Fresh Domestic Debt Exchange Programme looms as the government of Ghana, through its finance ministry, has announced a new opportunity for bondholders of E.S.L.A. Plc and Daakye Trust Plc to participate in the domestic debt exchange program.

In a press release by the ministry, the Ministry of Finance encouraged holders of domestic notes and bonds to actively consider and accept this invitation. Meanwhile, according to the press release, the government is reopening the invitation that was initially settled in February 2023, referred to as the “February 2023 Exchange.”

“This reopening invites holders of domestic notes and bonds from the Republic of Ghana, specifically those of E.S.L.A. Plc and Daakye Trust Plc, to exchange their eligible bonds. In return, they will receive a package of new tranches of the same bonds issued by the government, known as the ‘New Bonds,’ which were part of the February 2023 Exchange. This renewed invitation is referred to as the ‘Invitation.’”

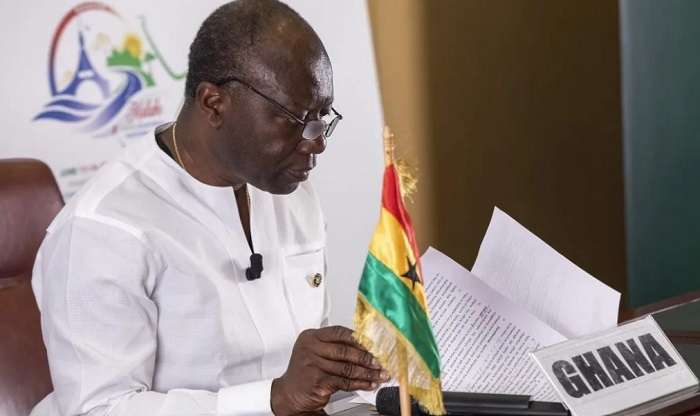

Ministry of Finance

The Ministry of Finance stated that this offer aims to provide an opportunity for holders who were unable to participate in the February 2023 exchange due to various delays or reasons. The release also emphasised that this invitation is exclusively available to registered holders of Eligible Bonds who are not Pension Funds.

Previous Bondholders

However, it noted that if a bondholder has previously tendered Eligible Bonds in either of the two prior GHS-denominated invitations for exchange conducted by the Government in 2023, namely the February 2023 Exchange or the Pension Fund Alternative Offer in August 2023, the bondholders are no longer eligible to participate in this Invitation and are no longer considered an Eligible Holder.

The Domestic Debt Exchange Program was initiated in December 2022 with the objective of restoring Ghana’s capacity to manage and service its debt.

This new opportunity allows bondholders to reconsider their holdings and participate in the exchange, contributing to the government’s debt management efforts.

Just recently, the Government announced the settlement of holders of pension funds and domestic dollar denominated bondholders under its Domestic Debt Exchange Programme. The Ministry of Finance announced that a payment of GHS2,060.72 million was made to holders of exchange bonds in respect of their Treasury Bonds.

Also, a payment of GHS274.91 million was made to holders of exchange bonds in respect of their ESLA Bonds and Daakye Bonds were made. On the Settlement Date, four (4) Series of New Bonds were issued to Eligible Holders whose tenders were accepted by the Government.

Pursuant to the Exchange Memorandum, the principal amount of the New Bonds per holder is composed of the outstanding principal amount of Eligible Bonds tendered by such holder plus any amount of Accrued Interest Payable in respect thereof, and was allocated per holding in equal proportions between New Bonds due 2027 and 2028 pursuant to the Exchange Memorandum.

The latest round of the DDEP are needed to unlock the second tranche of the IMF loan. The Finance Minister in few days ago disclosed that the country will receive the second instalment of the International Monetary Fund (IMF) bailout funds in December. He thus, noted that the country is preparing for its first review with the IMF in November, as they await the disbursement of the second tranche amounting to $600 million.

READ ALSO: GSE Calls for Consulting Services For African Exchanges Linkage Project Capital Markets Phase 2