rally this year, pushing its 2025 year-to-date gains to nearly 58%.

Market analysts attributed the latest surge to a combination of monetary policy expectations, safe-haven demand, and renewed global uncertainty surrounding U.S.–China trade relations.

“With U.S.–China trade tensions being reignited in the last few days, investors have even more reason to hedge their long equity bets by diversifying into gold.”

Fawad Razaqzada, analyst at City Index and FOREX.com

Monetary Policy Drives the Rally

Gold’s recent momentum has been fueled primarily by shifting expectations around U.S. monetary policy.

Traders are now overwhelmingly betting that the Federal Reserve will cut interest rates again in October, with market data from Reuters showing a 98% probability of a 25-basis-point reduction. A further cut in December is already fully priced in at 100%.

Since the Fed’s previous rate cut in September, bullion prices have risen by more than 25%, as lower interest rates tend to weaken the dollar and reduce the opportunity cost of holding non-yielding assets such as gold.

Fed Chair Jerome Powell’s dovish remarks on Tuesday further cemented market expectations.

Speaking at an event in Washington, Powell acknowledged that the U.S. labour market remained stuck in what he described as “low-hiring, low-firing doldrums,” signalling that policymakers were likely to continue supporting the economy through accommodative measures.

The ongoing U.S. government shutdown, now stretching into its third week, has further muddied the economic picture by halting key data releases, leaving investors and policymakers without clear indicators of economic performance.

Geopolitical Fears Reinforce Safe-Haven Demand

Beyond monetary policy, gold’s latest rally has been supercharged by a renewed bout of geopolitical anxiety. The U.S. and China have seen a fresh escalation in trade tensions over technology export controls and tariff threats, reigniting fears of a global economic slowdown.

“With the $5,000 handle now just $800 away, I wouldn’t bet against gold getting there eventually.

“However, a short-term correction is likely to shake out weaker hands and attract fresh dip buyers.”

Fawad Razaqzada, analyst at City Index and FOREX.com

Gold’s meteoric rise is also being driven by structural shifts in the global financial landscape.

Central banks, particularly in emerging markets, have continued to increase their gold holdings as part of a broader de-dollarization trend, seeking to reduce reliance on the U.S. dollar amid rising global financial fragmentation.

Meanwhile, exchange-traded funds (ETFs) backed by physical gold have seen robust inflows, signalling that institutional investors are also repositioning in anticipation of prolonged market volatility.

According to industry data, ETF holdings of gold have expanded sharply over the past two months, reflecting rising conviction that bullion will remain a key hedge against both inflation and currency risk.

Outlook: Eyes on the Fed and the $5,000 Mark

Looking ahead, the market’s attention remains fixed on the Federal Reserve’s October meeting, where an additional rate cut could serve as a fresh catalyst for gold.

Traders are also closely monitoring developments in the U.S.–China trade talks, as any escalation could further accelerate gold’s ascent.

With the $5,000 mark now within sight, investors and policymakers alike are watching whether the rally will extend into uncharted territory.

For now, gold’s glitter shows no signs of dimming, cementing its position as the world’s most trusted store of value in turbulent times.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization