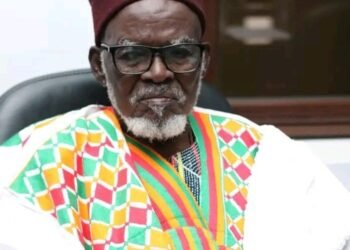

Dr. Sam Mensah, CEO of SEM Capital & Former Technical Adviser at the Ministry of Finance has revealed that the transaction cost of negotiating bilateral loans is very high. According to him, it takes a long time for the government to raise loans from bilateral sources due to the time involved. This, he said, is one of the reasons why the government often resorts to borrowing from the capital market.

However, Dr. Mensah explained that in the bond market, the government can raise the money within three months. This means that the government can use this avenue when it has to meet short-term pressing needs. This is one of the reasons, why recently, the government always resort to issuing of bond.

Meanwhile, he welcomed the government’s decision to issue the Eurobond. According to him, that was the best option available to government given the current economic conditions. He further added that the Eurobond is not free money and that the government is very much aware of the implications.

Also, he indicated that as a lower-middle income country, Ghana needed to rise up to its responsibilities. According to him, Ghana is not getting enough from the donor partners as it used to. So, it needs to graduate from bilateral to commercial loans. This, he said, will help the country get enough resources to undertake its developmental projects. As such, he noted that the country needed to diversify its sources of finance. This is also another reason why, according to him, the government resorts to borrowing from the capital market.

“So, as the country grows, and our needs grow, we needed to find alternative sources of financing. And so, Eurobond came in”.

He urged the government to spend the money on the programs for which it issued the bond wisely. According to him, if the government is not spending, then there is a violation of trust.

Pressure on government to deliver

Contrary to the notion that the government is insensitive to the current debt situation, Dr. Mensah stated that the government is very much aware.

He explained that all the ministers are very conscious of the fact that unsustainable debt is something we should avoid. However, he stated that the political environment in Ghana has high expectations. This, according to him, is because the demands from the people are very high and that puts so much pressure on the president to deliver. Therefore, he concluded that the pressure to push the debt up is always very high.

However, he indicated that at some point, the government needs to put a hold and say “that’s how far we can go”. Yet, making that decision is always very difficult to make, given the political costs, he indicated.

Furthermore, he explained that the finance ministers are always caught in the middle of two major factors: economic and political. So, even though they are very much aware of the debt situation, they needed to also satisfy their political mandate.

“That is why, it’s as if they are not seeing what you are seeing”.

He added that the population of the country keeps on increasing as such the size of the projects that government needs to undertake are becoming bigger.

“So, Ghana reached a point where we needed larger and larger amount of capital which is simply not available from the donor partners”.

Moreover, Dr. Mensah pointed out that one way of reducing the country’s debt stock is through “efficiency of our spending”. He, therefore, called for prudent management of the expenditure so as to reduce the debt. He also called for efficient mobilization of resources domestically, so as to reduce the debt.

READ ASLO: AMA urges citizen ‘policing’ on sanitation issues