Mr. Darryl Abraham Mawutor, the Growth Director in charge of Africa for Taptap Send, has disclosed that the financial technology (fintech) sector will flourish in a favorable climate and contribute to Ghana’s increasing remittances and economic growth.

According to the Growth Director, there is a need for government to stick to its promise to keep fostering an atmosphere that encourages businesses and investors to invest money and other resources into the nation.

Mr. Mawutor call comes at the backdrop of the just-ended Ghana Investment and Opportunity Summit (GHIOS) in London, an investment prospect that he said Taptap Send firmly supports.

The summit, themed “Ghana’s economic recovery post-pandemic; opportunities and possibilities,” was organized under the auspices of the Ghana Investment Promotion Authority (GIPC) in collaboration with the Ghana High Commission in London.

The Vice President of Ghana, Dr. Mahamudu Bawumia recognized Taptap Send at the conference for their dedication to promoting digital growth in remittances to Ghana.

Dr. Bawumia informed investors that government is putting in place strategic measures to resuscitate the economy, while creating the right environment for more business partnerships with the international community.

Government Commended For Its Plans To Support, Promote Fintech In Ghana

Commenting on the Dr. Mahamudu Bawumia’s remarks, Mr. Mawutor said: “It’s great to hear the Vice President promise that government will continue investing in strategic ventures that will help drive more opportunities into Ghana.”

“For fintechs like Taptap Send, we believe in Ghana and want to do more business and grow with Ghana; but it would be great if government commits to making it easier for fintechs, including those who are yet to come into the country to do business.”

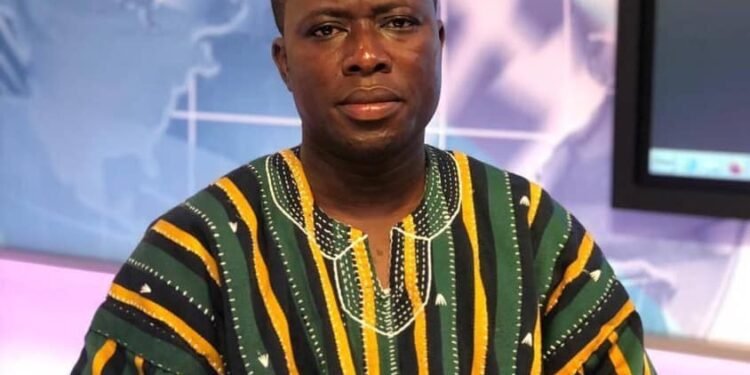

Mr. Darryl Abraham Mawutor

He pointed out that Ghana would draw more investment from the diaspora if companies and investors, including those in the fintech industry, found it easier to do business in terms of regulatory backing and other incentives.

“The only way to attract more investment is to make doing business in Ghana easier. There’s a scale for this, and Rwanda has done it so well. Ghana could do more on this level.”

Mr. Darryl Abraham Mawutor

On their part, he said, the company will intensify its public outreach on financial literacy while improving customer experience across the world by addressing challenges people face in transferring money to Ghana.

Such initiatives, he claimed, are intended to boost consumer confidence and aid in growing remittances into Ghana, which were estimated to total US$4.7 billion in 2022 and US$5 billion by the end of 2023.

“We’re helping people to send money instantly and securely at a fractional cost, by deepening our connections in Ghana and positioning our operations to attract more remittances to support economic growth through making money transfer seamless and safe.”

Mr. Darryl Abraham Mawutor

In addition to supporting transfers into Asia and several African nations, including Ghana, Senegal, Mali, Guinea, Kenya, the Ivory Coast, and Zambia, Taptap Send is available in the United Kingdom, the United States, and Canada.

The venture-backed company has investors: Reid Hoffman – an American Internet entrepreneur and co-founder of LinkedIn; the Omidyar Network, a social change investment firm; and Helois, a private investment firm.

Read also: SMEs Set To Gain Top Priority Support From ICC To Harness Greater Participation In The AfCFTA