Dr. Ernest Addison, Governor of the Bank of Ghana (BoG), has underscored that the current manual supervisory tools are ineffective in the supervision of Digital Financial Service Ecosystem (DFSE).

According to the Governor, the ineffectiveness of the manual supervisory tools is because the DFSE presently depends on digital technology, high frequency and dense data, fast transactions, complex and evolving systems.

“…We can confidently say that the strong regulatory and supervisory frameworks underpinning Ghana’s payment systems has enhanced the financial digitization process. However, digitization has come with risks which threaten customer trust and has the potential to unwind the gains of acceptability of digital products and services”.

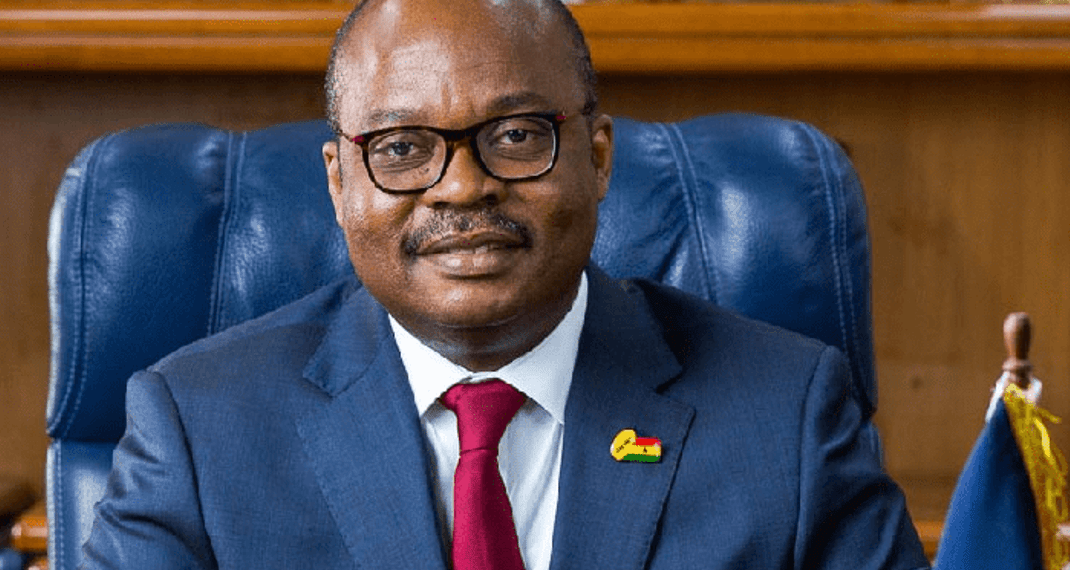

Dr. Ernest Addison

The Governor stressed that issues of cybercrime, scams, phishing, data and privacy breaches, digital illiteracy and unresponsiveness to customer complaints pose serious threats to consumer confidence in digital financial services. In view of this, the Bank has issued directives, regulations, policies and guidelines on Cyber Security to assist market players’ deal with such threats, he revealed.

Bank supervision and regulation

The BoG Boss stated in his keynote address at the ongoing Standard Chartered Digital Banking, Innovation & Fintech Festival that the burden of security awareness is not only on market players. He averred that the emergence of new and digital financial solutions has introduced significant complexities in regulation and supervision as well.

Dr. Addison therefore, highlighted that discussions on creating an enabling environment for financial sector digitization must also focus on regulatory technology (RegTech) and supervisory technology (SupTech).

“Consequently, the Bank has invested in SupTech tools to exercise effective oversight and supervision of digital financial services and reduce the burden of reporting on regulated entities. An online reporting analytic surveillance system (ORASS) has been set up to facilitate submission and improve analysis of prudential and other regulatory returns”.

Dr. Ernest Addison

A complementing supervisory intelligence tool that accepts granular data which are analyzed for patterns and trends for timely evidence-based policy interventions is also on-board, the Governor stated. According to Dr. Addison, an additional Chatbot project, which is an automated consumer complaints management system is in the offing and will help address market conduct concerns.

Current state of the banking industry

The banking industry in Ghana, Dr. Addison said, has changed significantly from the last quarter of the nineteenth century when Standard Chartered first opened its doors to customers more than a century ago.

Presently, the industry is characterized by adoption and diffusion of technology in every sphere of banking operations, the BoG Boss stated. Dr. Addison underscored that digitization of bank accounts has enabled customers to conduct financial services via online platforms in a seamless manner without stepping foot in the banking hall.

“The positive aspect of these is the broad acceptability of these technology-driven financial services due to its convenience, efficiency and affordability. This has also instigated innovative digital financial products services by banks and financial technology firms, to further reinforce financial inclusion”.

Dr. Ernest Addison

Dr. Addison emphasized that “the current vibrant state of Ghana’s digital financial service ecosystem is a product of well-thought-out and carefully crafted reforms and policies, spearheaded by the Bank over the past two decades”.

READ ALSO: Sika Opens New National Subsidiary In Ghana