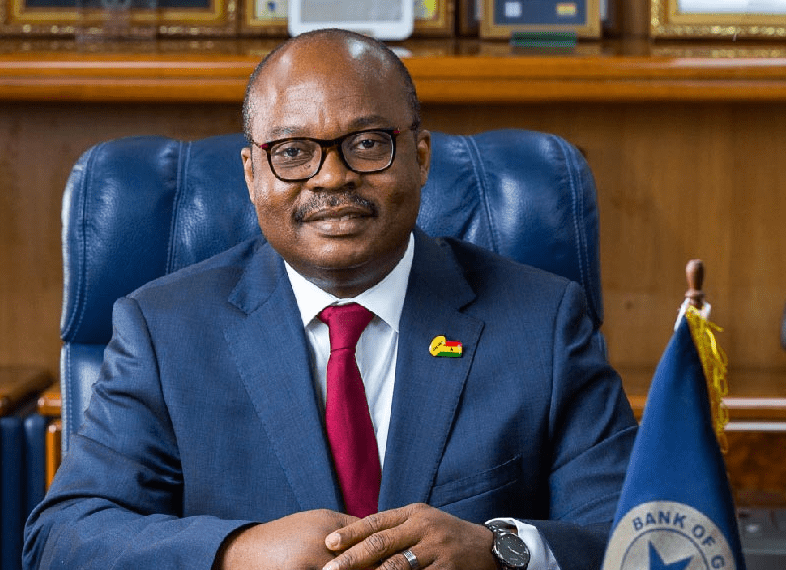

The Governor of the Bank of Ghana, Dr. Ernest Addison, has acknowledged the complex nature of managing the depreciation of the Ghanaian cedi, attributing much of the current volatility to sentiment-driven factors and concerns related to the upcoming elections.

Despite efforts by the Bank of Ghana (BoG) to stabilize the currency, Dr. Addison emphasized the difficulties in addressing the underlying issues influencing market perceptions and behaviors.

In a recent address, Dr. Addison noted that while the BoG has implemented various measures to address the challenges facing the cedi, the impact of market sentiments and election-related uncertainties has been particularly challenging to manage.

Dr. Addison remarked, “We also know that this is an election year, and therefore there are issues about the outlook, uncertainty, and speculations which have become more important in determining the behavior of market players.”

The sentiment-driven depreciation of the cedi reflects a broader concern among investors and market participants about the country’s economic outlook, especially in the context of an impending election. Such factors can lead to increased demand for foreign currencies as a hedge against potential instability, further pressuring the local currency.

Current Performance of the Cedi

The cedi has experienced significant depreciation in 2024, with the BoG reporting a decline of approximately 19.1 percent against the US dollar from January to July. The official exchange rate quoted by the BoG stands at 14.78 cedis to the dollar, while some commercial banks on the open market are quoting as high as 15.60 cedis. This disparity highlights the pressure on the currency and the challenges in maintaining a stable exchange rate.

Dr. Addison acknowledged the difficulty in managing these pressures, particularly in light of the speculative and uncertain environment. He questioned, “What else can you do about expectations, what else can you do about uncertainty, about the economy, given the fact that we have an election coming up?” The Governor’s remarks underscore the complexities involved in stabilizing the currency amidst external and internal economic pressures.

Despite the challenges, Dr. Addison expressed cautious optimism about the cedi’s prospects. He noted that the currency has started responding to recent market developments, suggesting that there could be relative stability moving forward. This optimism is partly contingent on the outcome of Ghana’s negotiations with its external creditors and the successful completion of the second review of the International Monetary Fund (IMF) program.

The IMF program is critical in restoring investor confidence and stabilizing the economy. It includes measures to build foreign exchange reserves and manage the country’s external obligations, which are crucial for maintaining currency stability. The BoG has reportedly been building up reserves to meet these obligations, including the servicing of Eurobond debts expected later this year.

One of the significant concerns is Ghana’s ability to meet its external debt obligations, including approximately $500 million in Eurobond payments due soon. Dr. Addison reassured stakeholders that the BoG has accumulated the necessary reserves to handle these payments.

Dr. Addison stated, “We were very much aware of these payments and we have indeed built up reserves to meet these obligations.” This preparation is a part of the broader IMF program, which aims to ensure that the country can manage its debt servicing needs without undue strain on the economy.

While the BoG has taken steps to stabilize the currency, the broader economic environment remains uncertain. The successful management of these challenges will depend on continued efforts to build foreign exchange reserves, secure agreements with external creditors, and restore market confidence through prudent economic policies.

READ ALSO: First Batch of FSRP Poultry Ready for Market