The Africa Sustainable Energy Centre (ASEC) has once again urged the Government of Ghana to permanently scrap the proposed GHC1 per litre fuel levy, warning that the policy is economically unsound and politically risky amid rising global oil prices.

In a press release issued today, ASEC’s Director of Research and Innovation, Dr. Elvis Twumasi, stated that the recent global crude oil price hikes—driven by escalating geopolitical tensions—validate ASEC’s earlier caution that the levy was based on “short-lived market conditions.”

“Global oil markets are inherently volatile, and policy decisions based on such fluctuations are not only unsustainable but also economically regressive.”

Dr. Elvis Twumasi, ASEC’s Director of Research and Innovation

Global crude prices have jumped to between $73 and $74 per barrel since mid-June, according to international benchmarks, following renewed tensions in the Middle East.

ASEC believes this development reinforces its argument that temporary drops in fuel prices—previously attributed to the cedi’s appreciation—should not have served as the basis for imposing a long-term tax.

“We are now seeing the very scenario we warned about. Any relief Ghanaians experienced at the pumps was always going to be temporary.

“With crude prices now rising, we are heading into a phase where the GHC1 levy, if implemented, could push pump prices to GHC15 per litre or more by July.”

Dr. Elvis Twumasi, ASEC’s Director of Research and Innovation

ASEC warned that the levy would place undue pressure on consumers who are already facing some level of hardship and a fragile economic recovery.

The organisation argued that rising global fuel costs will erode any benefits from the cedi’s earlier gains and negate government assurances of price stability.

“Government goodwill from recent macroeconomic stabilisation efforts—such as declining inflation and a stronger cedi—could be undone by a fuel levy that consumers perceive as both unfair and poorly timed.”

Dr. Elvis Twumasi, ASEC’s Director of Research and Innovation

Evidence-Based and Citizen-Focused Policy

ASEC reiterated that the fuel levy, even with its postponed implementation remains an ill-advised policy measure that reflects outdated fiscal thinking.

Rather than relying on consumer taxation to fund the energy sector’s recovery, the Centre is calling for bold structural reforms, increased energy efficiency, and diversified revenue sources.

“Policies must be evidence-based and flexible enough to accommodate shifts in the global energy landscape.

“Instead of doubling down on a flawed tax, we need a sustainable roadmap that includes investments in infrastructure, smart grid systems, digital metering, and anti-corruption frameworks in utilities like ECG.”

Dr. Elvis Twumasi, ASEC’s Director of Research and Innovation

With the postponement in effect, the Ghana Revenue Authority (GRA) assured stakeholders that a new implementation date will be communicated once conditions are deemed more favourable.

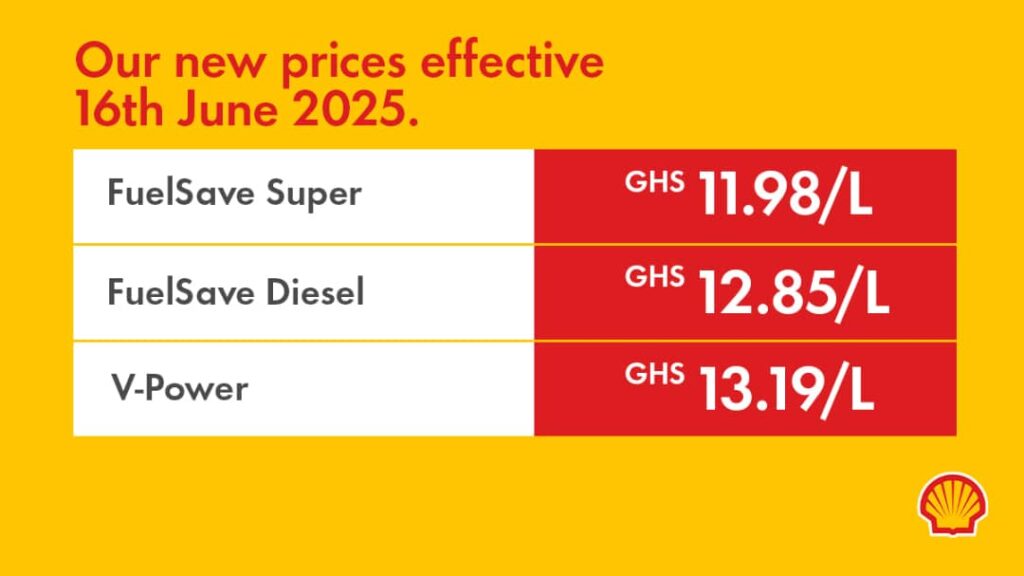

Several Oil Marketing Companies (OMCs) such as Star Oil and Shell reduced pump prices on Monday June 16, citing the cedi’s strength and improved inventory cycles.

However, ASEC believes this reduction is “short-lived” and should not be used to justify new levies.

“Our internal modelling indicates that prices are set to climb again.

“So any short-term relief experienced this week will quickly vanish if international price pressures persist. The GHC1 fuel levy, in such a context, becomes even more regressive.”

Dr. Elvis Twumasi, ASEC’s Director of Research and Innovation

With Ghana’s energy sector at a critical crossroads and global oil markets increasingly unstable, ASEC insisted that now is the time for prudent, citizen-focused policymaking—not reactionary taxation.

As the July pricing window nears, all eyes will be on the government’s next move—whether it listens to the calls for reform or proceeds with a policy that may undo recent economic gains.

READ ALSO: Cedi to Remain Stable Against Major Currencies- Finance Minister Assures Ghanaians