One of the world’s largest fossil fuel companies, Shell, has projected a significant increase in global liquefied natural gas (LNG) consumption over the next 15 years.

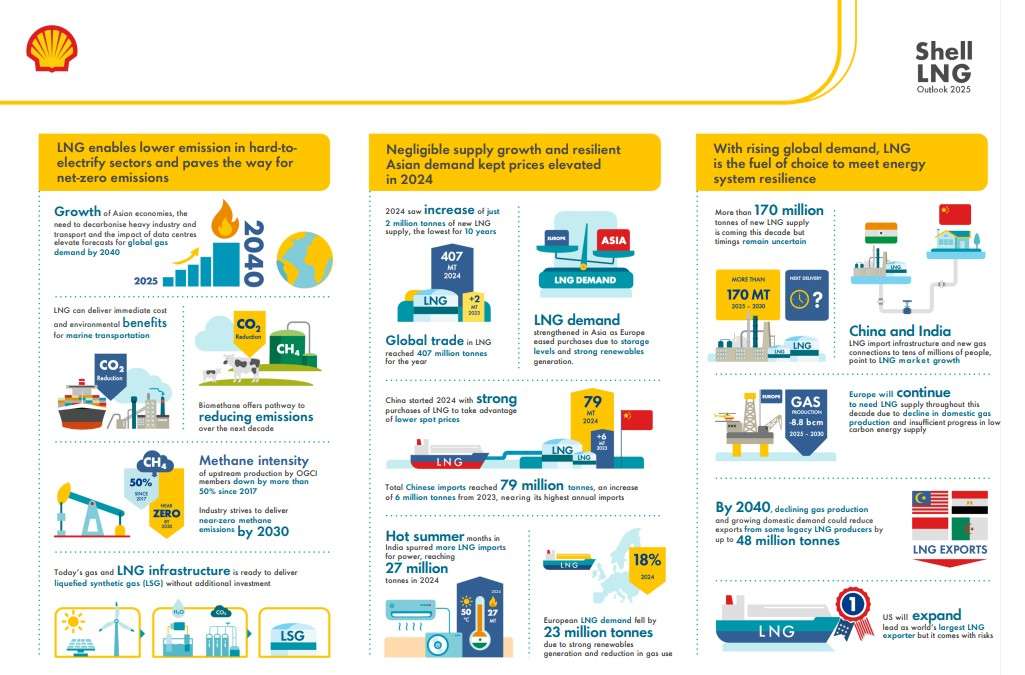

According to Shell’s annual industry report, worldwide LNG demand could rise by as much as 60% by 2040, potentially reaching 718 million tons per year. This projection underscores the company’s confidence in natural gas as a key energy source amid evolving global energy needs.

Tom Summers, Senior Vice President for Shell LNG Marketing and Trading, stated that the company’s upgraded forecast indicates the world’s increasing reliance on gas to meet growing energy demands.

“LNG will continue to be a fuel of choice because it’s a reliable, flexible, and adaptable way to meet growing global energy demand.”

Tom Summers, Senior Vice President for Shell LNG Marketing and Trading

According to Shell’s report, the global demand for LNG is expected to rise in various sectors, including power generation, heating, cooling, industrial applications, and transportation.

Shell’s forecast presents a more optimistic outlook compared to the 2023 assessment by the International Energy Agency (IEA), which suggested that global gas demand could peak before 2030 in alignment with the Paris Climate Agreement’s goals.

The IEA’s projections were supported by a 2024 slowdown in LNG trade growth, which declined to less than half a percent—the lowest annual rate recorded in a decade.

Despite this slowdown, Shell attributes the dip in trade growth to supply constraints rather than a fundamental shift in market demand.

The company argues that decarbonization efforts are, in fact, bolstering the demand for LNG, as natural gas is increasingly used to stabilize fluctuations in renewable energy generation.

According to Shell, despite these short-term challenges, the long-term trend remains one of increasing LNG demand driven by the need for reliable and flexible energy sources to complement renewables.

LNG Growth in Emerging Markets

Shell’s report highlights that LNG consumption is expected to rise across multiple sectors, including power generation, heating, cooling, industrial applications, and transportation.

China and India are expected to be key drivers of this demand increase, with a combined 180 million people projected to gain access to the gas network over the next five years.

Both countries have been expanding their LNG import infrastructure to accommodate rising industrial and residential energy needs.

Meanwhile, Europe is anticipated to maintain its reliance on LNG imports as a backup energy source to address intermittent production from renewable energy.

“More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain.”

Shell’s annual industry report

Shell’s bullish outlook on LNG demand is largely rooted in its belief that natural gas will play a transitional role in the global shift toward low-carbon energy.

As countries scale up renewable energy investments, the intermittency of solar and wind power will require stable backup sources, and natural gas is widely seen as a lower-carbon alternative to coal.

However, environmental advocates and energy analysts argue that a long-term dependence on LNG could slow the pace of the transition to fully renewable energy systems.

The IEA’s projections suggest that global energy policies could shift toward reducing reliance on fossil fuels much sooner than Shell anticipates, potentially undermining the company’s demand forecast.

Shell’s projection of a 60% increase in LNG emand by 2040 presents a confident outlook on the future of natural gas.

However, the industry faces significant challenges that could impede supply growth and alter market dynamics. The contrasting views between Shell and the IEA highlight the ongoing debate over LNG’s long-term role in a decarbonizing world.

While emerging markets in Asia and Europe are expected to drive demand, supply chain disruptions, geopolitical risks, and regulatory hurdles may challenge the industry’s ability to meet this rising consumption.

The coming years will reveal whether LNG remains a central pillar of global energy strategies or if alternative energy sources accelerate its decline.

READ ALSO: Hon. Boam Independence Day Quiz Competition – Pru East